-

A rise in coronavirus cases and the removal of a 50-basis-point adverse market fee designed to protect Fannie Mae and Freddie Mac during the pandemic contributed to the largest weekly drop so far this year.

July 22 -

Despite lower numbers, refi applications continued trending strongly, while purchases fell close to lows from more than a year ago.

July 21 -

The adverse market fee change could contribute to an increase in refinance volume, adds Mortgage Bankers Association economist Mike Fratantoni.

July 19 -

The GSE forecasts $4 trillion in production this year because refinance activity is stronger than expected.

July 16 -

Purchase loans also increase, as their average size shrinks

July 14 -

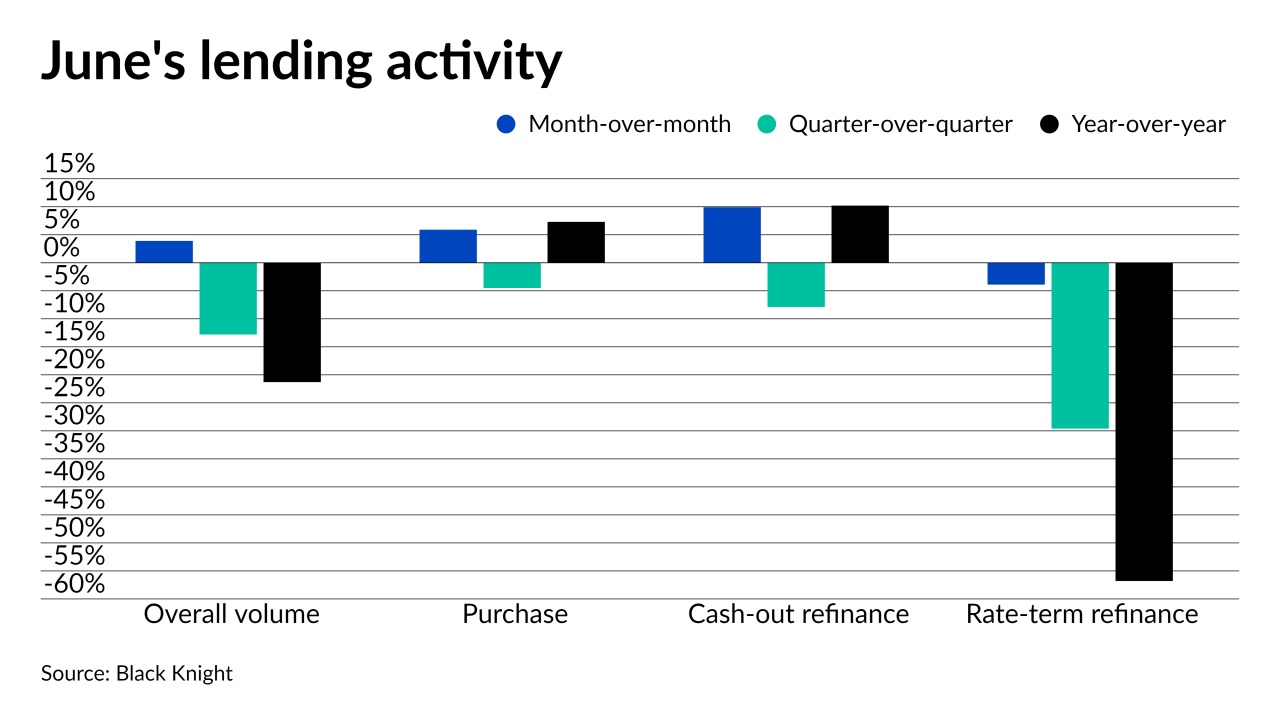

Boosts in purchases and cash-out refinances drove the summer turnaround, according to Black Knight.

July 12 -

Still, the average time a property is on the market is at an all-time low, with more than half going into contract within two weeks.

