Federal Reserve

Federal Reserve

-

Mortgage rates decreased for the third straight week and reached their lowest level since mid-April, according to Freddie Mac.

August 23 -

The Michigan company had been operating under the supervisory agreement since 2010.

August 17 -

The Fed's order targets affidavits prepared by employees of CitiFinancial in connection with the company's exiting the mortgage servicing business.

August 10 -

Mortgage rates rose to their highest level in seven weeks and fourth-highest of 2018, thanks to strong economic trends, according to Freddie Mac.

August 2 -

Mortgage rates rose to their highest level since late June, going up for the third time in the past nine weeks, according to Freddie Mac.

July 26 -

The federal bank regulators are considering roughly a dozen new rulemakings in response to the bill rolling back certain sections of Dodd-Frank.

July 20 -

Mortgage rates took a small step down, decreasing for the sixth time in the eight weeks since Memorial Day, according to Freddie Mac.

July 19 -

Mortgage rates broke from their recent respite, increasing for only the second time in the past seven weeks, according to Freddie Mac.

July 12 -

Despite available home equity shooting up in the first quarter, the share of total equity withdrawn by borrowers hit a four-year low, likely due to an increase in interest rates, according to Black Knight.

July 9 -

Mortgage debt outstanding remains below pre-crisis levels and home equity is growing, even as overall consumer debt is on pace to surpass its previous 2008 peak by $1 trillion, according to LendingTree.

June 25 -

Purchases of new homes advanced in May to a six-month high as sales in the South increased to the fastest pace since 2007, according to government data.

June 25 -

Mortgage rates slid over the past week and have now declined in three of the past four weeks, according to Freddie Mac.

June 21 -

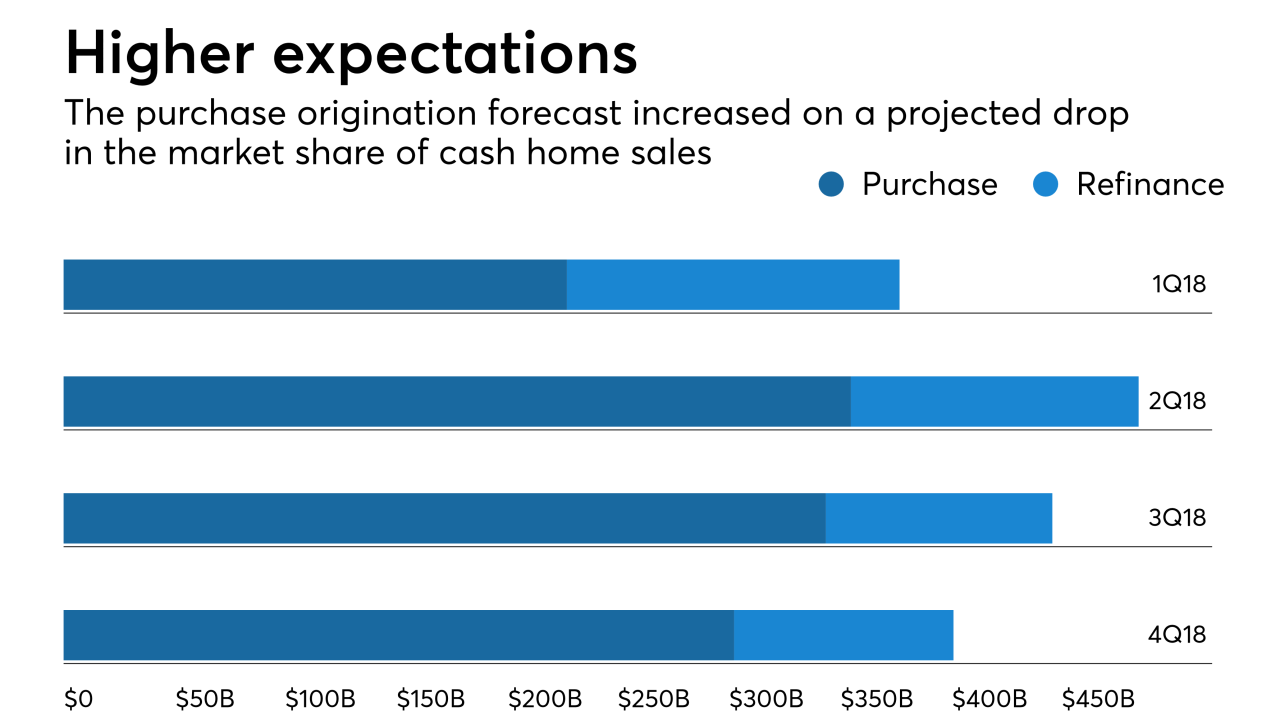

A declining share of cash home sales will drive purchase home originations higher than previously expected through 2019, according to Fannie Mae.

June 18 -

After declining for two straight weeks, mortgage rates reversed direction this week and rose to their second highest level this year, according to Freddie Mac.

June 14 -

Lenders would have a lighter data-reporting burden, but they may end up deciding to collect the data anyway.

May 25 -

Mortgage rates have reversed course and reached a new high last seen seven years ago as the yield on the 10-year Treasury crossed the 3% threshold this week, according to Freddie Mac.

May 17 -

The 10-year U.S. Treasury yield rose to its highest level since 2011, extending a selloff in the world’s biggest bond market and raising fresh questions about how high America's borrowing costs will climb.

May 15 -

Mortgage rates dipped slightly over the past week as yields on the 10-year Treasury retreated after breaking the 3% barrier, according to Freddie Mac.

May 3 -

Mortgage rates rose to their highest level in over four years, as 10-year Treasury yields broke the 3% ceiling this past week.

April 26 -

The international standards-setting body is weathering the infatuation with isolationism in the U.S. and elsewhere better than expected.

April 24