-

Overall debt outstanding for delinquent commercial and multifamily mortgages cut down in September as more of the economy opens further with lodging and retail far behind, according to the Mortgage Bankers Association.

October 1 -

Delinquencies will rise due to the severe effects of the pandemic on the commercial property sector, Fitch said.

September 30 -

The Mortgage Industry Standards Maintenance Organization drew up the recommended wording in consultation with a group of lenders and investors after the passage of the Taxpayers First Act last year.

September 30 -

Mortgage applications decreased 4.8% from one week earlier, as refinance activity was down even as average rates fell to a new record low, according to the Mortgage Bankers Association.

September 30 -

Approximately 75% of the quarter-to-quarter growth came from multifamily mortgage originations.

September 29 -

The net share of mortgages in Ginnie Mae securitizations with suspended payments appears to be stabilizing, but the number of new requests creates doubt about whether it will subside.

September 29 -

Mortgage applications increased 6.8% from one week earlier as this summer's surprise purchase demand has carried over to the fall, according to the Mortgage Bankers Association.

September 23 -

But the group is more conservative than Fannie Mae when it comes to interest rate movements over the next six quarters.

September 22 -

The percentage of borrowers who have asked to temporarily suspend payments due to coronavirus-related hardships is down overall, but in the Ginnie Mae market, they're still inching up.

September 21 -

Mortgage applications decreased 2.5% from one week earlier as refinance activity appears to decelerating, according to the Mortgage Bankers Association.

September 16 -

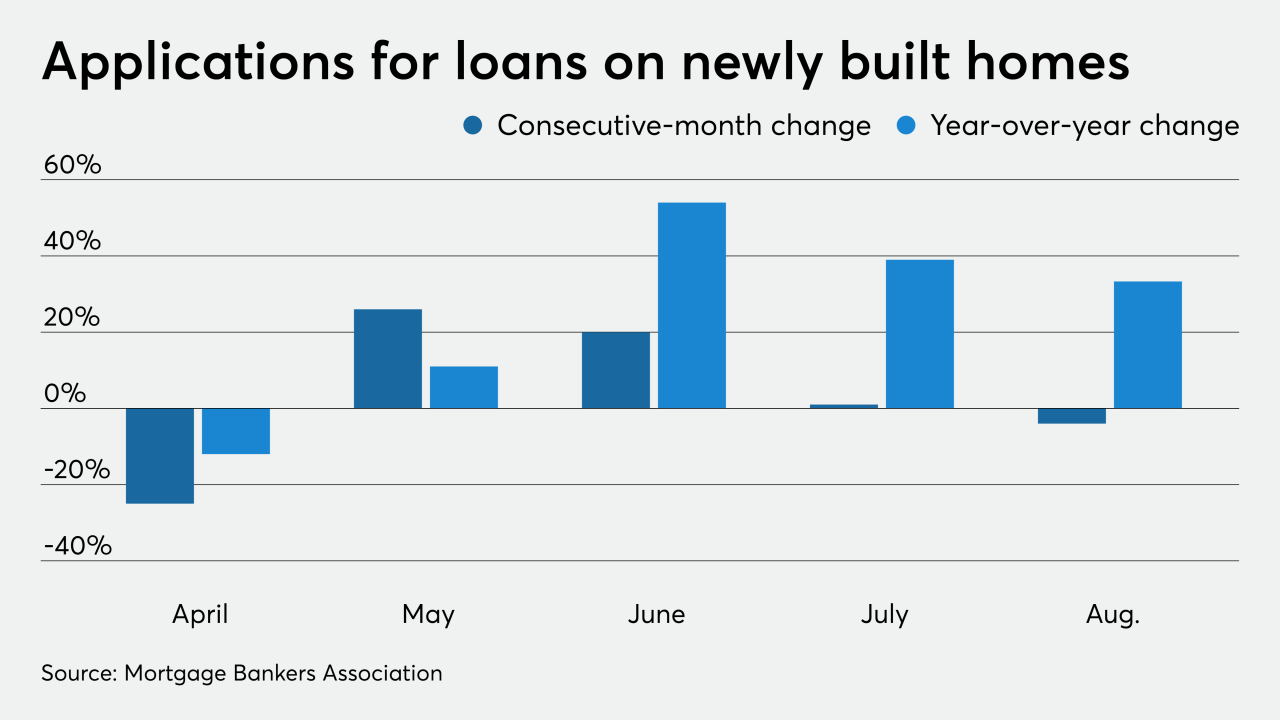

Loan applications for new homes have staged a remarkable turnaround this year after falling 25% month-over-month and 12% year-to-year due to the coronavirus' impact in April.

September 16 -

After flattening over the three prior weeks, the number of loans going into coronavirus-related forbearance dove at a rate not seen since early August, according to the Mortgage Bankers Association.

September 15 -

Many states currently have temporary work-from-home guidance for licensed mortgage professionals that extends through at least Dec. 31, but some have fall expiration dates.

September 14 -

Plus: mortgage credit availability hits 6-year-low and Ellie Mae and ICE Mortgage change leadership

September 11 -

Uncertainties in the job market drove mortgage credit availability down again, falling to the lowest point since March 2014, according to the Mortgage Bankers Association.

September 10 -

Some of the cures were the result of short-term remedies and could reverse as relief measures end.

September 10 -

Mortgage applications increased 2.9% from one week earlier, rising for the first time in nearly a month with home-buying demand remaining unusually strong as summer ends, according to the Mortgage Bankers Association.

September 9 -

"The current economic crisis continues to disproportionately impact borrowers with FHA and VA loans," said Mike Fratantoni, the MBA's senior vice president and chief economist.

September 8 -

But federal elections and the pandemic make projections on the sustainability of industry profitability especially tricky.

September 2 -

Mortgage applications fell for the third consecutive week, likely because those borrowers motivated to refinance have already done so, according to the Mortgage Bankers Association.

September 2