-

A deep understanding of the history of racial discrimination in both lending and technology is a prerequisite to the development of new technologies, panelists said.

September 16 -

The only rational strategy for holding MSRs is to be very aggressive on protecting the servicing assets via loan recapture. This is one of the chief reasons that banks have been willing to give up their share in lending and servicing as they collapse back to retail-only lending strategies.

September 16 Whalen Global Advisors LLC

Whalen Global Advisors LLC -

U.S. homebuilder optimism rose to a record in September, with low mortgage rates driving a housing boom that has boosted the pandemic economy.

September 16 -

Mortgage applications decreased 2.5% from one week earlier as refinance activity appears to decelerating, according to the Mortgage Bankers Association.

September 16 -

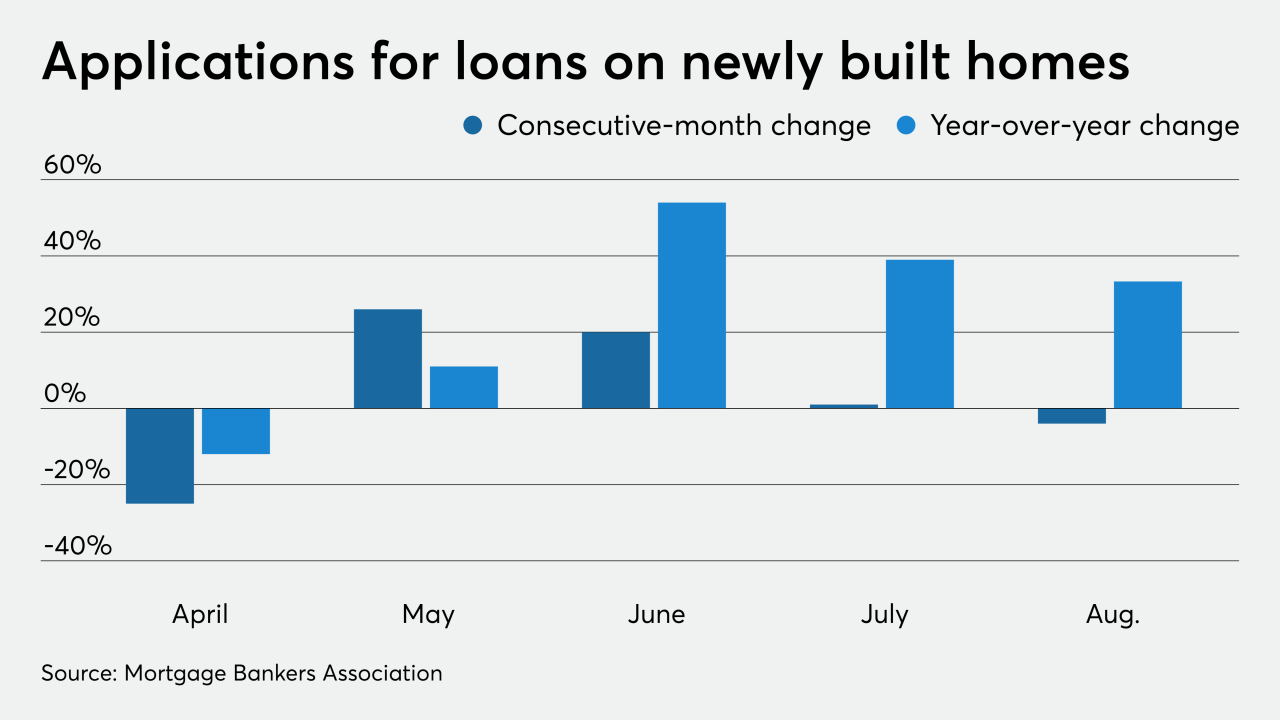

Loan applications for new homes have staged a remarkable turnaround this year after falling 25% month-over-month and 12% year-to-year due to the coronavirus' impact in April.

September 16 -

The potential acquirers included a "go shop" provision as a sweetener in the rejected offer.

September 15 -

After being approved, retroactively denied and having a second application rejected, the firm is appealing the decision with federal regulators.

September 15 -

Any roadmaps for client service that existed before the pandemic have changed, according speakers at DigMo2020.

September 15 -

The government-sponsored enterprise’s seller/servicer guide is now integrated into the online portal. Freddie also improved the readability of loan-level reporting it provides, and has further changes in the works.

September 15 -

Quicken Loans president and COO, Bob Walters, provided the first keynote of the 2020 Digital Mortgage Conference and gave insight into how this year changed the industry.

September 15 -

The proposals offer lenders both cause for celebration and for concern.

September 15 Promontory MortgagePath

Promontory MortgagePath -

After flattening over the three prior weeks, the number of loans going into coronavirus-related forbearance dove at a rate not seen since early August, according to the Mortgage Bankers Association.

September 15 -

Legislation favorable to the industry would be unlikely to pass in a divided Congress, but the biggest benefit for banks and credit unions of Republicans' retaining control of the chamber would be defending against the disruption of a Democratic blue wave.

September 14 -

The company's outgoing CFO discussed ways the asset cap is stunting growth, but provided no updates at an industry conference on when the restriction might be lifted or the types of jobs it will cut.

September 14 -

Median closing prices hit a new record high during the four-week period ended Sept. 6, Redfin said.

September 14 -

Many states currently have temporary work-from-home guidance for licensed mortgage professionals that extends through at least Dec. 31, but some have fall expiration dates.

September 14 -

Only 18% of refinance borrowers returned to the same lender in the second quarter, the second lowest rate since 2005.

September 14 -

Also the Federal Housing Administration, which is a key contributor of government-insured loans to Ginnie securitizations, recently set new conditions on mortgage applicants that have been in forbearance.

September 14 -

Plus: mortgage credit availability hits 6-year-low and Ellie Mae and ICE Mortgage change leadership

September 11 -

Even though second-quarter originations were nearly double the same period in 2019, most were refinancings, which generate less revenue for title companies.

September 11