-

About 7.3% of U.S. mortgages entered forbearance plans in April, providing temporary relief to more than 3.8 million borrowers who have lost income during the coronavirus pandemic.

May 1 -

Wells Fargo will temporarily stop accepting applications for home equity lines of credit, following a similar move by rival JPMorgan Chase.

April 30 -

The S&P CoreLogic Case-Shiller home price index hasn't yet reflected the impact of the coronavirus, but an independent market maker has some thoughts on how it might.

April 30 -

Dallas-Fort Worth home prices have slightly declined in each of the last three quarters.

April 30 -

While Freddie Mac stabilized liquidity in mortgage markets, coronavirus-related credit losses drove the GSE's income down in the first quarter of 2020.

April 30 -

Mortgage rates fell to their lowest level since Freddie Mac started reporting this data in 1971, as the coronavirus shutdown continued to play havoc with the economy.

April 30 -

The bureau issued an interpretive rule clarifying that consumers under certain conditions can modify or waive waiting periods required by the Truth in Lending Act and Real Estate Settlement Procedures Act.

April 29 -

Federal Reserve officials restated their pledge to hold the benchmark interest rate near zero and will keep buying bonds, judging that the coronavirus pandemic "poses considerable risks to the economic outlook over the medium term."

April 29 -

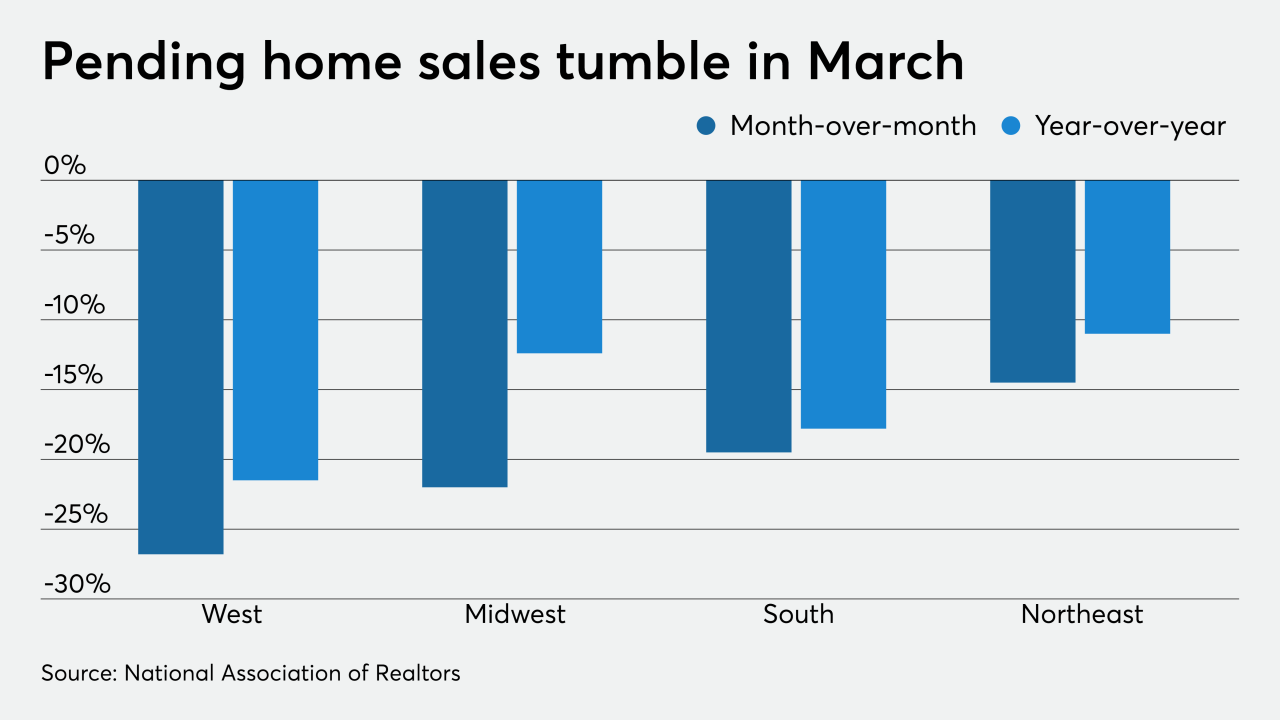

The coronavirus disruption caused March's pending home sales to fall and the losses will reverberate through the rest of 2020, according to the National Association of Realtors.

April 29 -

It's now definitive: Before coronavirus hit, the Seattle area's home market was hotter than almost anywhere else in the country.

April 29 -

Contracts to buy existing homes plunged in March by the most since 2010 as the coronavirus forced people to stay home and the economy spiraled down.

