-

Mortgage rates rose significantly across the board as the economy continued to show resilience with strong business activity and growth in employment, according to Freddie Mac.

November 8 -

The Federal Housing Finance Agency is leaving the government-sponsored enterprises' multifamily caps for 2019 unchanged at $35 billion per agency, but is making other changes to prerequisites for excluded loans.

November 6 -

Returns on mortgage-backed securities in October lagged Treasuries by 37 basis points, the most since November 2016.

November 5 -

The unique approach Fannie Mae and Freddie Mac are each taking with their credit-risk transfer products is quickly becoming a key point of differentiation that's rekindling competition between the government-sponsored enterprises.

November 2 -

Walker & Dunlop acquired commercial mortgage banker iCap Realty Advisors as part of its strategic plan to increase its annual originations by at least one-third in the next two years.

November 2 -

Fannie Mae and Freddie Mac transferred a substantial amount of credit risk to the private sector through both single-family and multifamily market transactions in the first half of the year, with activity expected to rise in 2019, according to the Federal Housing Finance Agency.

November 1 -

Mortgage rates dropped slightly for the second time in the past three weeks as yields on the benchmark 10-year Treasury note remained flat for most of the period, according to Freddie Mac.

November 1 -

When the mortgage giant will be released from government control is anyone's guess, but the company's third-quarter report shows signs of an easier transition.

October 31 -

A combination of moderate rises in mortgage rates and dipping growth in home prices are projected to boost existing and new housing sales through 2020, according to Freddie Mac.

October 31 -

Mortgage rates increased slightly across the board, even as the Dow Jones Industrial Average fell nearly 1,000 points over the past few days, according to Freddie Mac.

October 25 -

Despite recriminations about how the crisis and ensuing regulations have tightened loan access, an actual assessment of mortgage credit availability finds the situation is more complicated.

October 24 -

Incenter Mortgage Advisors is facilitating the sale of $3.7 billion in mortgage servicing rights tied to Fannie Mae and Freddie Mac loans, roughly one-third of which have private mortgage insurance.

October 19 -

Donald Layton, who has run the mortgage giant since 2012, discussed the busy agenda leading up to his departure and says Freddie can serve as a "technical adviser" in GSE reform talks.

October 18 -

Conforming mortgage interest rates dropped slightly over the past seven days after weeks of steady increases, according to Freddie Mac.

October 18 -

Exploration and adoption of new technologies is essential for achieving strategic goals and satisfying the needs and expectations of mortgage borrowers.

October 16 Freddie Mac

Freddie Mac -

The departing CEOs of Fannie Mae and Freddie Mac oversaw significant cultural and operational shifts that made the housing finance system safer and more responsive to market needs, but a tough job lies ahead for their successors.

October 16 -

The Federal Housing Finance Agency, Fannie Mae and Freddie Mac have launched an online clearinghouse with resources to assist lenders in serving borrowers with limited English proficiency.

October 15 -

It's a critical time in Washington, with many key institutions in the mortgage and housing industries getting new leaders. At the Mortgage Bankers Association, there's a renewed focus on maintaining effective influence with decision makers on initiatives like housing finance reform, innovation and the evolving needs of home buyers.

October 14 -

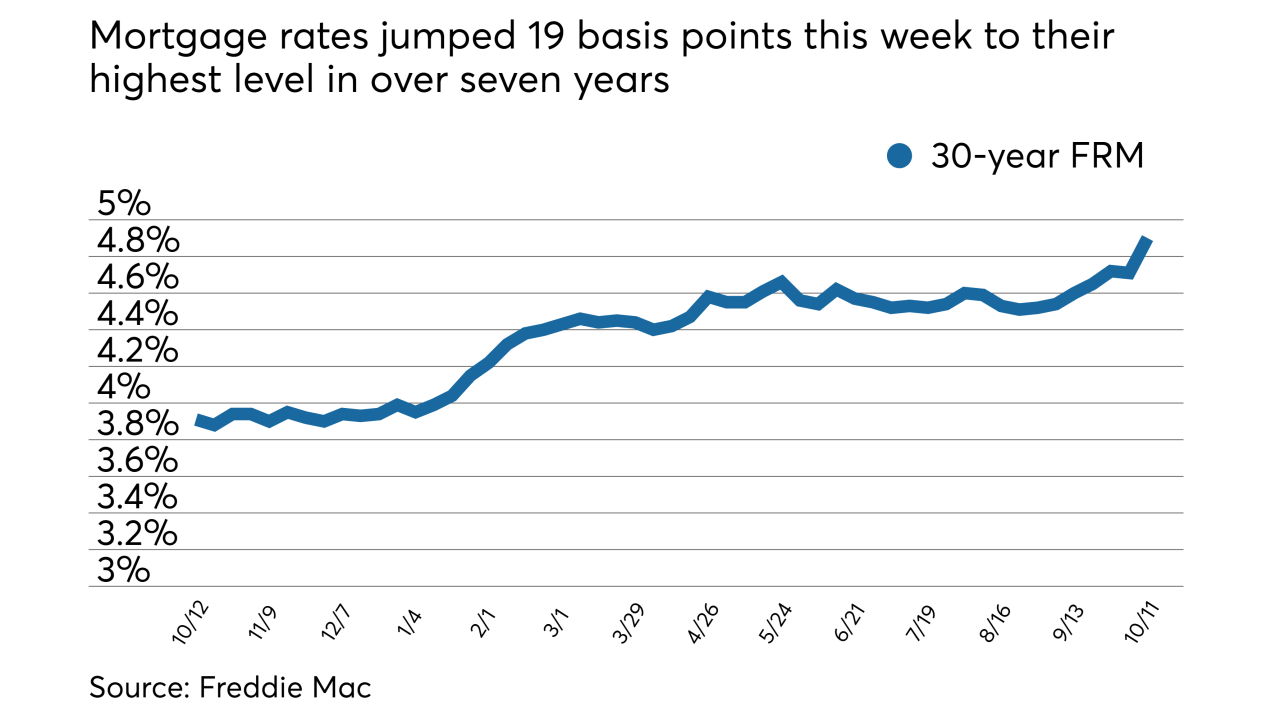

Mortgage rates, after a brief respite last week, rose to their highest level in over seven years, according to Freddie Mac.

October 11 -

Freddie Mac made its first equity investment into a low-income housing tax credit fund in nearly a decade, through a partnership with Enterprise Community Investment.

October 5