Federal Reserve

Federal Reserve

-

The Federal Reserve decision to shift into Treasuries could pull rates down and increase the prepayment speeds on mortgage-backed securities.

March 22 -

The Federal Reserve will roll its maturing holdings of mortgage-backed securities into Treasuries starting after September, capping it at $20 billion per month.

March 20 -

Fannie Mae estimates the average 30-year fixed-rate mortgage to hold at 4.4% through 2019 and 2020 due to the overall slowdown in the economy, according to the March housing forecast.

March 20 -

Home equity is at an all-time high, but consumers aren't taking advantage of this financing option, according to LendingTree.

March 19 -

Recent remarks from top officials at the FDIC and Fed suggest the agencies' recent impasse over reforming the Community Reinvestment Act may be ending.

March 18 -

Sentiment among homebuilders held steady in March, sustaining a rebound from a recent three-year low on improvement in sales and a brighter outlook for the next six months.

March 18 -

Mortgage rates declined across the board this week, which should make home buying more attractive although there are continuing concerns about inventory, according to Freddie Mac.

March 14 -

While the OCC has led the charge on modernizing the Community Reinvestment Act, Gov. Lael Brainard gave a rundown of new ideas under discussion — from updating assessment boundaries to a comprehensive community development test.

March 12 -

With few headlines to drive up or down movement in the bond markets, mortgage rates held steady after declining for three consecutive weeks, according to Freddie Mac.

February 28 -

Private flood insurance rules that go into effect this summer have a safe harbor for some policies, but determining whether others are compliant could be a time-consuming, imprecise and costly exercise.

February 27 -

The federal banking agencies will not hold a hearing on a proposal to reduce the number of residential real estate transactions that require an appraisal.

February 22 -

As expected economic growth remains at 2.2% — down from 2018's 3.1% — 2019 should only be accompanied by a solitary rate hike from the Federal Reserve, according to Fannie Mae.

February 21 -

Sentiment among homebuilders rose in February for a second month, exceeding all forecasts, as lower mortgage rates and a strong labor market help stabilize demand.

February 19 -

Recent data from the Federal Reserve suggests lenders are growing pessimistic about the credit environment. But is that a sign of trouble ahead, or just sound risk management?

February 18 -

Mortgages rates fell to their lowest levels since early 2018, but positive news involving trade and no new shutdown could send them rising again, according to Freddie Mac.

February 14 -

Depository mortgage lenders are optimistic the final version of a regulation designed to open up the flood insurance market will make it easier for them to comply with a rule requiring them to accept private carrier policies.

February 11 -

The comptroller of the currency also addressed, in his role as acting FHFA head, whether Congress or the Trump administration will spearhead GSE reform.

February 7 -

The combined bank will move into a more demanding supervisory class under the Fed’s regime, but analysts also see a regulatory upside from the deal.

February 7 -

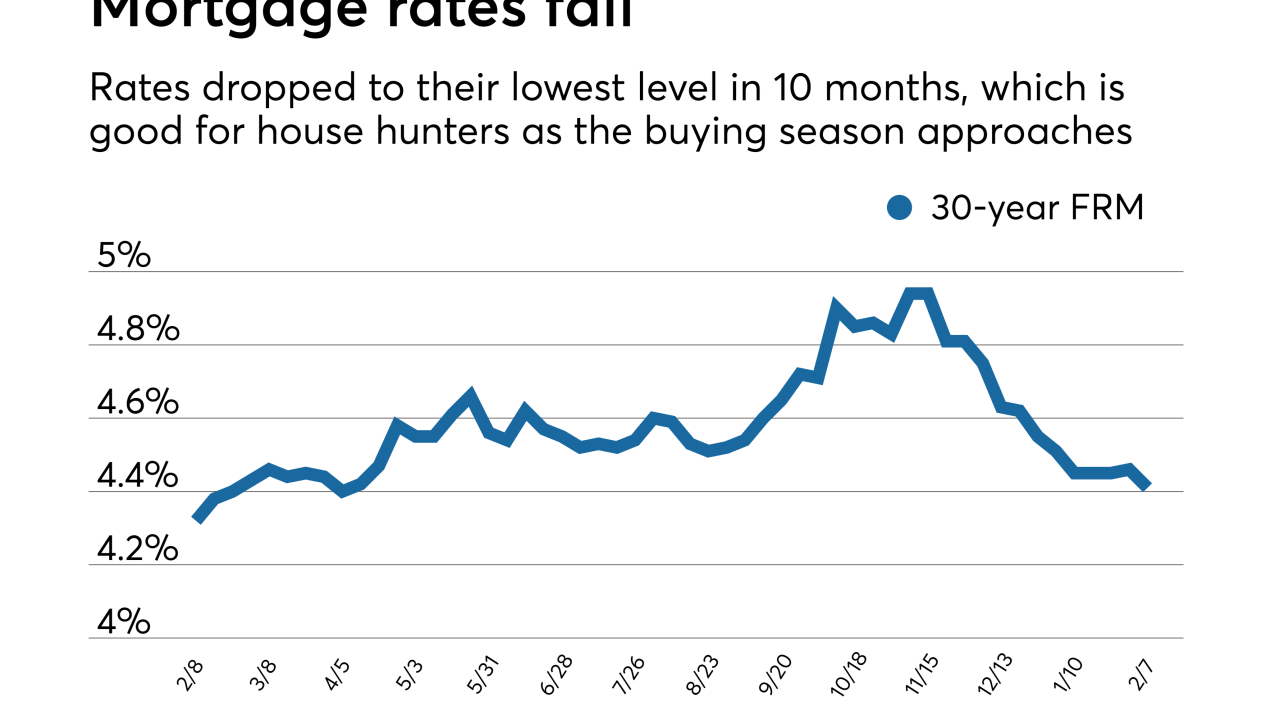

Mortgage rates fell to their lowest level in 10 months, bringing good news for house hunters as spring's home buying season approaches, according to Freddie Mac.

February 7 -

The House Financial Services Committee will hold a hearing Feb. 26 on "holding credit bureaus accountable" — one of seven hearings scheduled by the panel for the month.

February 6