-

Mark Calabria, who could be confirmed as early as this month, is expected to focus on changes to Fannie Mae and Freddie Mac’s conservatorships to let the mortgage giants keep more of their profits.

March 10 -

The increase in average mortgage rates this week should not affect the spring home purchase market because other factors remain strong, according to Freddie Mac.

March 7 -

Freddie Mac is broadly offering instant representation and warranty relief for automatically validated self-employment income following a test of the concept last year.

March 6 -

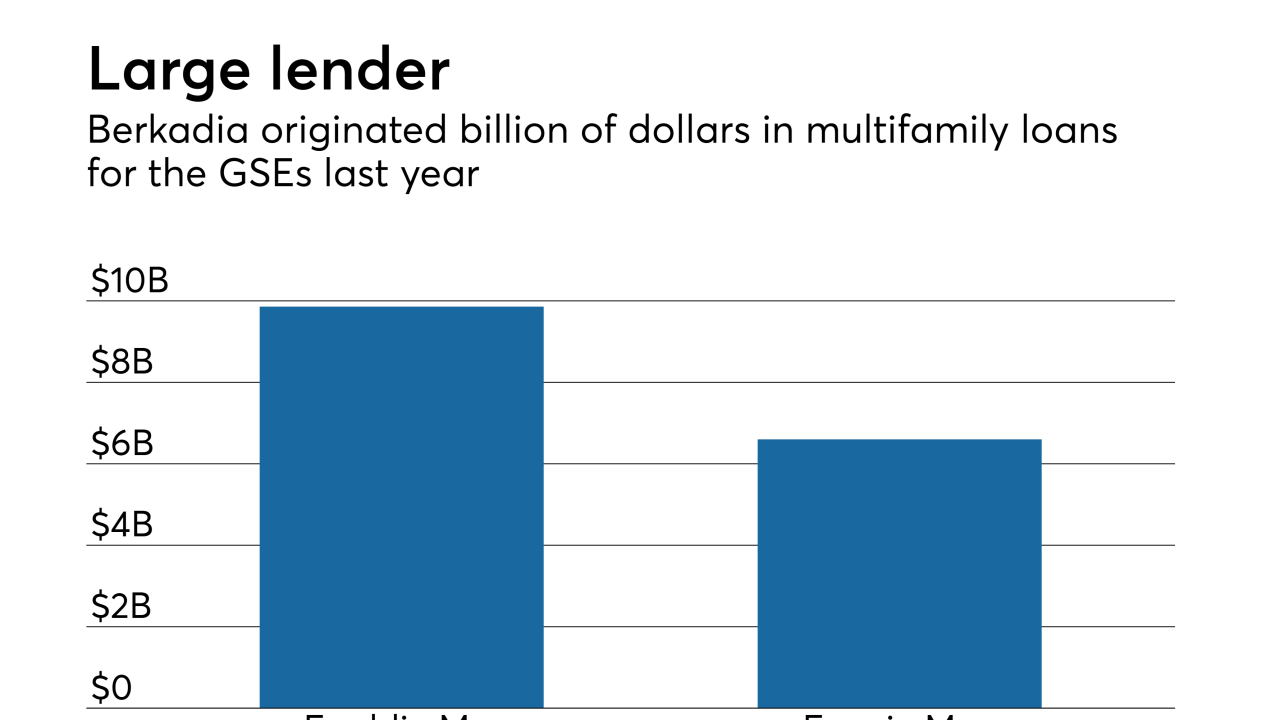

Berkadia, a joint venture run by Berkshire Hathaway and Jefferies Financial Group, is acquiring real estate capital advisory firm Central Park Capital Partners to diversify its capital sources.

March 6 -

Freddie Mac closed its fifth LIHTC fund since 2018 and will make three investments in affordable housing through a partnership with National Equity Fund.

March 4 -

Whether through greater investments in technology and talent, or streamlining back-end processes to improve the decision-making process, mortgage servicers are doing more to prioritize borrowers. Here's a look at seven of these borrower-focused initiatives and how they're reshaping mortgage servicing.

March 1 -

The Mortgage Bankers Association, National Association of Realtors and 26 other groups warned the agency not to pursue steps reducing the scope of Fannie Mae and Freddie Mac that could upset the mortgage market.

