-

Measures designed to give banks and credit unions more flexibility to help customers weather the coronavirus pandemic are set to expire Dec. 31 unless Congress renews them.

September 18 -

A combination of pent-up demand, low inventory and rock bottom interest rates is making it extra tough for homebuyers with government-backed loans.

September 18 -

The future of Fannie Mae and Freddie Mac, the Fed’s supervisory regime for the biggest financial institutions, reform of the Community Reinvestment Act and a host of other industry-related issues are on the ballot this November.

September 17 -

The Flagstar MortgageTech Accelerator program was designed to give qualified fintechs access to experienced mentors and potential customers. Applicants also may obtain access to seed capital funding.

September 17 -

Mortgage lender loanDepot is taking steps toward rebooting plans for an initial public offering, about five years after scrapping one at the last minute, according to people with knowledge of the matter.

September 17 -

Mortgage rates remained relatively flat, rising a single basis point off of last week's record low, according to Freddie Mac.

September 17 -

Nowhere is the widening gap between real estate and the real economy more apparent than in Las Vegas, where tourism is in ruins, wages are plunging and home prices just keep rocketing higher.

September 17 -

Fannie Mae and Freddie Mac have been slammed for planning an additional refinancing charge to cover COVID-related losses, but the head of the Federal Housing Finance Agency defended the policy in House testimony.

September 16 -

Low rates, along with increased new and existing home sales activity drives the latest forecast.

September 16 -

The central bank said it would keep interest rates at current levels through at least to help the U.S. economy recover from the coronavirus pandemic.

September 16 -

A deep understanding of the history of racial discrimination in both lending and technology is a prerequisite to the development of new technologies, panelists said.

September 16 -

The only rational strategy for holding MSRs is to be very aggressive on protecting the servicing assets via loan recapture. This is one of the chief reasons that banks have been willing to give up their share in lending and servicing as they collapse back to retail-only lending strategies.

September 16 Whalen Global Advisors LLC

Whalen Global Advisors LLC -

U.S. homebuilder optimism rose to a record in September, with low mortgage rates driving a housing boom that has boosted the pandemic economy.

September 16 -

Mortgage applications decreased 2.5% from one week earlier as refinance activity appears to decelerating, according to the Mortgage Bankers Association.

September 16 -

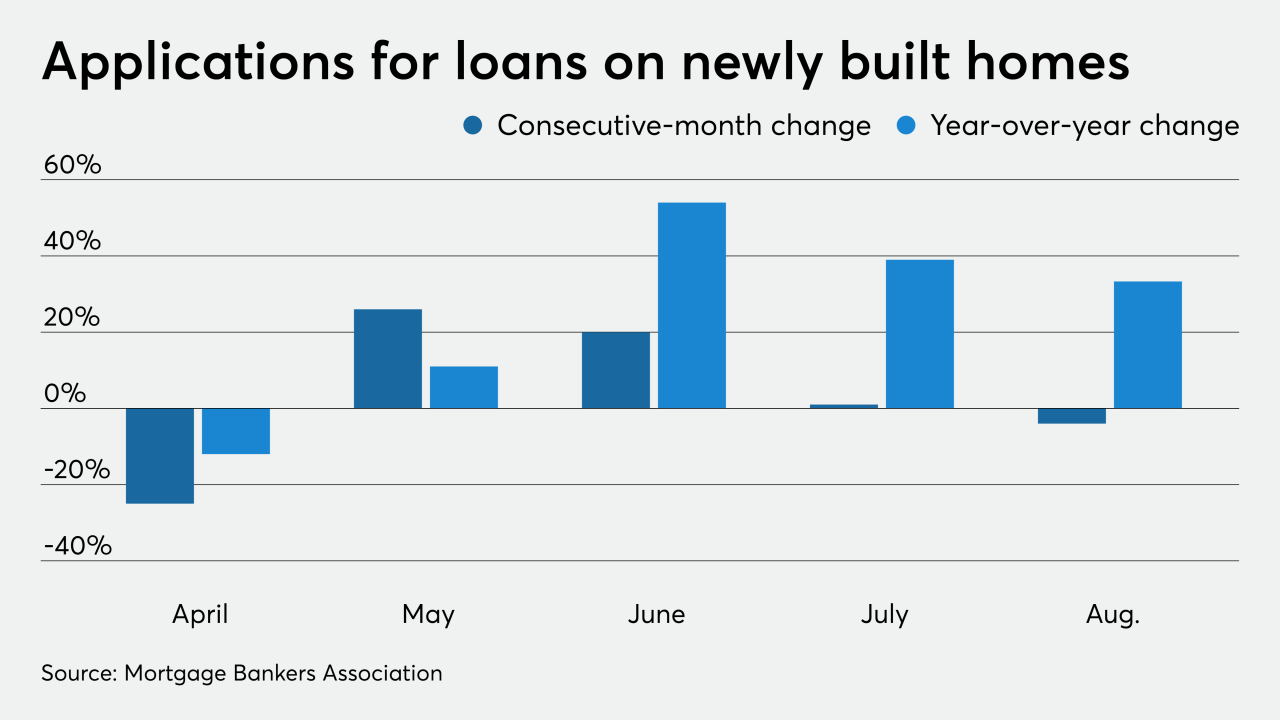

Loan applications for new homes have staged a remarkable turnaround this year after falling 25% month-over-month and 12% year-to-year due to the coronavirus' impact in April.

September 16 -

The potential acquirers included a "go shop" provision as a sweetener in the rejected offer.

September 15 -

After being approved, retroactively denied and having a second application rejected, the firm is appealing the decision with federal regulators.

September 15 -

Any roadmaps for client service that existed before the pandemic have changed, according speakers at DigMo2020.

September 15 -

The government-sponsored enterprise’s seller/servicer guide is now integrated into the online portal. Freddie also improved the readability of loan-level reporting it provides, and has further changes in the works.

September 15 -

Quicken Loans president and COO, Bob Walters, provided the first keynote of the 2020 Digital Mortgage Conference and gave insight into how this year changed the industry.

September 15