-

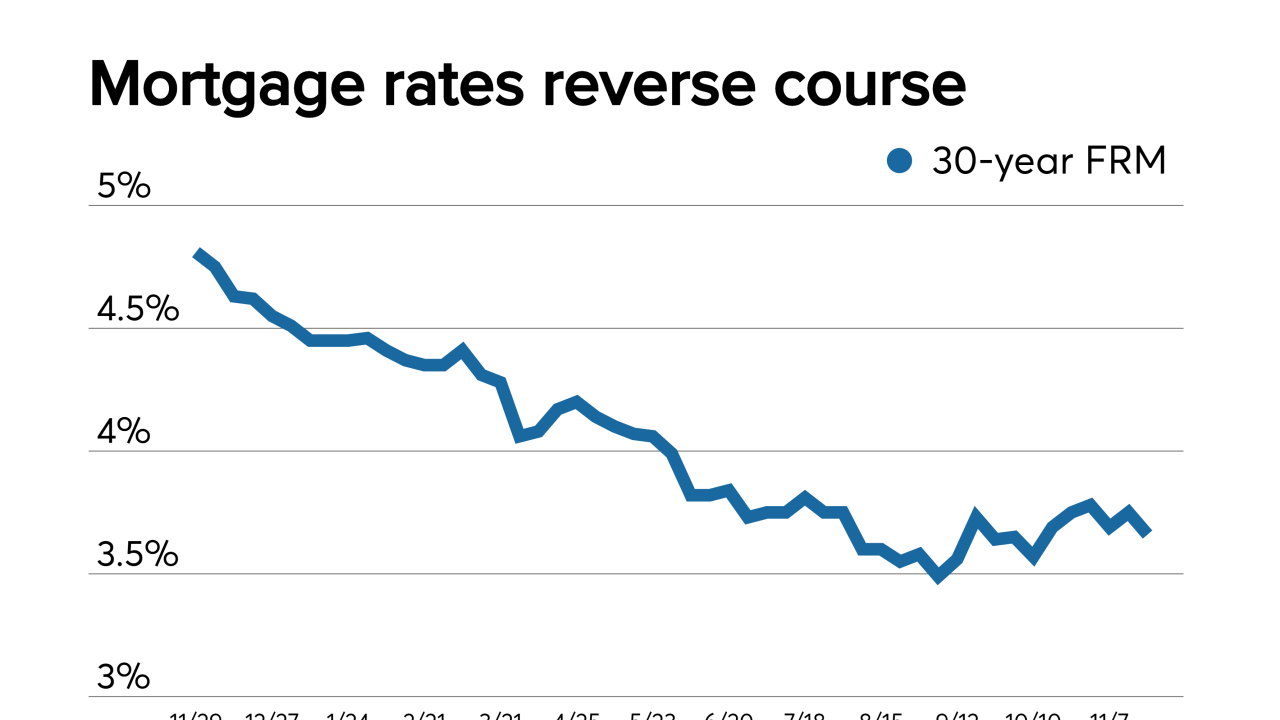

Mortgage rates rose slightly with a stronger-than-expected jobs report starting the week and the Federal Open Market Committee decision to hold the line on short-term rates ending it, according to Freddie Mac.

December 12 -

The prequalification letter is a great way to move borrowers from casual tire kickers to committed applicants, but advances in digital verification will soon make it obsolete.

