-

The recent increase in loan size across all application types reflects rising prices, which contributed to a drop in applications, Mortgage Bankers Association economist Joel Kan said.

May 5 -

Hedge accounting will align Fannie’s reporting with competitor Freddie Mac, and will address a mismatch between the recorded value of financial instruments used to offset interest-rate volatility on mortgages and the loans themselves.

April 30 -

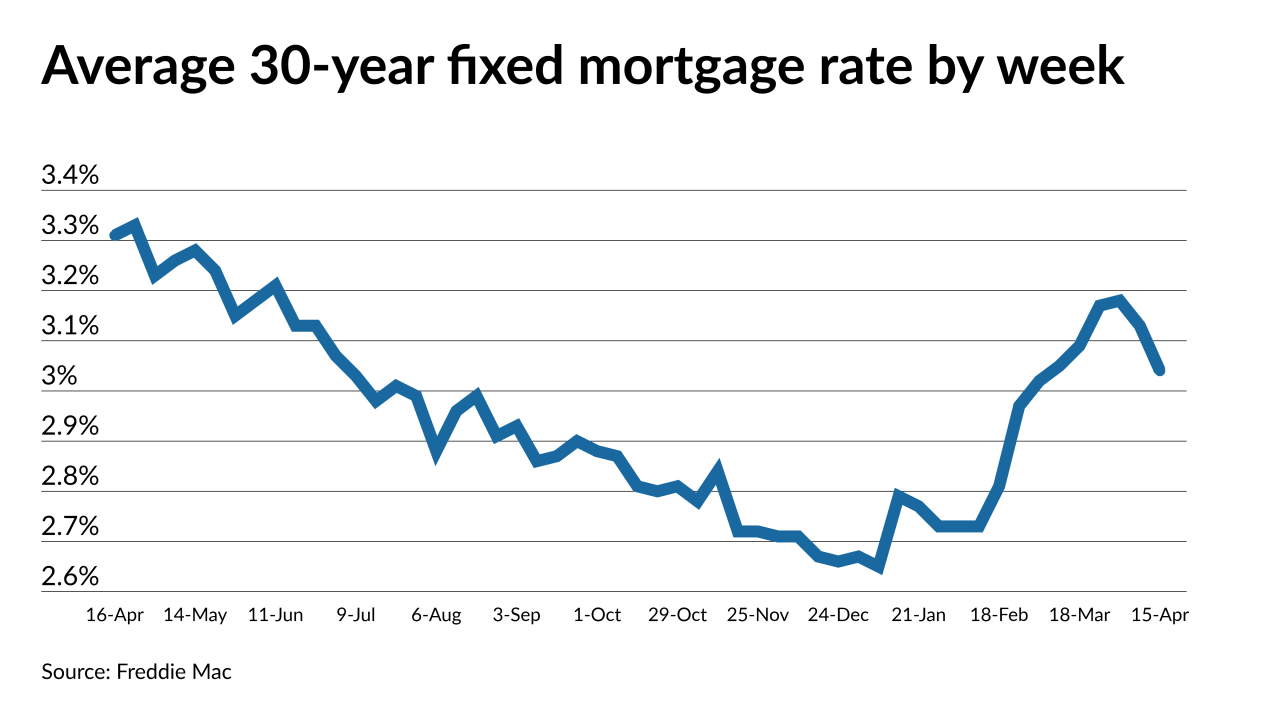

Depressed Treasury yields have kept mortgage rates under 3% recently, but positive economic news could indicate larger increases will follow this week’s uptick.

April 29 -

After a one-week reprieve, mortgage activity waned again with decreased demand for refinances and extremely low inventory for homebuyers.

