-

To paint nonbanks as a source of systemic risk, particularly given the track record of commercial banks in causing the 2008 subprime mortgage fiasco, seems absurd.

February 7 Whalen Global Advisors LLC

Whalen Global Advisors LLC -

Mortgages guaranteed by the Department of Veterans Affairs may increase in certain regions due to a new option that can offset a broader fee increase.

February 6 -

Mortgage application volume increased 5%, led by refinancings, as interest rates continued to fall on fears that the coronavirus was spreading in China and elsewhere, according to the Mortgage Bankers Association.

February 5 -

Mortgage applications increased 7.2% from one week earlier as consumers reacted to falling interest rates related to news regarding the coronavirus, according to the Mortgage Bankers Association.

January 29 -

Howard Bancorp is transferring its mortgage business, along with VAMortgage.com, to a limited liability company formed by former managers in the division

January 24 -

Mortgage application activity slowed down this past week from its fast start to 2020, with a decrease of 1.2% from one week earlier, according to the Mortgage Bankers Association.

January 22 -

Loan applications to purchase newly constructed homes rose over one-third annually during December as new residential construction recovered, according to the Mortgage Bankers Association.

January 16 -

Mortgage application activity increased 30.2% from one week earlier as purchases were at their highest level in over a decade along with substantial growth in refinancings, according to the Mortgage Bankers Association.

January 15 -

There was less credit available for the first time in four months in December, when lenders offered fewer conventional and government products, particularly Veterans Affairs-guaranteed loans, the Mortgage Bankers Association said.

January 13 -

While the refinancing boom took a step back, millennials purchasing power grows in the low mortgage rate environment, according to Ellie Mae.

January 9 -

Mortgage applications decreased 1.5% on a seasonally adjusted basis from two weeks earlier amid the annual end-of-year slowdown despite lower rates from global tensions, according to the Mortgage Bankers Association.

January 8 -

The nomination deadline for the 2020 Top Producers program is coming up soon.

January 8 -

Mortgage applications decreased 5.3% on a seasonally adjusted basis from one week earlier led by a decline in conventional refinance loan demand, according to the Mortgage Bankers Association.

December 26 -

Mortgage applications decreased 5% from one week earlier as, absent any rate incentive, activity slowed because of the holiday season, according to the Mortgage Bankers Association.

December 18 -

Even with an increase in both new and existing home construction activity during November, the slowdown over the previous 11 months will constrain inventory going into 2020, according to BuildFax.

December 16 -

Issuance of Ginnie Mae mortgage-backed securities slipped after several months of gains, but high volume still pushed the year-to-date total for 2019 ahead of 2018’s full-year figure.

December 16 -

Mortgage application activity increased 3.8% from one week earlier, with refinance volume for Federal Housing Administration-insured loans taking the spotlight, the Mortgage Bankers Association said.

December 11 -

The housing market is likely changing to predominantly repeat purchasers, even as growth in the first-timer buyer segment continued in the third quarter, a study from Genworth found.

December 10 -

The share of Department of Veterans Affairs-guaranteed loans in Ginnie Mae mortgage-backed securities issuance rose to 42% in the most recent fiscal year from almost 39%, and could continue to rise.

December 9 -

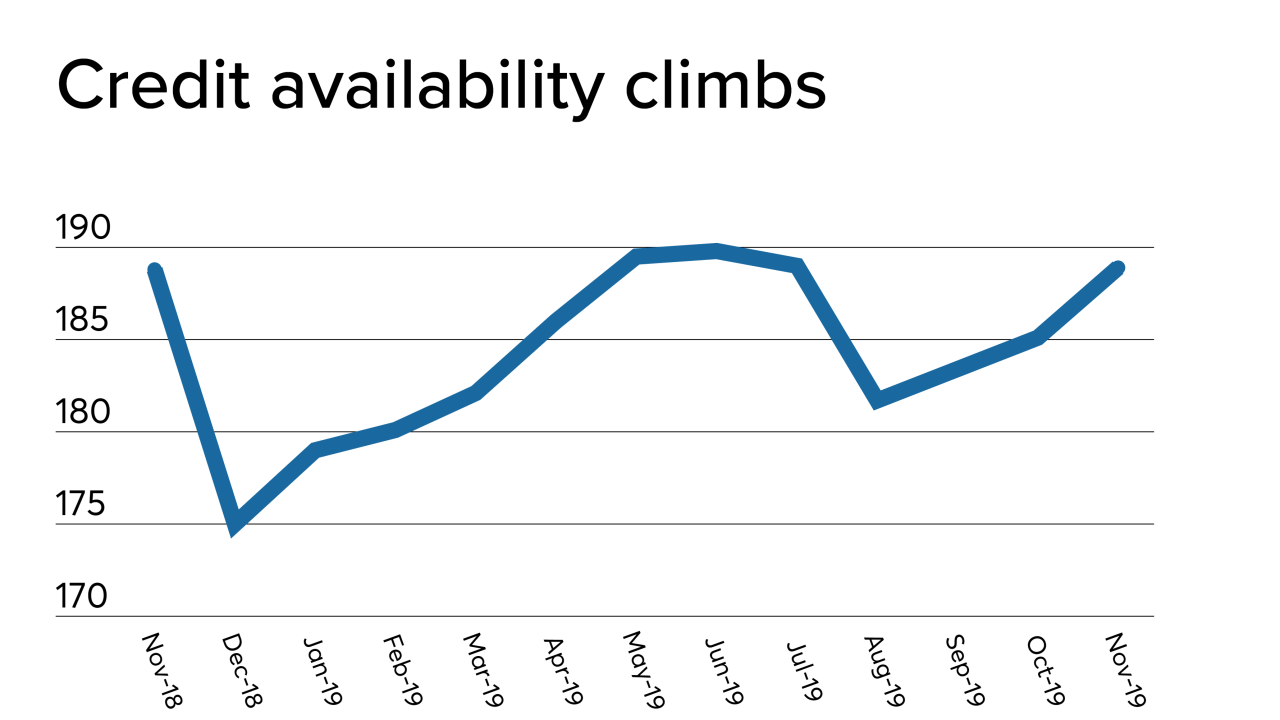

The availability of mortgage credit jumped in November from the previous month as jumbo activity and refinancing in the government market increased, according to the Mortgage Bankers Association.

December 5