-

While employment typically ebbs as home buying slows in the fall, several nonbanks have ambitious hiring plans in the works, which call for them to add thousands of workers by year-end.

September 4 -

Today there are 1 million fewer Americans in forbearance than there were at the peak in May, according to Black Knight.

September 4 -

When it comes to branch cleanliness and mask-wearing, the San Francisco bank is more diligent than its rivals in helping to reduce the spread of coronavirus, according to a new study.

September 4 -

The mortgage industry comes together to address current issues and prepare for a post-COVID marketplace Sept. 14 to 17.

September 4 -

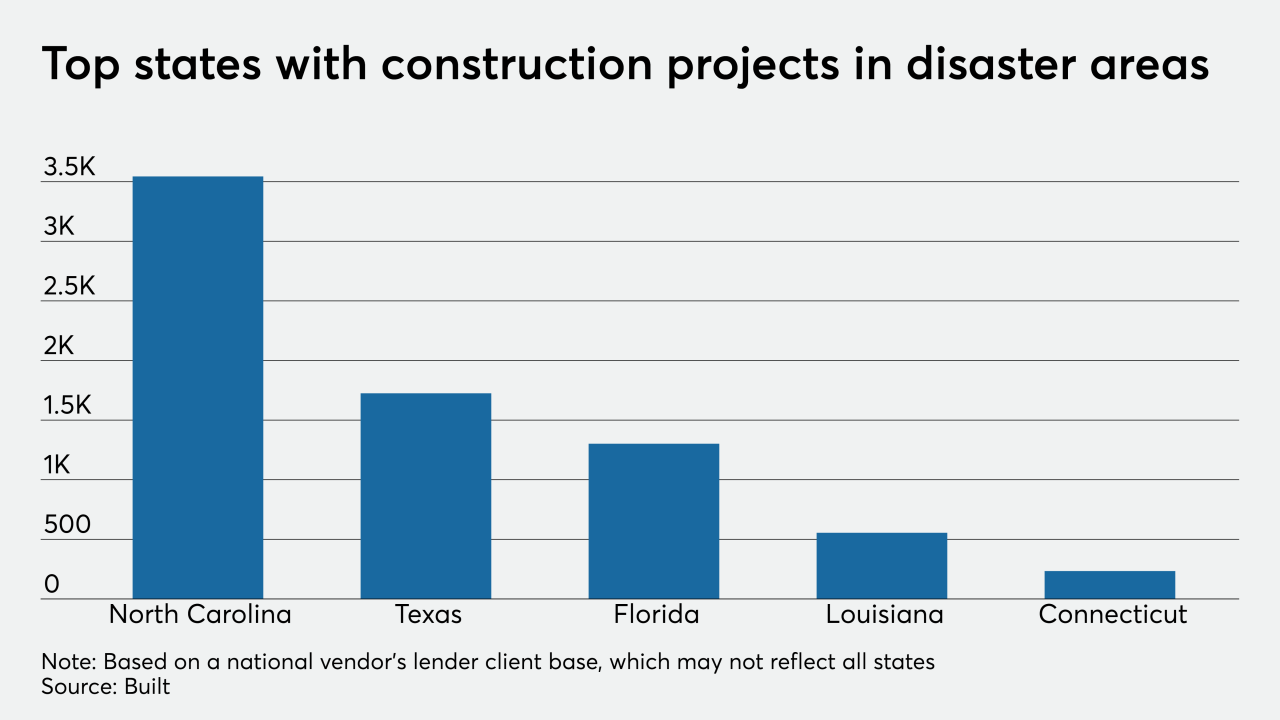

The technology company arrived at this percentage by mapping federally declared disaster areas to the projects it helps lenders manage.

September 3 -

Home purchase power increased by almost 7% annually in July as mortgage rates were at or near record lows.

September 3 -

Mortgage rates remained relatively flat this week, as yields for the benchmark 10-year Treasury spiked at the start of the period before dropping, according to Freddie Mac.

September 3 -

Nearly half of the second-quarter volume came from its existing customers.

September 3 -

The agency’s plan to extend the "qualified mortgage" stamp of approval to more loans could help lenders that rely on alternative data and cushion the blow of other QM changes for Fannie Mae and Freddie Mac.

September 2 -

But federal elections and the pandemic make projections on the sustainability of industry profitability especially tricky.

