-

The number of bidding wars increased for the fifth straight month, with Salt Lake City posting the highest rate of competitive listings in two years, according to Redfin.

October 20 -

The Bay Area real estate market continued its roaring recovery in September, as buyers took advantage of ultra-low mortgage rates to scoop up a shrinking number of homes for sale at an astonishing pace.

October 20 -

New-home starts increased in September on a sharp gain in single-family house construction while building permits climbed, indicating residential building had plenty of momentum at the end of the third quarter.

October 20 -

With record low mortgage rates driving buyer demand, home sales and prices spiked in September, shrinking the supply and days on market, according to Remax.

October 19 -

This year will top the total volume generated in the housing boom year of 2003. Meanwhile, next year's 30-year FRM is predicted to stay at 2.8%.

October 16 -

In the Philadelphia metropolitan area, the number of homes that sold in 10 days or fewer jumped from about 1,730 in September 2019 to roughly 4,250 last month.

October 16 -

Just a week after commenting that the bottom on mortgage rates was possibly reached, Freddie Mac reported that they fell 6 basis points to another record low.

October 15 -

Lower-than-expected rates will drive mortgage production this year, but they’ll have less of an impact in 2021.

October 14 -

A surge of mortgage originations allowed Ginnie Mae to surpass its high watermark for mortgage-backed security issuance by nearly 33%.

October 14 -

California house sales will rebound slightly next year from the pandemic, and home prices will continue edging upward, thanks to rock-bottom mortgage rates and strong homeownership demand, according to the California Association of Realtors.

October 14 -

Mortgage applications decreased 0.7% from one week earlier, but lending activity should continue strong for the remainder of the year as rates stay low, according to the Mortgage Bankers Association.

October 14 -

Record-low interest rates, high origination volumes and social distancing created a perfect storm for mortgage fintechs like SnapDocs and LoanSnap to score a cash infusion.

October 13 -

With millions out of work, and restaurants, shops and retailers closing, one spot in the economy shines for thriving and affluent professionals — Bay Area real estate.

October 8 -

Mortgage rates remained flat this week, a sign that the bottom has possibly been reached, but the housing market looks to remain strong for the near future, according to Freddie Mac.

October 8 -

Millennials continue to lock in the lowest average mortgage rates on record, keeping lenders busy and the housing market churning, according to Ellie Mae.

October 7 -

But overall sentiment as measured by Fannie Mae continued to recover from the depths of this spring.

October 7 -

The up-and-down pattern for mortgage application activity continued, as volume rose 4.6% from one week earlier led by refinancings, according to the Mortgage Bankers Association.

October 7 -

Low mortgage rates and strained supply drove the housing market price growth to a 26-month high in August, according to CoreLogic.

October 6 -

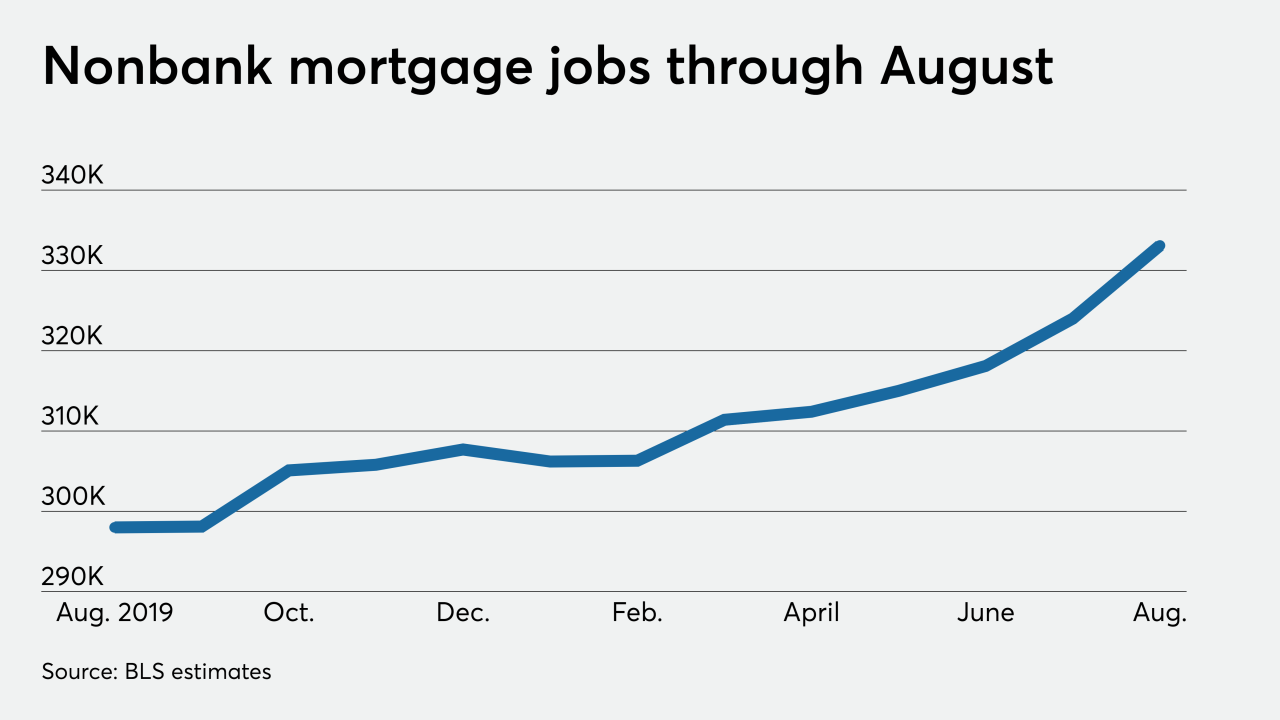

There was an estimated total of 333,100 people on nonbank mortgage banker and broker payrolls in August, and that's the highest recorded since at least 2010.

October 2