-

Mortgage applications decreased 1.9% from one week earlier as rising rates started to affect refinance activity, according to the Mortgage Bankers Association.

January 20 -

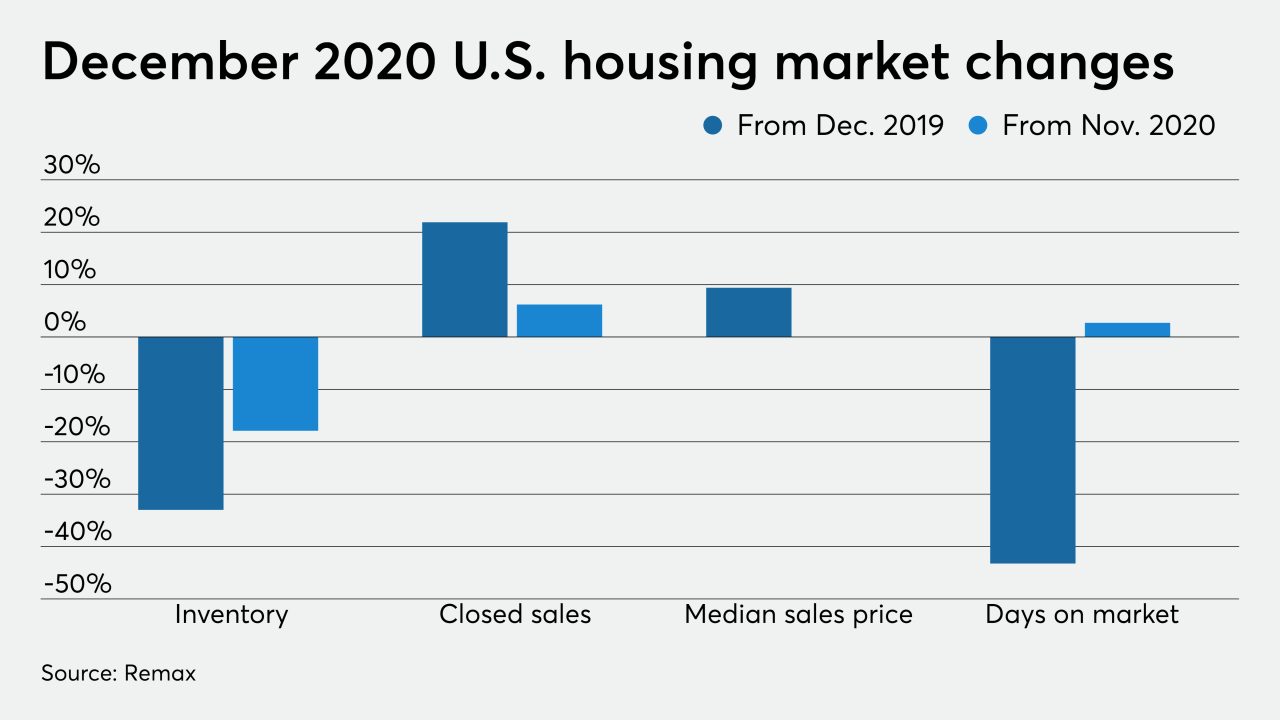

Bottomed-out mortgage rates cut listing times and housing inventory while sales volume and average prices jumped annually.

January 19 -

Despite mortgage rates expected to rise modestly in 2021, a bolstered Biden administration stimulus package and COVID-19 vaccination efforts bring promise for economic recovery.

January 15 -

The pandemic-fueled exodus from New York City propelled nearby Westchester County to its strongest year for home sales in more than two decades.

January 15 -

Mortgage rates, whose movements until now had not reflected gains in the benchmark 10-year Treasury yield, rose 14 basis points this week, according to Freddie Mac.

January 14 -

Cash offers are taking priority in the Boise, Idaho, area, shutting out homebuyers who need a conventional mortgage.

January 13 -

Mortgage applications increased 16.7% from one week earlier to their highest level in 10 months, although rates rose in expectation of additional government pandemic relief, according to the Mortgage Bankers Association.

January 13 -

For eight years after the Great Recession, home prices in metro Atlanta climbed steadily but slowly. Since mid-summer, they have been soaring.

January 11 -

Housing values are outpacing record-low rates and that’s hurting the entry-level homebuyers, but down payment programs and other traditional measures to assist them may only drive prices to greater heights, according to former Freddie Mac CEO Don Layton.

January 8 -

Metro Denver's housing market ended 2020 with a bang, popping the roof with a record-high number of home sales and busting through the basement with the fewest listings available for sale.

January 8 -

December’s housing market sentiment hit a seven-month low, indicating that inventory could be further constrained by sellers waiting for a better time to list, according to Fannie Mae.

January 7 -

It’s more of the same when it comes to mortgage rates entering 2021, as once again they have dropped to lowest point in the 50-year history of Freddie Mac’s Primary Mortgage Market Survey.

January 7 -

Mortgage applications decreased 4.2% over the final two weeks of 2020, but the strong demand for home buying throughout most of the year should continue, according to the Mortgage Bankers Association.

January 6 -

In the midst of the coronavirus pandemic, San Antonio's housing market is booming.

December 31 -

Mortgage rates rose a basis point this week, ending the year near record lows, according to Freddie Mac.

December 31 -

A gauge of pending home sales fell for the third consecutive month in November, suggesting higher prices and limited inventory are slowing momentum in the housing market despite record-low borrowing costs.

December 30 -

Despite intensified demand and plummeting inventory, consumer home purchasing power made gains behind falling interest rates in October, according to First American.

December 28 -

Defying a tumbling economy, worsening health crisis and early doomsayers, Bay Area single-family home prices jumped to record levels this fall as most counties saw median prices top $1 million.

December 28 -

Falling interest rates more than canceled out median home listing prices, reaching an all-time time high during the month, Redfin said.

December 24 -

Mortgage rates yet again have dropped to a record low, even as the yield on the benchmark 10-year Treasury flirts with breaking back above the 1% mark, according to Freddie Mac.

December 24