-

Despite a drop in multifamily loan volume, industrial, health care, office and retail originations pushed overall multifamily and commercial mortgage lending to unprecedented heights, according to the Mortgage Bankers Association.

February 10 -

Mortgages guaranteed by the Department of Veterans Affairs may increase in certain regions due to a new option that can offset a broader fee increase.

February 6 -

Mortgage application volume increased 5%, led by refinancings, as interest rates continued to fall on fears that the coronavirus was spreading in China and elsewhere, according to the Mortgage Bankers Association.

February 5 -

After maintaining a $250,000 exemption threshold for real estate appraisals for nearly 20 years, the National Credit Union Administration is set to raise that limit to $400,000.

January 31 -

Mortgage applications increased 7.2% from one week earlier as consumers reacted to falling interest rates related to news regarding the coronavirus, according to the Mortgage Bankers Association.

January 29 -

A culture that celebrates diversity, fun, and an employee-driven value system.

January 29 -

Lower rates spurred a lot of unexpected mortgage business in 2019 but credit unions need to prepare themselves for what happens once the boom ends.

January 28 -

Mortgage application activity slowed down this past week from its fast start to 2020, with a decrease of 1.2% from one week earlier, according to the Mortgage Bankers Association.

January 22 -

Mortgage loan officer compensation remained level year-over-year as an unexpected surge in originations surprised employers expecting it to be a down year, an LBA Ware report said.

January 17 -

Loan applications to purchase newly constructed homes rose over one-third annually during December as new residential construction recovered, according to the Mortgage Bankers Association.

January 16 -

Mortgage application activity increased 30.2% from one week earlier as purchases were at their highest level in over a decade along with substantial growth in refinancings, according to the Mortgage Bankers Association.

January 15 -

There was less credit available for the first time in four months in December, when lenders offered fewer conventional and government products, particularly Veterans Affairs-guaranteed loans, the Mortgage Bankers Association said.

January 13 -

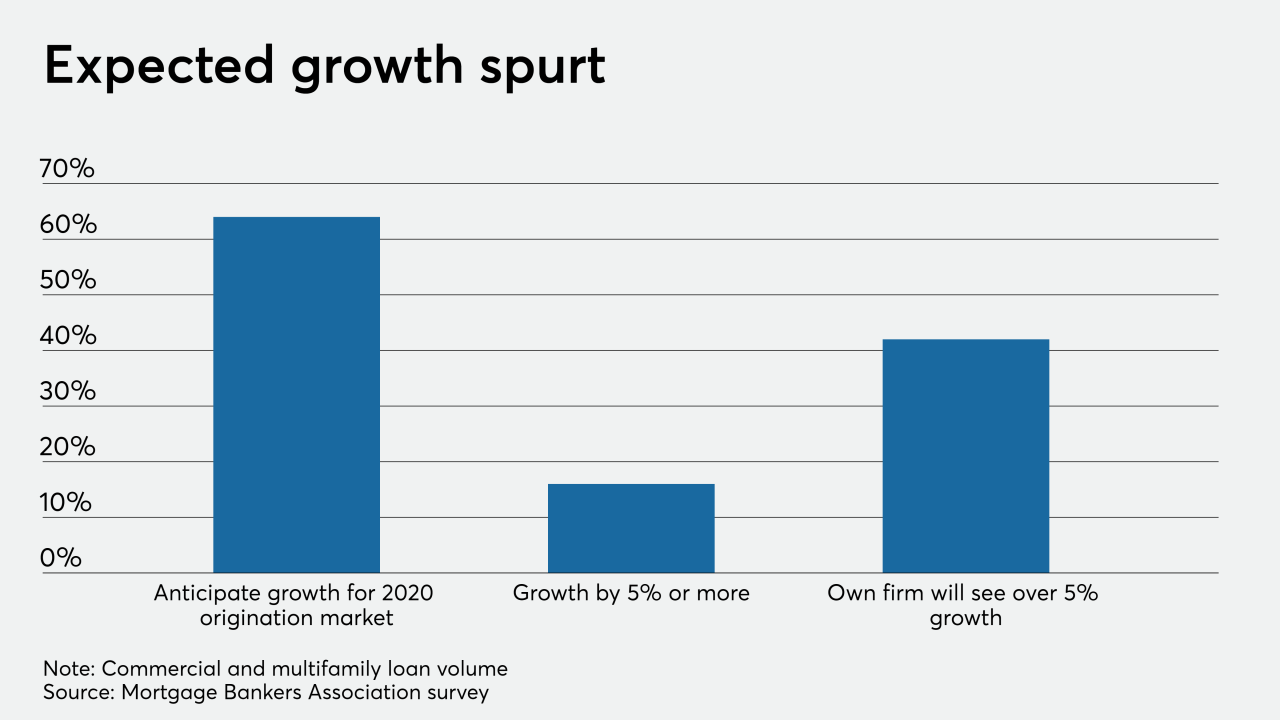

Bolstered by a high demand by both lenders and borrowers, 2020's commercial and multifamily loan volume is anticipated to shoot well past last year's record total but adapting to the LIBOR and CECL shifts will provide challenges, according to the Mortgage Bankers Association.

January 10 -

Mortgage applications decreased 1.5% on a seasonally adjusted basis from two weeks earlier amid the annual end-of-year slowdown despite lower rates from global tensions, according to the Mortgage Bankers Association.

January 8 -

The Federal Housing Administration has implemented defect taxonomy revisions for 2020 that it considers one of several milestone achievements in its efforts to "provide greater clarity and consistency for lenders.”

January 3 -

The case before the court deals mainly with a statutory clause limiting the president’s ability to fire a CFPB director. But briefs filed with the court say striking that provision does not fully solve the bureau’s constitutional problems.

January 3 -

Mortgage applications decreased 5.3% on a seasonally adjusted basis from one week earlier led by a decline in conventional refinance loan demand, according to the Mortgage Bankers Association.

December 26 -

Women in the mortgage industry are taking a stand and becoming empowered.

December 19 Mortgage Bankers Association

Mortgage Bankers Association -

Mortgage applications decreased 5% from one week earlier as, absent any rate incentive, activity slowed because of the holiday season, according to the Mortgage Bankers Association.

December 18 -

Even with an increase in both new and existing home construction activity during November, the slowdown over the previous 11 months will constrain inventory going into 2020, according to BuildFax.

December 16