-

Total forbearance driven by the coronavirus rose by 25 basis points, which suggests it is still growing but at a slowing pace, according to the Mortgage Bankers Association.

May 18 -

Pent-up demand is already pushing buyers to a gradual return to the market, the report asserts.

May 18 -

Ginnie Mae is offering temporary relief related to its acceptable delinquency-rate threshold in response to issuers' need to fulfill the forbearance requirements in the coronavirus rescue package.

May 18 -

Homebuilder sentiment rose in May by more than forecast following a record slump a month earlier as a pickup in sales and demand expectations pointed to stabilization in the real estate market.

May 18 -

Now is the time for mortgage servicers to prioritize customer care for the homeowners they serve.

May 15 Sagent Lending Technologies

Sagent Lending Technologies -

But in the worst-case scenario, the number of forbearances could grow by 3 percentage points through the end of June.

May 15 -

Democrats’ latest proposal to back debt collectors, enable loans for nonprofits and provide other relief could help steer negotiations with the Senate on more stimulus.

May 15 -

The upstarts enjoyed rapid growth during the long economic expansion. Now they are on the ropes.

May 14 -

JPMorgan Chase's asset-management unit and joint-venture partner American Homes 4 Rent are betting on the Las Vegas rental market.

May 14 -

The economic contraction will keep mortgage rates low for the foreseeable future.

May 14 -

Mortgage rates remained generally steady this past week, even with the continuing market volatility, and that is helping the purchase market, according to Freddie Mac.

May 14 -

The agency's announcement came one day after the agency said it would provide borrowers struggling to stay current with an additional payment deferral option.

May 14 -

Homeowners hurt by coronavirus were told they could delay their mortgage payments without facing consequences. Now, some are learning they’re at risk of being shut out of the housing market.

May 14 -

Eligible borrowers can add the forborne payments to the end of their loan term.

May 13 -

If employers maintain flexible working practices after lockdowns get lifted, housing preferences and subsequent property values could greatly change.

May 13 -

Previously, mortgage firms concentrated on borrower-facing systems at the expense of internal experience.

May 13 -

Incoming chief Frank Bisignano downplays any pressure to find $1.2 billion in cost cuts promised to shareholders from the acquisition of First Data. Instead he emphasized his track record of producing revenue growth and pledged to keep funding innovation projects.

May 13 -

The head of the U.S. central bank said its emergency credit programs were not designed to prop businesses up over the long term.

May 13 -

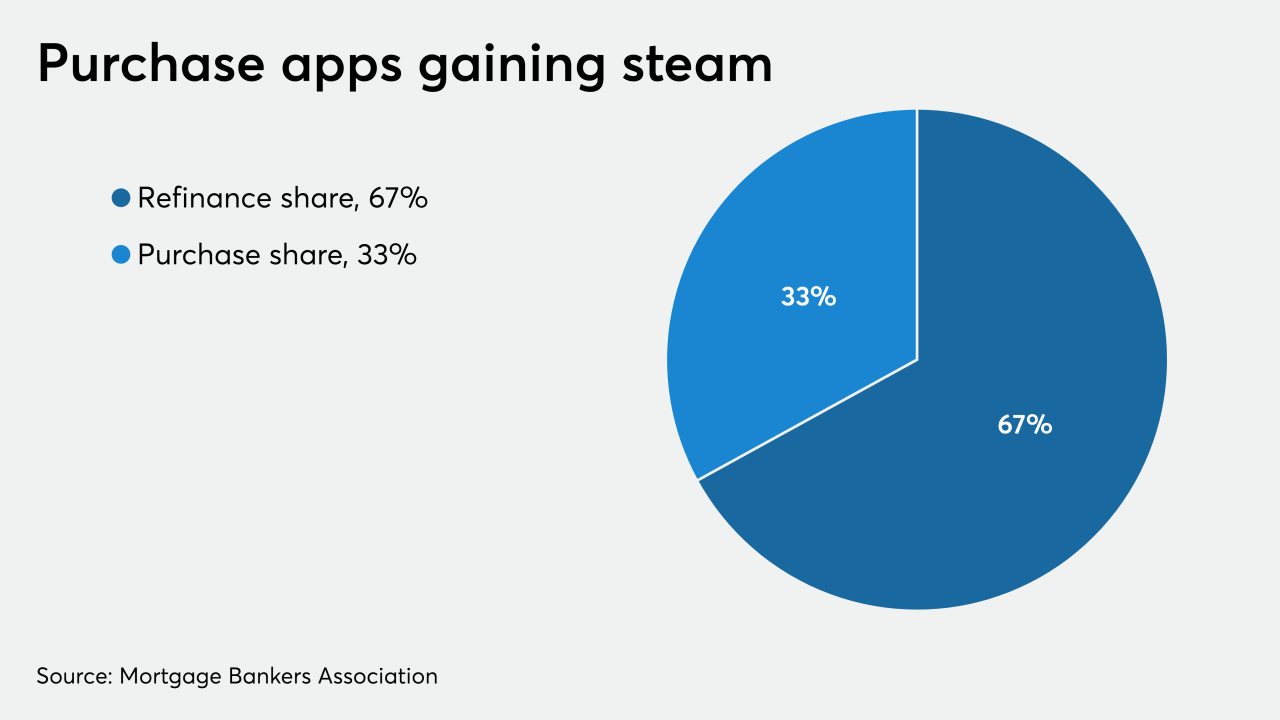

While overall mortgage application volume remained flat, purchase activity continued to rebound — and that should be the case through the remainder of the spring, according to the Mortgage Bankers Association.

May 13 -

A negative Federal Reserve policy rate is still improbable, but if it were to happen it could be a net benefit, according to a note from JPMorgan Chase.

May 13