-

Wall Street won big buying up homes during the foreclosure crisis and renting them out. Now, it's headed back to the suburbs in hopes of scoring again.

September 25 -

The Financial Stability Oversight Council said the mortgage giants may need a bigger capital cushion than their regulator has proposed, but stopped short of designating them as “systemically important financial institutions.”

September 25 -

After an annual gain in July, newly constructed home listings tumbled in August as coronavirus complications caused the largest inventory drops on record, according to Redfin.

September 25 -

Retiring Ellie Mae CEO Jonathan Corr and new ICE Mortgage Technologies President Joe Tyrrell discuss how the two companies will be merged.

September 25 -

Arizent's latest survey finds that respondents are sharply divided on key issues regarding the upcoming election.

September 25 -

The agency’s report on mortgage data submitted by lenders identified persistent disparities between white borrowers and minorities in denial rates and pricing. Some observers say the bureau should have been more explicit as the nation wrestles with systemic racism.

September 24 -

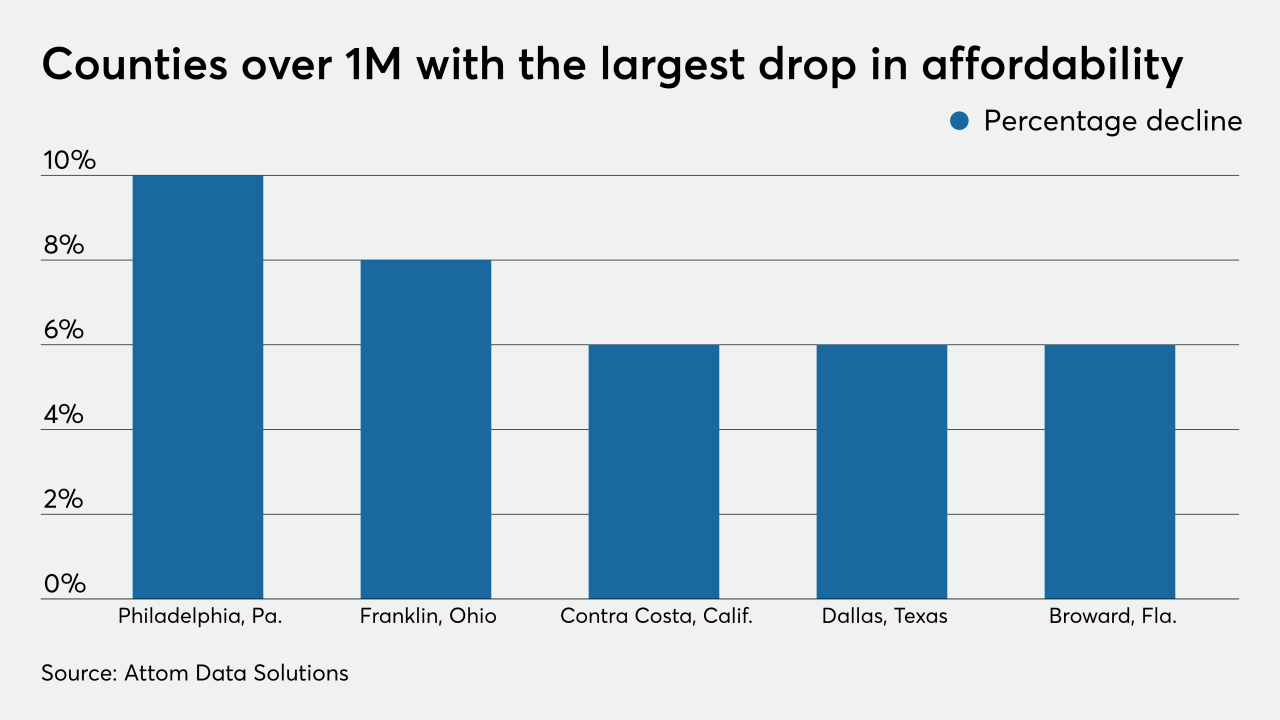

More counties have median home prices above their historic averages for typical wage earners, the company found.

September 24 -

Twelve people were charged in a scheme regarding the creation of 100 fraudulent mortgages in Georgia, according to the HUD inspector general.

September 24 -

Mortgage rates experienced a marginal uptick this week, rising three basis points. But they remained near record lows and possibly soon could track down again, according to Freddie Mac.

September 24 -

A summer resurgence of home buying stretched into August, defying the pandemic to set record home prices and drive sales to a near two-year high, new housing figures show.

September 24 -

The company's software can now be used to handle personal loans, credit cards and specialty-vehicle loans.

September 24 -

The agency reported signs of stress on the credit quality in residential loans serviced by seven large banks as a result of the COVID-19 pandemic.

September 23 -

Mortgage applications increased 6.8% from one week earlier as this summer's surprise purchase demand has carried over to the fall, according to the Mortgage Bankers Association.

September 23 -

Under fire for saying that the potential pool of talent is "limited," CEO Charlie Scharf issued a memo to employees Wednesday acknowledging that his words reflected his own "unconscious bias" and vowing to improve diversity in the bank's leadership.

September 23 -

Wells Fargo's top executive created a firestorm on social media over comments that the bank has had trouble meeting its diversity goals because there isn't enough minority talent.

September 23 -

FHA Commissioner Dana Wade offered a preview of ambitions she has for the Federal Housing Administration at a virtual event held by Women in Housing and Finance on Tuesday.

September 22 -

As part of the revamp, Rocket’s referral network, technology and marketing tools will now be available to QLMS users, EVP Austin Neimeic told NMN.

September 22 -

But the group is more conservative than Fannie Mae when it comes to interest rate movements over the next six quarters.

September 22 -

Commercial real estate companies are among those left out of the Federal Reserve’s middle-market relief program, but House members said they need government-backed financing to navigate the pandemic as much as anyone.

September 22 -

Outside the densely populated coastal hubs, annual home sales grew by leaps and bounds, as buying patterns shifted toward more space with less emphasis on proximity to urban centers, according to Redfin.

September 22

![Fed Chairman Jerome Powell said the central bank had previously concluded that asset-based borrowers were able to secure financing elsewhere. Treasury Secretary Steven Mnuchin said “small hotels do not fit into [the Main Street Lending Program] because they already have other indebtedness.”](https://arizent.brightspotcdn.com/dims4/default/71a30be/2147483647/strip/true/crop/1600x900+0+0/resize/1280x720!/quality/90/?url=https%3A%2F%2Fsource-media-brightspot.s3.us-east-1.amazonaws.com%2Fb3%2F79%2F3b1db6264efa9eab86e05b296afc%2Fpowell-jerome-mnuchin-steven-bl-092220.png)