-

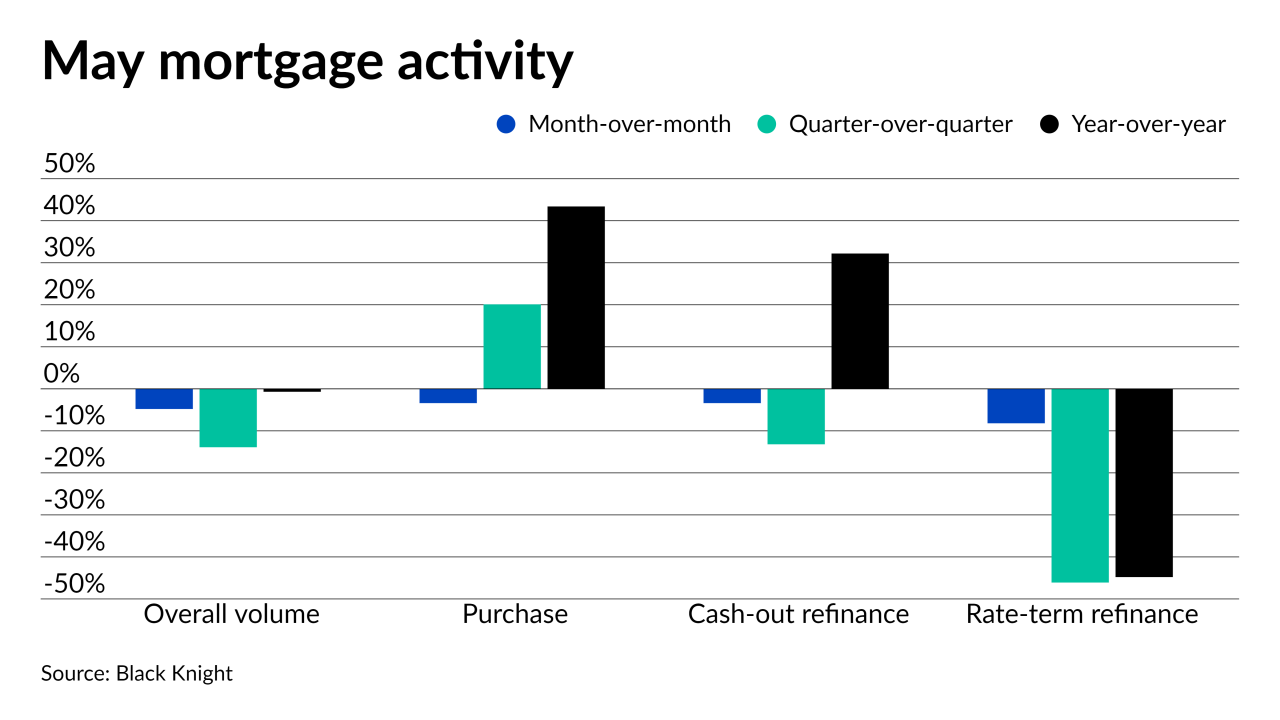

Changed borrower psychology and the severe housing inventory shortage dropped lending activity across the board, according to Black Knight.

June 14 -

Recent reports show inflation rising, but employment underperforming, while interest rates dropped across the board.

June 10 -

Purchase loans tick upward, even as housing demand pushes prices well above 2020 levels.

June 9 -

While a growing share of consumers feel optimistic about the economic recovery underway, the extreme seller’s market made the majority of prospective borrowers pessimistic for only the second time in 10 years, according to Fannie Mae.

June 7 -

Home prices grew at a record annual pace in April but indicators of a possible slowdown popped up in May, Redfin noted.

June 7 -

Rates have seesawed in recent weeks, with investors looking for signs of inflation as the economy recovers from the pandemic.

June 3 -

The MBA’s Market Composite Index decreased a seasonally adjusted 4% last week, dropping to a point not seen since February 2020.

June 2 -

The steady pace of refinance activity has also continued, as borrowers seek to take advantage of sub-3% rates.

May 27 -

While purchases increased, refinancing activity slowed considerably compared to its pace over the past month.

May 26 -

A week of light data could possibly lead to further mortgage-rate volatility ahead depending on what monetary officials say in the coming days.

May 20 -

Remote workers looking across the country for an inexpensive house have a wide net to cast, but a few important socioeconomic factors can narrow the search.

May 20 -

Average loan size also continues to increase, as demand remains high and costs in homebuilding materials rise this year.

May 19 -

The month saw the highest median home sales price ever along with the quickest time ever to sell a new listing.

May 19 -

Economic recovery should soar into the summer as vaccination rates climb and restrictions loosen up, but low inventory is likely to limit mortgage activity into the next year, according to Fannie Mae.

May 19 -

With little transitional disruption, the bigger players on the non-agency side could gain a hefty share of non-owner-occupied mortgage volume as a result of Fannie Mae and Freddie Mac’s caps on such purchases, a KBRA analysis finds.

May 17 -

Inflation concerns may reverse the trend that has seen the 30-year rate decline six out of the last seven weeks.

May 13 -

Purchase loan volume also increased, as borrowers tried to take advantage of rate dips across all loan types

May 12 -

While the first quarter is typically the weakest period for the title business, the sector benefited from strong refinance volumes that were driven by low interest rates.

May 10 -

In spite of an improving economy, acute competition and supply scarcity soured homeshoppers on the purchase market in April, according to Fannie Mae.

May 7 -

Promising jobs numbers and favorable economic data are an encouraging sign for the post-pandemic future, but rising interest rates are sure to follow.

May 6