-

Fannie Mae and Freddie Mac transferred a substantial amount of credit risk to the private sector through both single-family and multifamily market transactions in the first half of the year, with activity expected to rise in 2019, according to the Federal Housing Finance Agency.

November 1 -

The structure reduces counterparty risk in the GSE's benchmark Connecticut Avenue Securities program; it also expands the investor base.

October 30 -

Fannie Mae has priced more securities that support a transition away from the London interbank offered rate.

October 26 -

Despite recriminations about how the crisis and ensuing regulations have tightened loan access, an actual assessment of mortgage credit availability finds the situation is more complicated.

October 24 -

Incenter Mortgage Advisors is facilitating the sale of $3.7 billion in mortgage servicing rights tied to Fannie Mae and Freddie Mac loans, roughly one-third of which have private mortgage insurance.

October 19 -

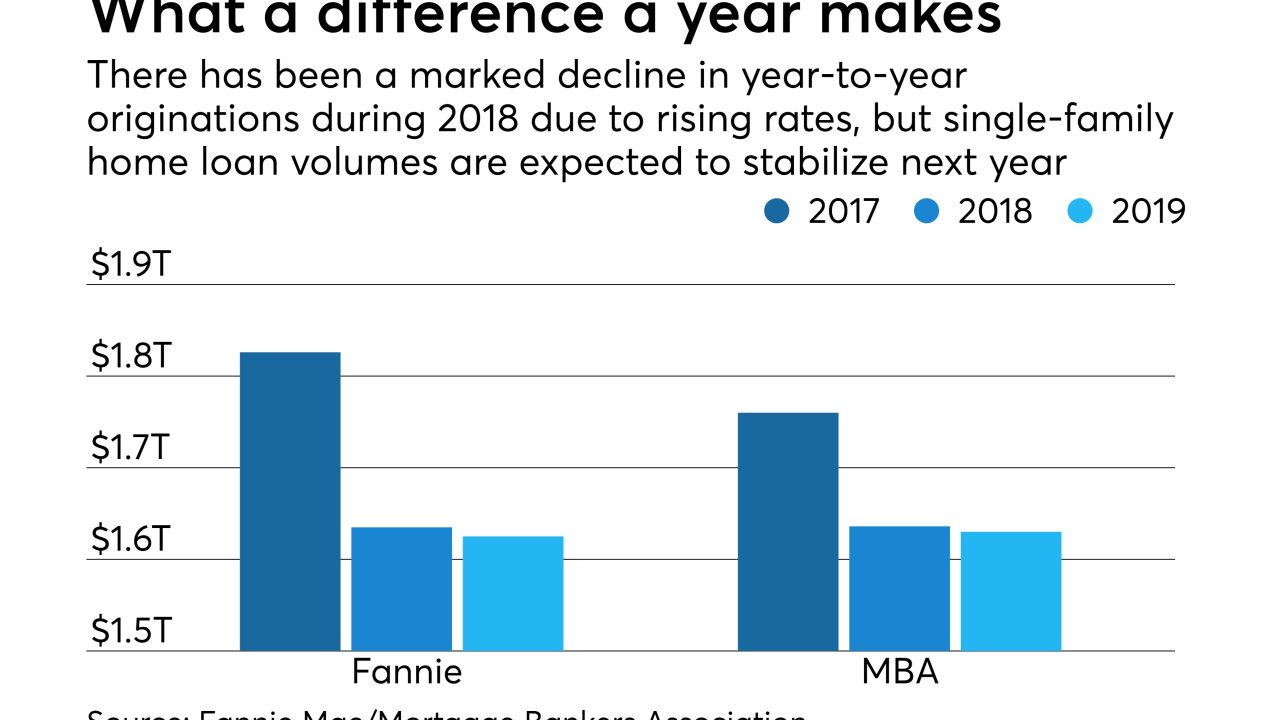

Increasing pessimism about housing is driving Fannie Mae's estimates for originations this year down a little further.

October 18 -

The departing CEOs of Fannie Mae and Freddie Mac oversaw significant cultural and operational shifts that made the housing finance system safer and more responsive to market needs, but a tough job lies ahead for their successors.

October 16 -

The Federal Housing Finance Agency, Fannie Mae and Freddie Mac have launched an online clearinghouse with resources to assist lenders in serving borrowers with limited English proficiency.

October 15 -

Industry downsizing resulted in an increase in critical defects found in closed mortgages as loan packaging errors continued to rise during the first quarter, according to Aces Risk Management.

October 15 -

The REIT is purchasing another $500 million of credit risk transfer notes through Fannie's L Street Securities program; this is its first deal rated by Fitch.

October 15 -

It's a critical time in Washington, with many key institutions in the mortgage and housing industries getting new leaders. At the Mortgage Bankers Association, there's a renewed focus on maintaining effective influence with decision makers on initiatives like housing finance reform, innovation and the evolving needs of home buyers.

October 14 -

Hurricane Michael is putting mortgage transactions with a combined value of over $400 million in jeopardy, according to ClosingCorp estimates.

October 11 -

Rising interest rates, both current and the prospect for future increases, took a toll on consumers' outlook on the housing market during September, according to Fannie Mae.

October 9 -

Fannie Mae has appointed Hugh Frater, a member of its board of directors, to serve as its interim chief executive officer after Timothy Mayopoulos steps down next week, the company said in a statement on Monday.

October 9 -

Hiring by nonbank mortgage lenders and brokers reversed course again and got slightly higher in August as originators made a last-ditch effort to reach seasonal homebuyers before fall.

October 5 -

Movement Mortgage, citing the continuing deterioration of the housing market, is eliminating approximately 180 back office positions on Oct. 5.

October 4 -

Some lenders are tapping artificial intelligence and machine learning to improve operational efficiency and enhance the borrower experience, but complexities do exist in implementing the technology.

October 4 -

Fannie Mae and Freddie Mac issued new capital requirements for private mortgage insurers that will create big swings in carriers' asset reserves.

September 27 -

After a run-up in the latter half of last year, delinquencies on mortgages sold to Fannie Mae and Freddie Mac look fairly stable for the time being.

September 27 -

As the House Financial Services Committee prepares to hold a hearing Thursday on oversight of the Federal Housing Finance Agency, the exact focus of the hearing remains somewhat in flux.

September 25