-

As mortgage rates recently hit their highest point in seven years, closed refinances fell back to their low point of 2018, according to Ellie Mae.

October 19 -

Lenders offered fewer government-guaranteed mortgage programs in September, leading to an overall decline in mortgage credit availability, according to the Mortgage Bankers Association.

October 4 -

August's share of conventional mortgages closed by millennials reached a three-year high as lenders added products to meet their lifestyle, Ellie Mae said.

October 3 -

As mortgage rates remained mostly tepid throughout the summer, closed refinances had their first month of growth in August, according to Ellie Mae.

September 19 -

Ellie Mae EVP Joe Tyrrell talks customer acquisition strategy. Crafting a personalized consumer experience, he says, starts with data.

September 18 -

Mortgage credit accessibility dropped for the first time in four months as jumbo loan products took a step back, according to the Mortgage Bankers Association.

September 11 -

Nearly half of July's millennial homebuyers were single, a sign that they are not waiting for certain milestones like marriage before deciding to become homeowners, according to Ellie Mae.

September 5 -

The vast majority of consumers start the mortgage process with internet research, but when it comes time to initiate contact with a lender, borrowers are nearly as likely to pick up the phone as they are to connect online.

August 29 -

Purchase-loan share held steady month-to-month for the first time this year, even though it is still above year-ago levels in line with a seasonal decline, but growth remains in the forecast.

August 15 -

Mortgage credit accessibility kept climbing in July, mostly thanks to an expansion of jumbo loan products offered, pushing that index to its historical high point, according to the Mortgage Bankers Association.

August 7 -

Revisions to the TILA/RESPA integrated disclosure that go into effect this fall drove the changes Ellie Mae made in its latest update to the Encompass loan origination system.

August 6 -

An increase in millennials making home purchases is a call to the mortgage industry for a quicker, more efficient digital process.

August 1 -

Ellie Mae saw a 20% year-over-year increase in second-quarter revenue with more loans closed using Encompass, but net income fell nearly 50% on an accounting change and acquisition costs.

July 26 -

As purchase mortgages continue to dominate overall industry volume, lenders aren't letting the extra work required to close these loans affect their productivity.

July 18 -

The average millennial borrower credit score remained unchanged in May, but values by city painted very different pictures, according to Ellie Mae.

July 11 -

Access to mortgage credit inched up in June, as competition for jumbo loans resulted in looser underwriting, but government lending standards got more restrictive, the Mortgage Bankers Association said.

July 10 -

Higher interest rates on home mortgages drove the share of loans used to purchase houses rather than refinance to new heights in May.

June 20 -

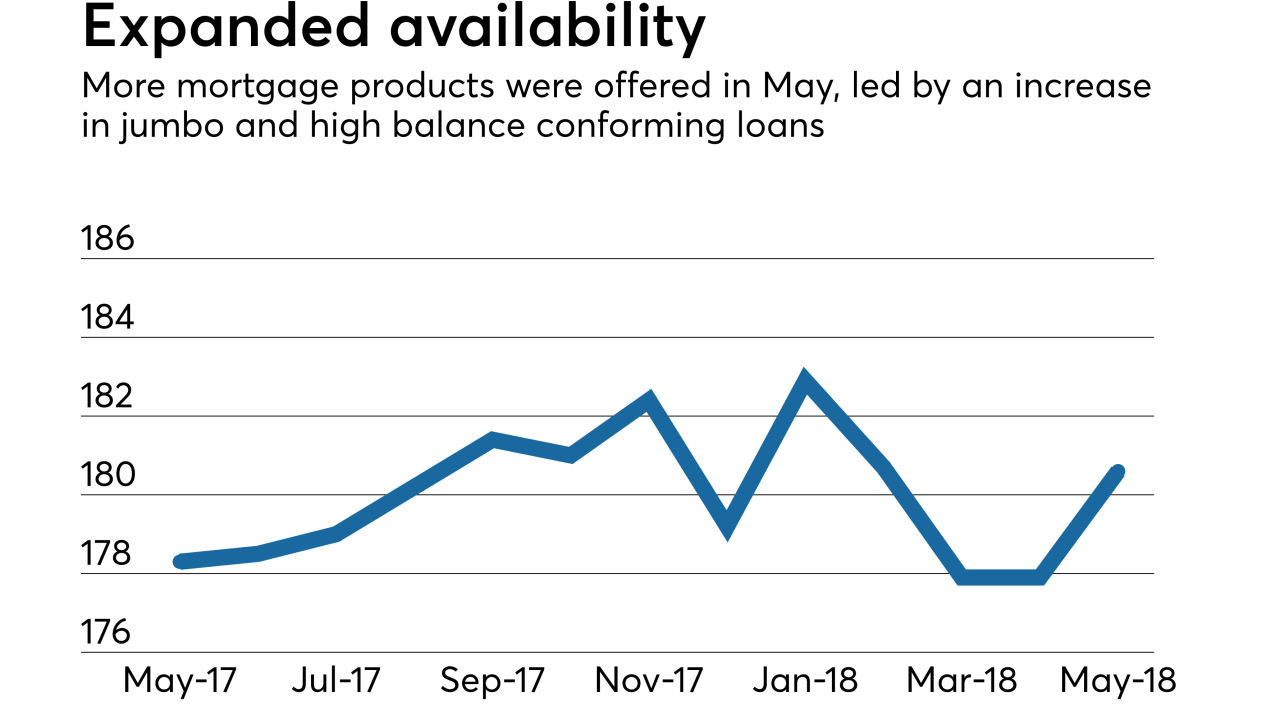

Mortgage credit availability increased in May by 1.5% as more jumbo and high-balance conforming loan products came on the market, the Mortgage Bankers Association said.

June 13 -

A new integration between Blend and Ellie Mae seeks to improve the use and accessibility of electronic mortgage documents, the latest in an ongoing industry effort to create a more simplified and consistent borrower experience.

May 24 -

As mortgage rates continued rising, the percentage of closed home purchase loans grew to its highest level in about four years, according to Ellie Mae.

May 16