July 9 -

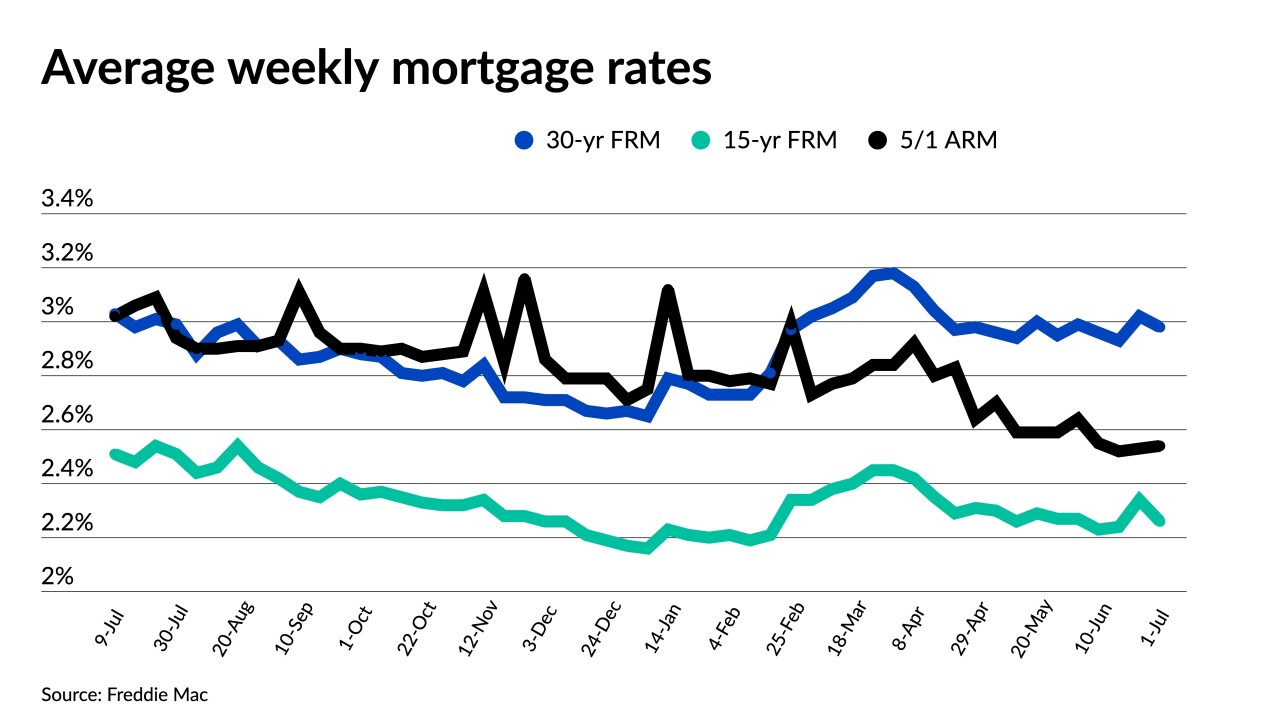

With talk of an overheating economy abating, economists see few signals that would indicate near-term rate spikes.

July 8 -

But some local markets in the Midwest and oil regions are seeing a lag compared to nationwide annual gains, Veros Real Estate Solutions found.

July 8 -

The dynamic between housing market players diverged to an even greater degree amid intense demand and surging home prices, according to Fannie Mae.

July 7 -

Government-sponsored loans gain volume share, but overall numbers tumble to a point not seen since before the pandemic.

July 7 -

Markets react calmly to inflationary worries, but short supply and rising home prices loom as a greater concern.

July 1 -

Limited housing supply, climbing rates cause applications to decline across the board.

June 30 -

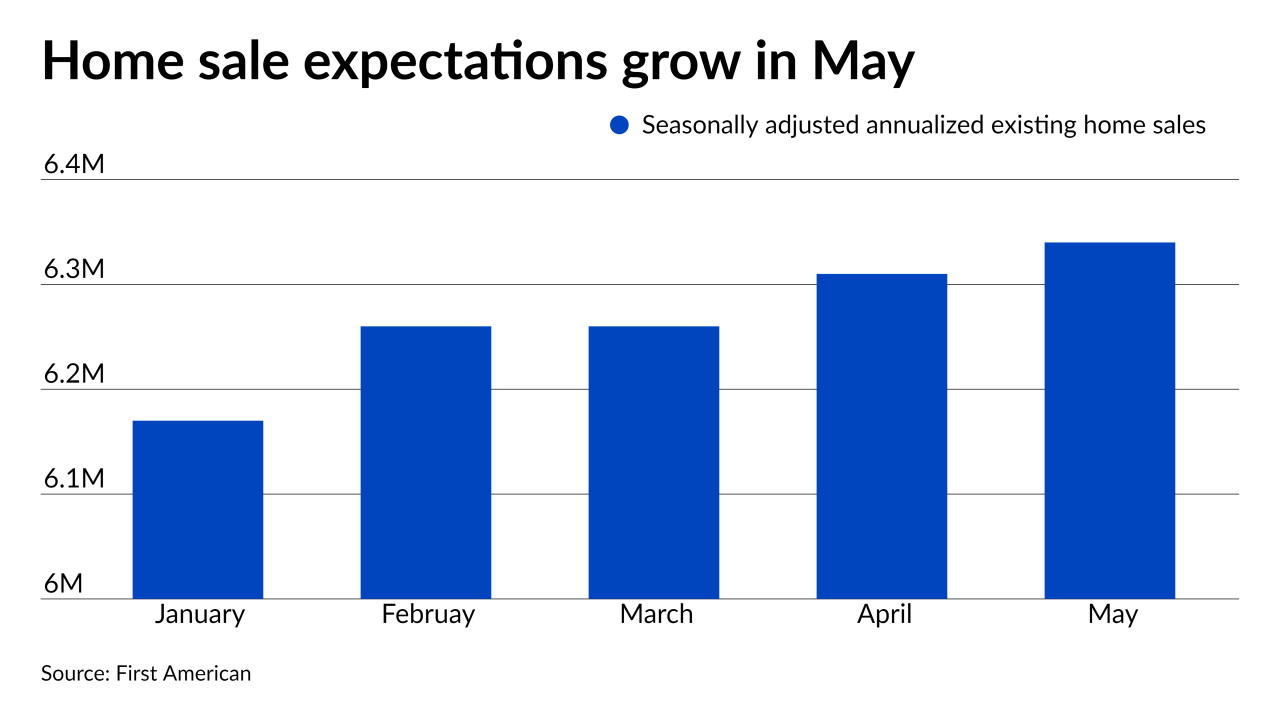

While purchasing power grew for the 16th straight month in April, surging property values and increased mortgage rate forecasts will keep driving down affordability, according to First American.

June 28 -

Median home prices are higher than the historical average in 61% of U.S. counties, Attom Data Solutions said, and it's unclear if the situation gets better or worse.

June 24 -

Corresponding Treasury yields seesawed over the past week, as some experts see “transitory” inflation persisting.

June 24 -

Increases in refinances, both in applications and average size, help lead overall numbers higher

June 23 -

While purchasing power rose due to low rates and increasing income, “homebodies” suppressed inventory, according to First American.

June 22 -

Signs from the Fed regarding tapering and interest rate hikes could spell the end to the year’s low rates.

June 17 -

A spike in government-sponsored applications helped lead indexes to their largest gains in several weeks.

June 16