-

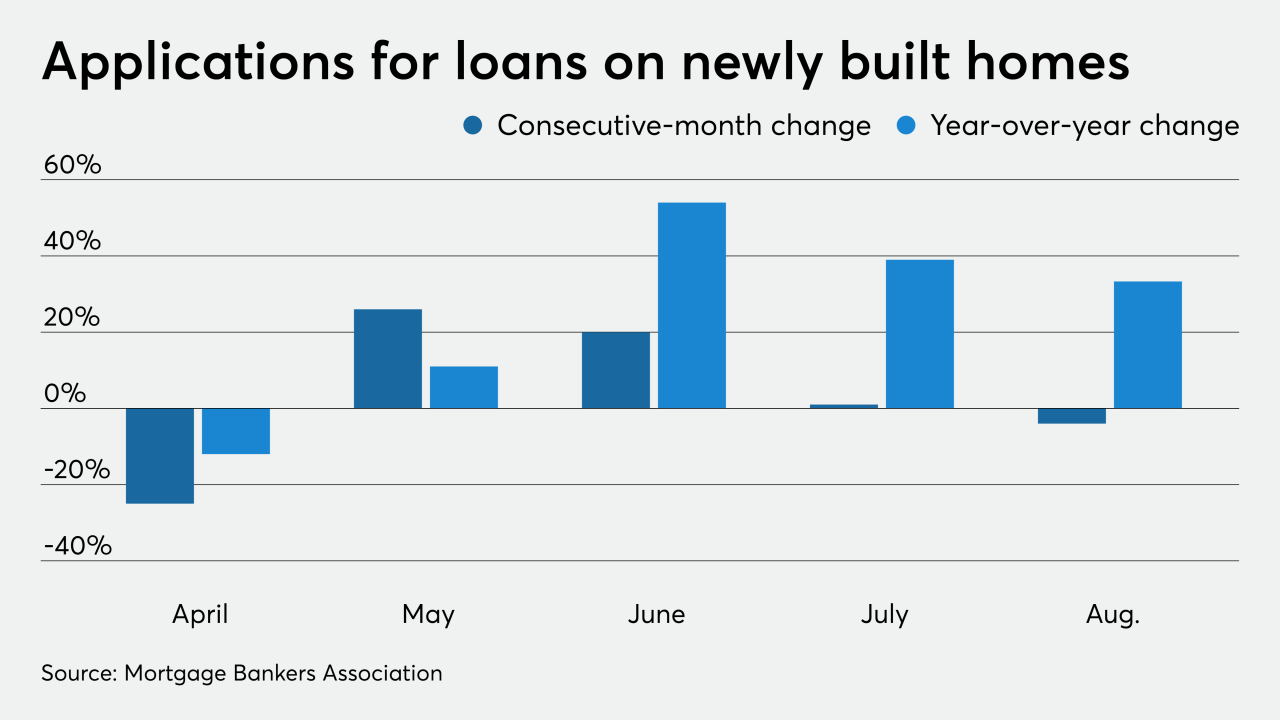

Loan applications for new homes have staged a remarkable turnaround this year after falling 25% month-over-month and 12% year-to-year due to the coronavirus' impact in April.

September 16 -

After flattening over the three prior weeks, the number of loans going into coronavirus-related forbearance dove at a rate not seen since early August, according to the Mortgage Bankers Association.

September 15 -

Many states currently have temporary work-from-home guidance for licensed mortgage professionals that extends through at least Dec. 31, but some have fall expiration dates.

September 14 -

Plus: mortgage credit availability hits 6-year-low and Ellie Mae and ICE Mortgage change leadership

September 11 -

Uncertainties in the job market drove mortgage credit availability down again, falling to the lowest point since March 2014, according to the Mortgage Bankers Association.

September 10 -

Some of the cures were the result of short-term remedies and could reverse as relief measures end.

September 10 -

Mortgage applications increased 2.9% from one week earlier, rising for the first time in nearly a month with home-buying demand remaining unusually strong as summer ends, according to the Mortgage Bankers Association.

September 9 -

"The current economic crisis continues to disproportionately impact borrowers with FHA and VA loans," said Mike Fratantoni, the MBA's senior vice president and chief economist.

September 8 -

But federal elections and the pandemic make projections on the sustainability of industry profitability especially tricky.

September 2 -

Mortgage applications fell for the third consecutive week, likely because those borrowers motivated to refinance have already done so, according to the Mortgage Bankers Association.

September 2 -

For the first time since June 7, the number of loans going into coronavirus-related forbearance didn't decrease from the week before, according to the Mortgage Bankers Association.

August 31 -

Party polarization and racial equity issues make it tougher for trade groups to manage internal divisions while ensuring the field supports those who get their hands on the levers of power.

August 27 -

Mortgage application volume decreased 6.5%, falling for the second consecutive week with refinance activity at its lowest since early July, according to the Mortgage Bankers Association.

August 26 -

The number of loans going into coronavirus-related forbearance decreased for the tenth straight week, but to a lesser degree than in previous weeks, according to the Mortgage Bankers Association.

August 24 -

Mortgage applications decreased 3.3% from one week earlier, but purchase activity momentum persisted with home sales remaining a bright spot in the economic recovery, according to the Mortgage Bankers Association.

August 19 -

More homeowners in Florida and nationwide became delinquent on their mortgage payments in the second quarter compared to the first, according to the Mortgage Banker Association.

August 19 -

The number of loans going into coronavirus-related forbearance decreased for the ninth consecutive week, according to the Mortgage Bankers Association.

August 17 -

All states that had licensing restrictions related to remote work temporarily lifted them due to the pandemic, but whether those changes could become permanent remains to be seen.

August 17 -

Refinance volume led the spike in mortgage applications for the week ending Aug. 7 as interest rates continued tumbling.

August 12 -

In a letter to the Consumer Financial Protection Bureau, the Mortgage Bankers Association recommended adding six more months to the latest GSE patch proposal.

August 12