April 28 -

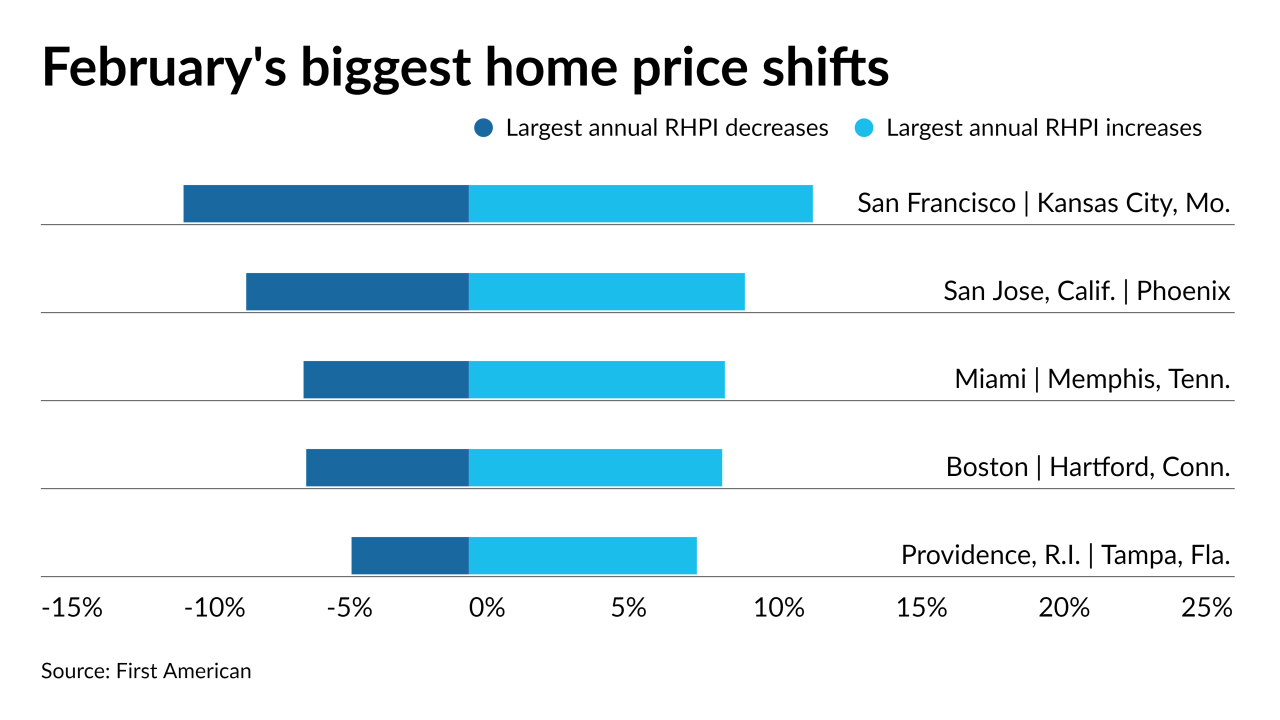

Despite home purchasing power growing for the 14th consecutive month in February, rising property values and mortgage rates are likely to influence would-be sellers to stay put, according to First American.

April 27 -

Inflation, an improving economy and the increased federal budget deficit make rate increase inevitable this year, the Mortgage Bankers Association said.

April 22 -

While it’s the third straight week of a downward trend, borrowers likely have only a brief opportunity to take advantage of sub-3% rates before a reversal comes.

April 22 -

While purchase volume is seeing its usual seasonal pickup, lower rates caused a spike in activity among existing homeowners looking to refinance.

April 21 -

The government sponsored enterprise’s latest forecast calls for a nearly $4 trillion year for 2021.

April 16 -

Rising cases and vaccine issues caused bond yields to fall, but inflationary pressures will likely reverse that course.

April 15 -

The shift ended a long run of higher rates that have depressed loan application activity, and it temporarily creates a new refinancing incentive for some borrowers.

April 8 -

Vaccinations and a third round of stimulus payments are boosting consumers views on the housing market, according to Fannie Mae.

April 7 -

Mortgage rates that are rising in tandem with a recovering economy dampened borrower activity, even with prime homebuying season underway.

April 7 -

The increase won’t hurt the incentive for the average home shopper, but it means those who were looking to “buy the dip” in prices amid the pandemic may have missed their chance.

April 5 -

After two straight months on an upward trajectory, rising interest rates pushed homebuyer demand down to a third of where it stood at the start of 2021, according to Freddie Mac.

April 1 -

While there were fewer new mortgages sought on a week-to-week basis, the index was higher than it has been during the same week in the last two years.

March 31 -

But the 10-year Treasury yield began backing down after the weekend as investors reacted to turmoil in Europe.

March 25 -

From offering operations folks big bonuses to grooming recent grads, lenders are getting creative in their efforts to manage staffing throughout the boom-bust cycle.

March 22 -

Household formations, looser credit and an improved economy will overcome higher rates — and even the inventory shortage.

March 19 -

However, the increase has been more gradual than that seen in Treasury yields, and loan activity has only subsided slightly to date.

March 18