-

Home starts fell more than forecast in August, reflecting less construction of apartments and a decline in the tropical storm-hit South, representing a pause in momentum for a housing market that's been a key source of fuel for the economy.

September 17 -

Mortgage rates remained relatively flat, rising a single basis point off of last week's record low, according to Freddie Mac.

September 17 -

Low rates, along with increased new and existing home sales activity drives the latest forecast.

September 16 -

U.S. homebuilder optimism rose to a record in September, with low mortgage rates driving a housing boom that has boosted the pandemic economy.

September 16 -

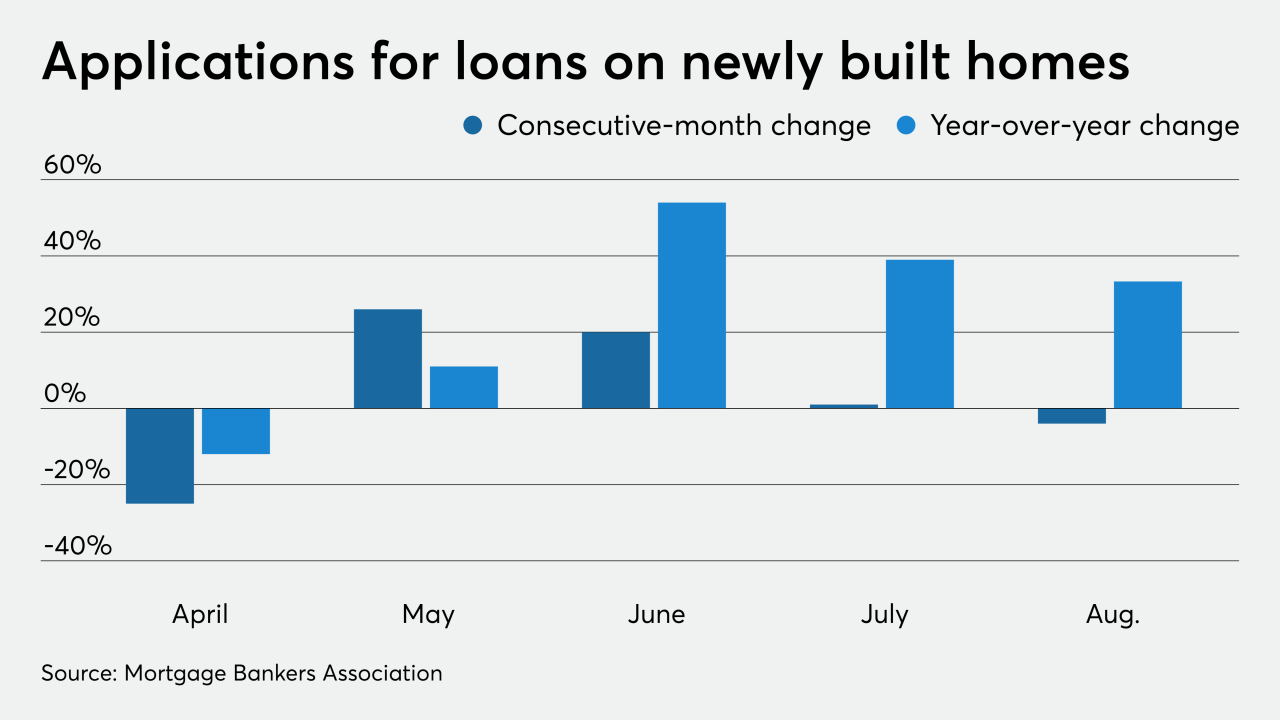

Loan applications for new homes have staged a remarkable turnaround this year after falling 25% month-over-month and 12% year-to-year due to the coronavirus' impact in April.

September 16 -

Also the Federal Housing Administration, which is a key contributor of government-insured loans to Ginnie securitizations, recently set new conditions on mortgage applicants that have been in forbearance.

September 14 -

Plus: mortgage credit availability hits 6-year-low and Ellie Mae and ICE Mortgage change leadership

September 11 -

Even though second-quarter originations were nearly double the same period in 2019, most were refinancings, which generate less revenue for title companies.

September 11 -

The Spokane County, Wash., housing market continues to show resilience during the coronavirus pandemic as the median closing price skyrocketed to a record-breaking $317,000 in August.

September 11 -

Mortgage rates fell 7 basis points this week to yet another record low in the 49-year history of the Freddie Mac Primary Mortgage Market Survey, as stock market indicators sank during the period.

September 10 -

Homebuyers are fleeing dense Bay Area neighborhoods for Wine Country environs, heating up a local real estate market rapidly recovering from a pandemic-induced slowdown.

September 9 -

As bidding wars raged on and mortgage rates remained near historic lows, housing market confidence grew in August, according to Fannie Mae.

September 8 -

Residential real estate has been a hot commodity in the Sioux City, Iowa, metro this summer, with prices and demand rising while interest rates and supply are low.

September 8 -

New Yorkers fleeing the city and cooped-up workers in cramped home offices are helping fuel a hot home sale market in Connecticut, with properties selling at a dizzying pace.

September 8 -

More than half of listings underwent bidding wars in August with some housing markets peaking above 65%, according to Redfin.

September 4 -

While employment typically ebbs as home buying slows in the fall, several nonbanks have ambitious hiring plans in the works, which call for them to add thousands of workers by year-end.

September 4 -

Home purchase power increased by almost 7% annually in July as mortgage rates were at or near record lows.

September 3 -

Mortgage rates remained relatively flat this week, as yields for the benchmark 10-year Treasury spiked at the start of the period before dropping, according to Freddie Mac.

September 3 -

Northeastern Minnesota home sales have been on a tear this summer despite a relative scarcity of listings.

September 3 -

Mr. Cooper plans to hire an additional 2,000 employees by the end of this year as record low interest rates spur home purchases and mortgage refinancings.

September 2