April 29 -

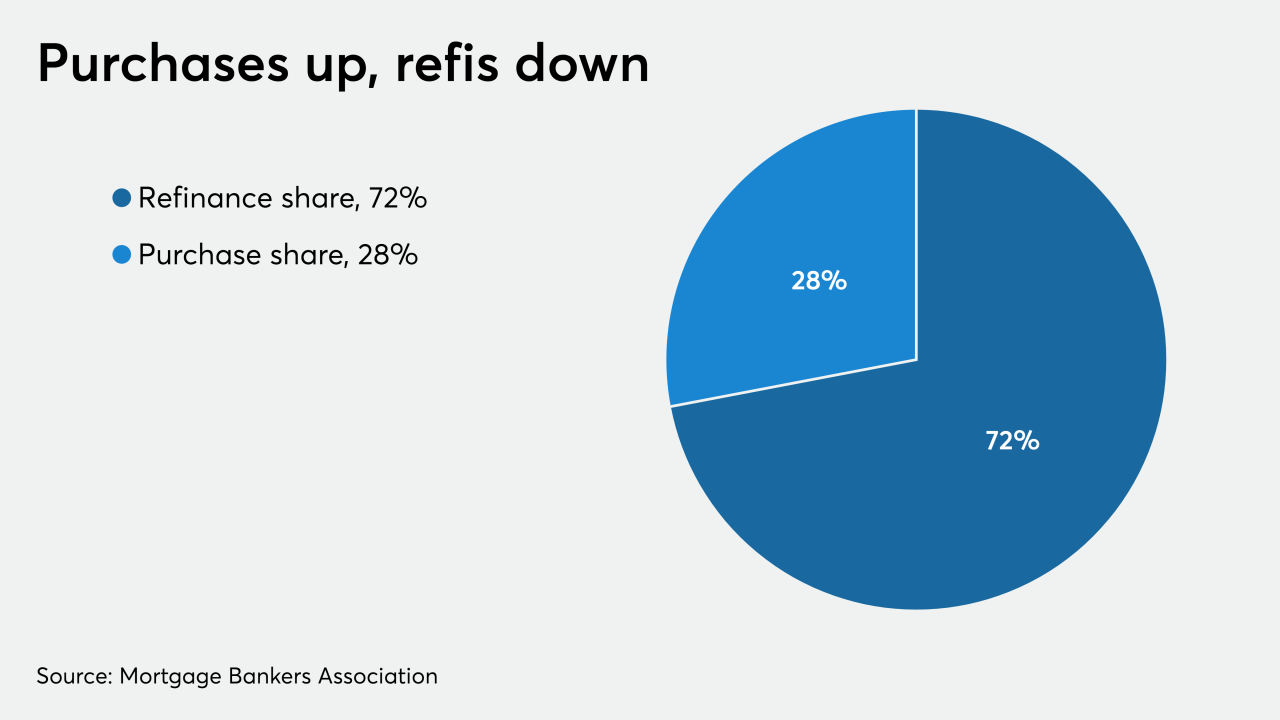

Even though mortgage application volume decreased from one week earlier, lenders had their best week for purchase business since the coronavirus shutdown began, according to the Mortgage Bankers Association.

April 29 -

The Consumer Financial Protection Bureau's chief operating officer will take a similar position at the Federal Housing Finance Agency, fulfilling one of the multiple recruiting goals the FHFA announced in January.

April 28 -

The government-sponsored enterprises are focusing on how loans can be repaid after the federal forbearance period ends, and projections for loan modification volumes suggest the larger industry should, too.

April 28 -

Fannie Mae and Freddie Mac are now able to buy loans in forbearance to alleviate pressure on the sector, but the fees charged by the mortgage giants to assume more risk could turn away some originators.

April 28 -

Refinancing drove a 75% year-over-year increase in mortgage banking revenue during the first quarter at Flagstar Bancorp as it shored up its operations to avoid other negative repercussions from the coronavirus.

April 28 -

Mass layoffs and furloughs due to COVID-19 disproportionately affected Asian, black and Latino workers, and, in turn, will impact their housing security the most, according to Zillow.

April 28 -

Dallas-area home prices were up just 2.5% in the latest national comparison, but the small year-over-year increase came in February before the COVID-19 pandemic significantly impacted the market.

April 28 -

Is JPMorgan Chase an outlier or the canary in the coal mine when it comes to home equity lending during the coronavirus spread?

April 28 -

The agency stated it’s concerned that securitization payment cash flow for the notes could be disrupted by deals’ stop-advance features that limit the period in which servicers must cover principal and interest payments on delinquent loans to MBS noteholders.

April 27