March 1 -

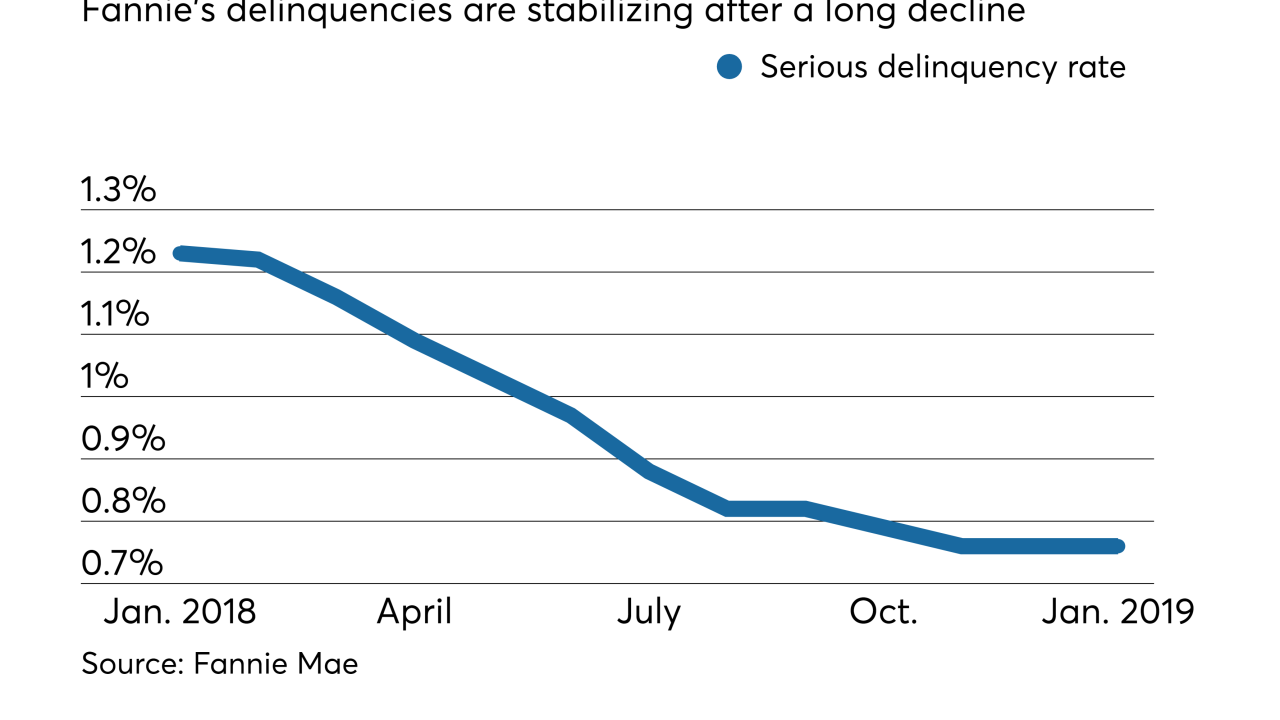

Fannie Mae's serious delinquency rate stood firm for the third month running, adding to evidence that it has hit a floor after dropping for most of the past year.

March 1 -

Freddie Mac again increased its origination forecast for the next two years, as the rate drops of the past few months are expected to boost refinance volume.

March 1 -

Community banks and credit unions fear a Senate plan and other legislative ideas will nullify steps taken by Fannie Mae and Freddie Mac that have made it easier for smaller institutions to compete.

February 28 -

The new regulation, codifying requirements already in practice, is meant to help the mortgage giants prepare for the adoption of a uniform security in June.

February 28 -

With few headlines to drive up or down movement in the bond markets, mortgage rates held steady after declining for three consecutive weeks, according to Freddie Mac.

February 28 -

Credit risk transfer does more than just reduce exposure to a downturn in the housing market. It also provides them with information about how others view mortgage credit risk.

February 27 -

Being too dependent on the automated underwriting tools created by the government-sponsored enterprises to originate loans underlying private-label mortgage-backed securitizations could negatively affect their credit quality, a report from Moody's said.

February 26 -

Without the ability to issue unsecured debt nearly as cheaply as U.S. Treasury bonds, Freddie Mac could not afford to repurchase defaulted loans from MBS, Freddie CEO Don Layton said.

February 26 -

The Federal Reserve Bank of New York is streamlining its Ginnie Mae holdings by combining mortgage-backed securities with similar characteristics into larger pass-through instruments.

February 25 -

The Senate Banking Committee's vote on Mark Calabria's nomination to lead the agency comes amid speculation about congressional and administrative GSE reform plans.

February 21 -

Mortgage rates declined for the third straight week, adding to a brighter outlook for the spring home buying season, according to Freddie Mac.

February 21 -

Refinance volume slipped following growth in mortgage rates, and loans refinanced through the Home Affordable Housing Program barely made a dent in overall volume, according to the Federal Housing Finance Agency.

February 15 -

The government-sponsored enterprises are going through a transition period. From proposals for rebuilding their capital cushions to tackling shortages in affordable housing, Fannie Mae and Freddie Mac face a number of key challenges with wide-ranging consequences this year.

February 14