December 10 Blend

Blend -

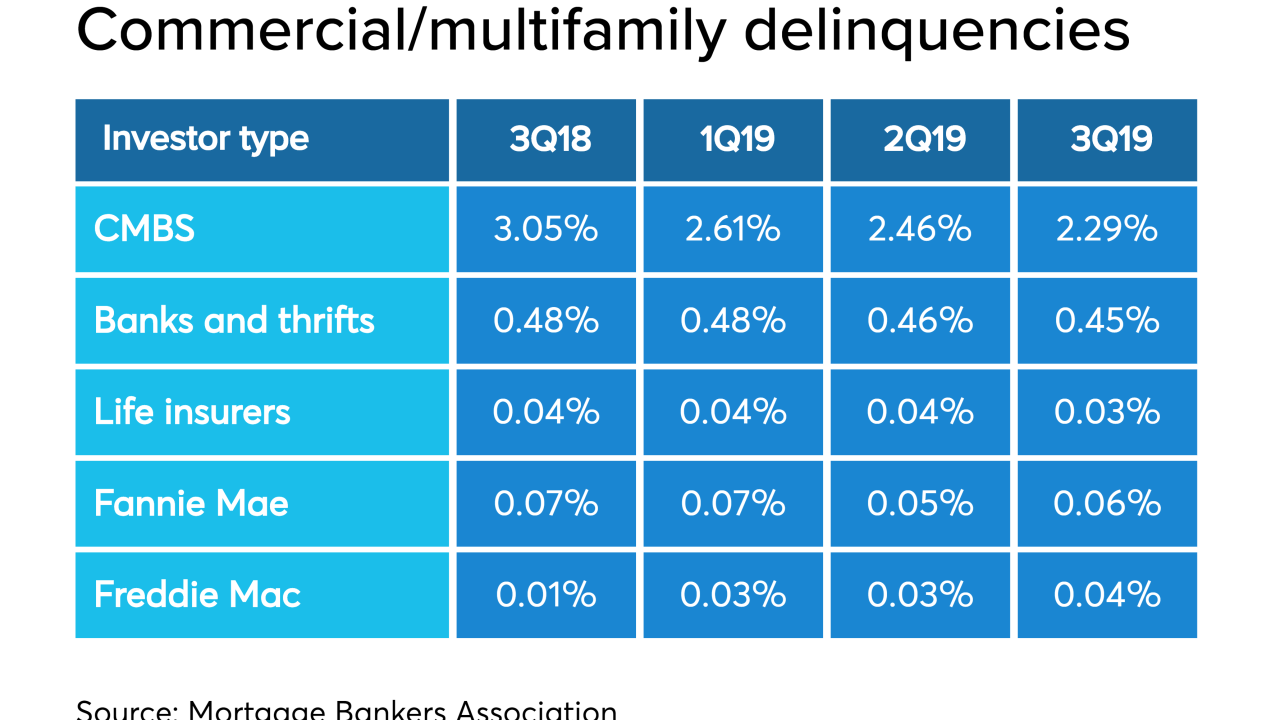

Most commercial and multifamily loan delinquency rates remained near record lows in the third quarter extending a long run of declines in the securitized market, according to the Mortgage Bankers Association.

December 6 -

Mortgage rates remained unchanged this week, after moving back and forth during the period on economic and trade news, according to Freddie Mac.

December 5 -

The outperformance of mortgage-backed securities versus U.S. Treasuries has extended for a third straight month into November, buoyed in part by a decline in volatility.

December 2 -

Loan limits for most mortgages Fannie Mae and Freddie Mac buy will exceed $500,000 for the first time ever next year, and the maximum for most high-cost areas will be $765,000.

November 27 -

Mortgage rates resumed their upward movement this week, but it's not putting a damper on real estate sales activity, noted Freddie Mac.

November 27 -

For the private-label mortgage-backed securities market to grow, regulators need to focus on collateral management in addition to changes to data disclosure rules.

November 25 Whalen Global Advisors LLC

Whalen Global Advisors LLC -

The former head of the Office of Federal Housing Enterprise Oversight explains why he thinks the mortgage industry is closer than ever to having a truly paperless process, and weighs in on GSE reform.

November 22 -

Mortgage rates fell this week, reversing a gradual upward trend, to reach their lowest level in six weeks, according to Freddie Mac.

November 21 -

The Federal Housing Finance Agency has extended its deadline for investor comments on a proposal aimed at better aligning pooling practices for loans in uniform mortgage-backed securities.

November 19 -

The Federal Housing Finance Agency is scrapping a capital proposal it released last year and will seek comments on a new plan in 2020.

November 19 -

There's been chatter that investors are shying away from Fannie Mae and Freddie Mac mortgage-backed securities because Congress may not enact housing finance reform. Be skeptical of those claims.

November 19

-

Lenders have bundled more than $18 billion worth of non-QM, private-label loans into bonds this year that they then sold to investors, a 44% increase from 2018 and the most for any year since the securities became common post-crisis.

November 18 -

The Federal Housing Financial Agency's latest report on credit risk transfers shows Fannie Mae continues to slowly improve a multifamily mortgage risk-sharing metric that lags Freddie Mac's by a wide margin.

November 15 -

Mortgage rates rose modestly this week as investors have a more positive view of the economy and so they are moving money out of the bond market, according to Freddie Mac.

November 14 -

And the government-sponsored enterprises could hold initial public offerings in 2021 or 2022 to ensure they hold adequate capital, FHFA Director Mark Calabria said.

November 13 -

Fannie Mae and Freddie Mac’s exemption from the Qualified Mortgage rule is on borrowed time, but a House bill would allow lenders to use the mortgage giants’ guidelines for documenting borrower income.

November 12 -

Rick Lang of Freddie Mac, Tim Mayopoulos of Blend and Tamra Rieger of Evergreen Home Loans discuss the key objectives – from customer experience to system integrations – that mortgage companies are pursuing through digitalization.

November 7 -

Mortgage rates fell for the first time in four weeks, although given investor optimism over better economic news, it might be a blip, according to Freddie Mac.

November 7