September 2 -

The pandemic drives home the point that without those funds being siphoned off, the recent fee hikes would not be necessary.

September 2 Community Home Lenders Association

Community Home Lenders Association -

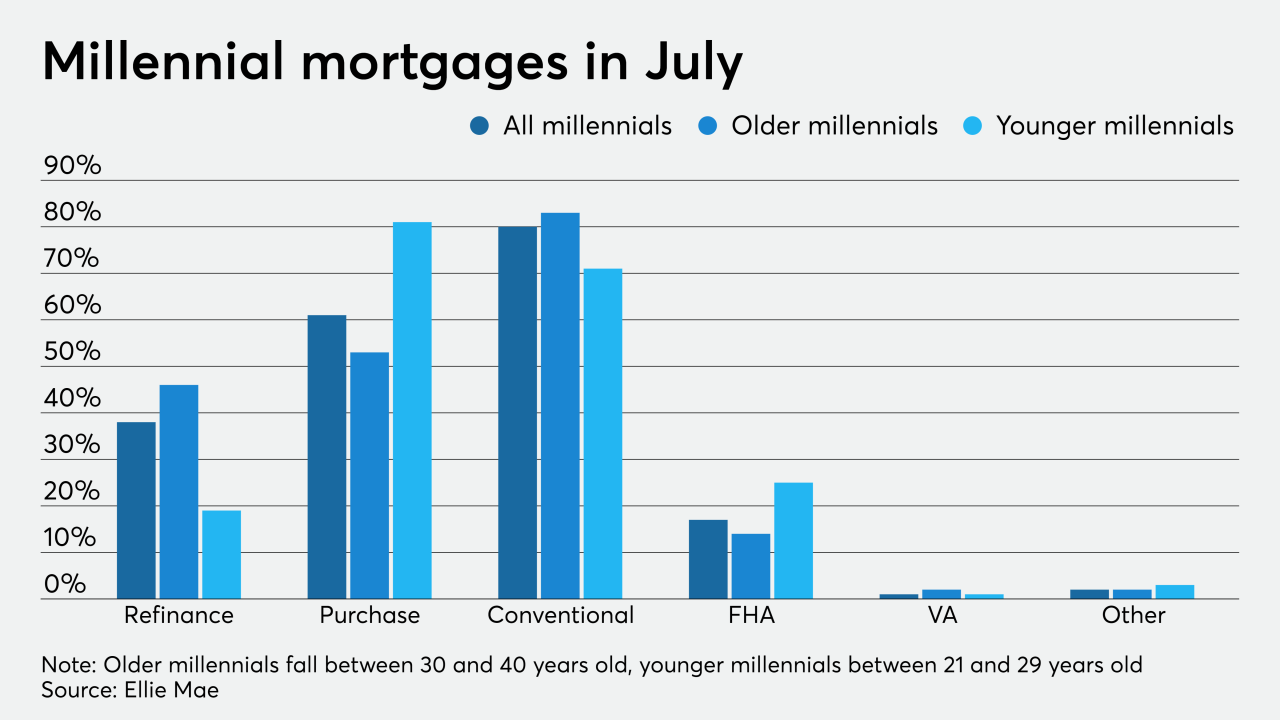

Millennials locked in the lowest mortgage rates on record and kept the summer housing market hot, according to Ellie Mae.

September 2 -

Home prices continue to accelerate in Southwest Florida, but at a slower pace than the state and the nation.

September 2 -

This proposed Libor replacement is an imaginary, backward-looking benchmark dreamed up by the economists at the Fed with no discernible market.

September 2 Whalen Global Advisors LLC

Whalen Global Advisors LLC -

Mortgage applications fell for the third consecutive week, likely because those borrowers motivated to refinance have already done so, according to the Mortgage Bankers Association.

September 2 -

Individuals who received a coronavirus stimulus check earlier this year also qualify for the protection, as do couples who jointly file their taxes and expect to earn less than $198,000.

September 1 -

Following its deadline for written comments on the topic last month, the Federal Housing Finance Agency is scheduling events that will focus on two key themes emerging in responses.

September 1 -

Neither side opted to invoke their Aug. 31 termination rights and the deal is set to close by the end of September.

September 1 -

Driven by robust purchase demand and tight housing supply, housing price growth reached a two-year high in July, according to CoreLogic.

September 1 -

America's real estate meccas aren't what they used to be as COVID-19 revives U.S. mobility.

September 1