-

The proposals offer lenders both cause for celebration and for concern.

September 15 Promontory MortgagePath

Promontory MortgagePath -

After flattening over the three prior weeks, the number of loans going into coronavirus-related forbearance dove at a rate not seen since early August, according to the Mortgage Bankers Association.

September 15 -

Legislation favorable to the industry would be unlikely to pass in a divided Congress, but the biggest benefit for banks and credit unions of Republicans' retaining control of the chamber would be defending against the disruption of a Democratic blue wave.

September 14 -

The company's outgoing CFO discussed ways the asset cap is stunting growth, but provided no updates at an industry conference on when the restriction might be lifted or the types of jobs it will cut.

September 14 -

Median closing prices hit a new record high during the four-week period ended Sept. 6, Redfin said.

September 14 -

Many states currently have temporary work-from-home guidance for licensed mortgage professionals that extends through at least Dec. 31, but some have fall expiration dates.

September 14 -

Only 18% of refinance borrowers returned to the same lender in the second quarter, the second lowest rate since 2005.

September 14 -

Also the Federal Housing Administration, which is a key contributor of government-insured loans to Ginnie securitizations, recently set new conditions on mortgage applicants that have been in forbearance.

September 14 -

Plus: mortgage credit availability hits 6-year-low and Ellie Mae and ICE Mortgage change leadership

September 11 -

Even though second-quarter originations were nearly double the same period in 2019, most were refinancings, which generate less revenue for title companies.

September 11 -

Jonathan Corr's departure from the nation's largest loan origination system company follows the completion of its sale to Intercontinental Exchange.

September 11 -

The guidelines are somewhat similar to those the Federal Housing Finance Agency established for the government-sponsored enterprise market in response to the high number of loans impacted by coronavirus-related hardships.

September 11 -

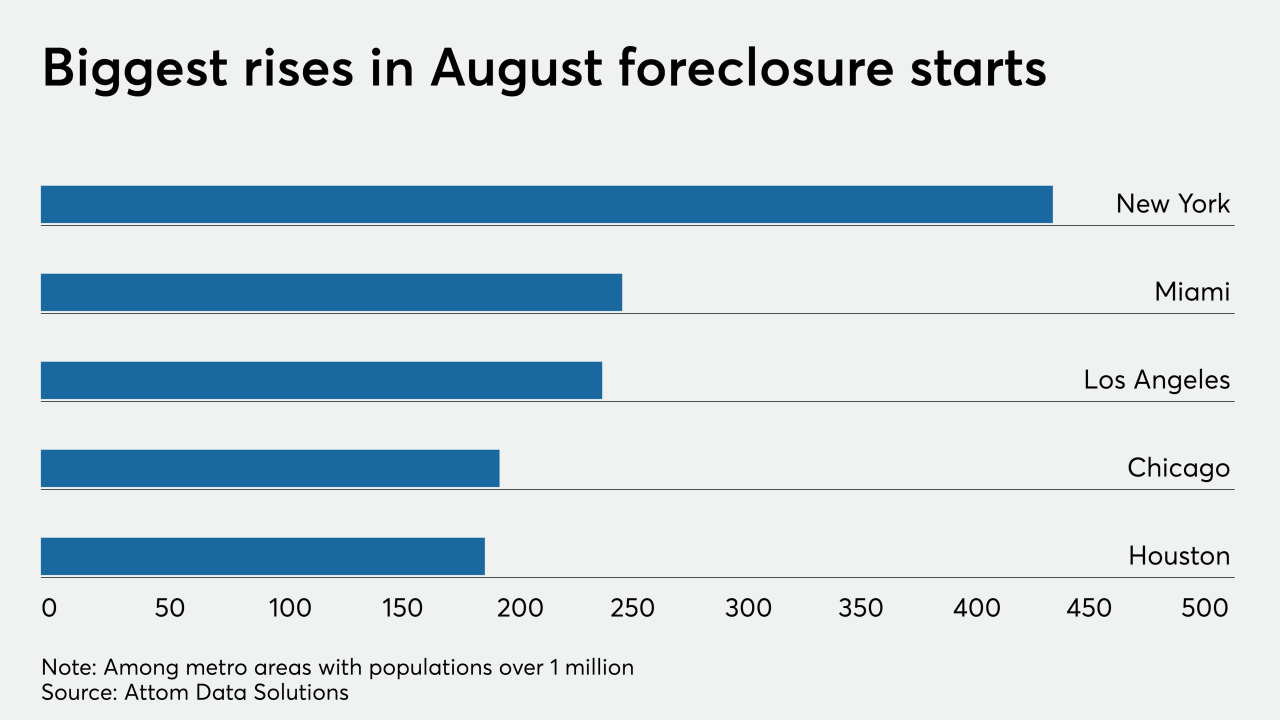

While still greatly trailing year-ago numbers, mortgage foreclosure activity jumped in August from July as moratorium restrictions started lifting and courthouses reopened, according to Attom Data Solutions.

September 11 -

The financial industry has praised the measured approach taken in a pending regulation on permitted communications with consumers. But two recent complaints by the bureau against debt collectors reflect a potentially aggressive enforcement stance.

September 11 -

The GSEs began sharing their risk with the private market in new ways during conservatorship, and the Federal Housing Finance Agency’s proposed capital framework currently discourages the use of those strategies. Industry leaders voiced concerns in a FHFA listening session this week.

September 11 -

That, along with continued high refinance volume over the next three months, keeps originators' profit forecasts elevated, Fannie Mae said.

September 11 -

When Jane Fraser takes the reins of Citigroup in February, she will have to tackle the company’s cards slump, lagging performance metrics and challenges presented by employees’ return to the office.

-

The post was vacant since Kristy Fercho left to run Wells Fargo Home Loans in July.

September 10 -

Uncertainties in the job market drove mortgage credit availability down again, falling to the lowest point since March 2014, according to the Mortgage Bankers Association.

September 10 -

Jane Fraser, a longtime Citigroup executive, will be the first female CEO of a major Wall Street bank. She succeeds Michael Corbat, who had held the post for eight years.

September 10