-

The bureau released a five-year review of the so-called TRID regulation that found consumers benefited from being able to compare mortgage terms and costs, but the price tag for the industry was roughly $146 per loan.

October 1 -

Customers suffered when they were placed in mortgage relief plans without their consent, the Massachusetts senator says. She urged the Federal Reserve to take the blunder into account as it weighs when to lift other sanctions against the bank.

October 1 -

The government-sponsored enterprise's first multifamily sustainability bond transaction, totaling $600 million, is part of Freddie's K-Deal program.

October 1 -

The proposed best practices would be modeled after federal servicing standards and be used to supervise nonbanks firms subject to state regimes.

October 1 -

China Oceanwide said it was not able to meet with Hony Capital to finalize the terms and conditions because of the pandemic.

October 1 -

Mortgage rates fell back toward their all-time low this week, increasing purchasing power for homebuyers. But the lack of homes for sale drives up prices and reduces affordability, according to Freddie Mac.

October 1 -

Delinquencies will rise due to the severe effects of the pandemic on the commercial property sector, Fitch said.

September 30 -

Student housing and assisted/independent living centers were small portions of Freddie's multifamily securitizations prior to COVID, but Kroll noticed they've been missing in most rated deals since spring.

September 30 -

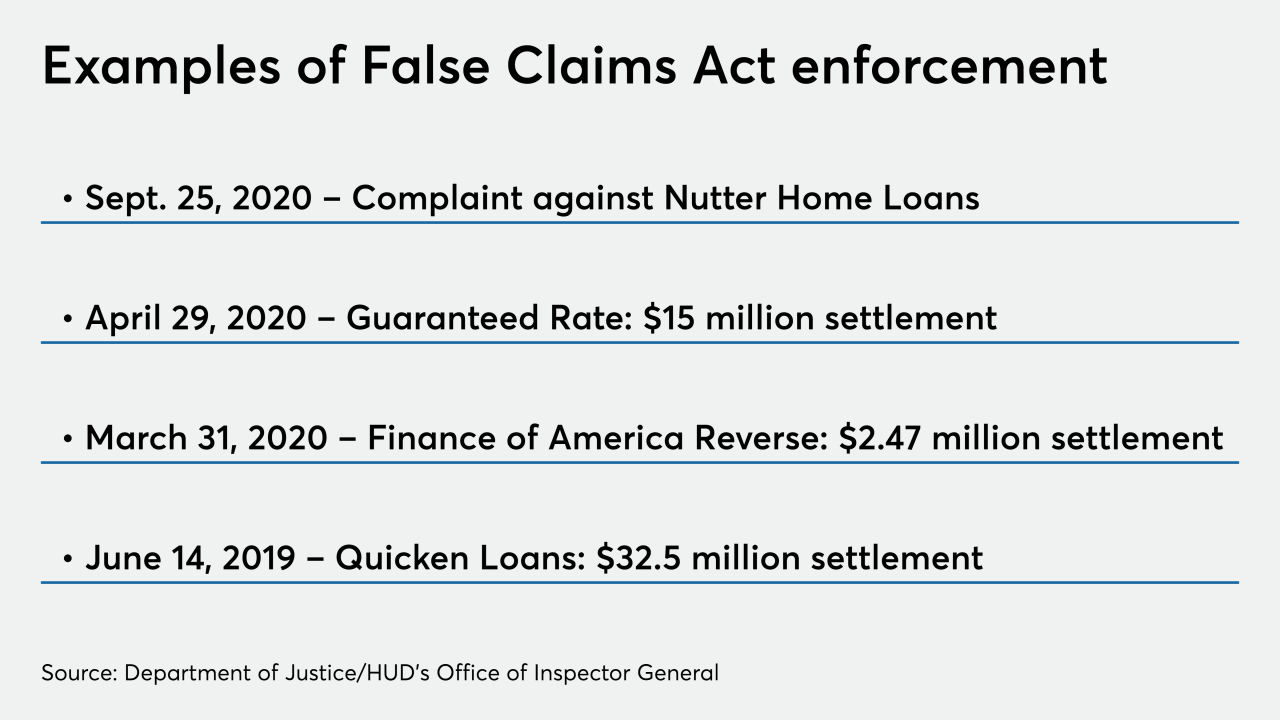

The accusations against Nutter Home Loans, like an earlier settlement with the Department of Housing and Urban Development, center on concerns related to FHA-insured reverse mortgages. The company "strongly disputes" them.

September 30 -

Pending home sales rose more than expected in August, reaching the highest level on record as low mortgage rates fuel a housing rally.

September 30 -

The Mortgage Industry Standards Maintenance Organization drew up the recommended wording in consultation with a group of lenders and investors after the passage of the Taxpayers First Act last year.

September 30 -

Mortgage applications decreased 4.8% from one week earlier, as refinance activity was down even as average rates fell to a new record low, according to the Mortgage Bankers Association.

September 30 -

Home prices around Seattle rose faster than in any city in the country, save Phoenix, for the sixth consecutive month in midsummer.

September 30 -

Through Operation Corrupt Collector, the bureau is coordinating with over 50 other state and federal agencies to target firms for wrongdoing and inform consumers of their rights

September 29 -

Approximately 75% of the quarter-to-quarter growth came from multifamily mortgage originations.

September 29 -

Home prices in 20 U.S. cities gained in July, pushed higher by demand for housing that has been fueled by low mortgage rates.

September 29 -

Dallas had the greatest price gains in more than a year the latest nationwide comparison.

September 29 -

The net share of mortgages in Ginnie Mae securitizations with suspended payments appears to be stabilizing, but the number of new requests creates doubt about whether it will subside.

September 29 -

Consumer home purchasing power gained steam in July thanks to plummeting interest rates and gains in the median income despite steady price growth, according to First American.

September 28 -

Despite a roller-coaster stock market, lingering pandemic and uncertainty caused by natural and made disasters, the real estate market continues to connect buyers to sellers.

September 28