-

The tightest housing markets in the U.S. are unwinding in time for the key spring selling season, giving buyers an edge for the first time in years, a Trulia study said.

April 15 -

From the middle of the country to the Pacific Northwest, here's a look at cities where consumers wield the most purchasing power for the upcoming home buying season, based on changes in housing values compared to local wages and mortgage rates.

April 12 -

The gap between potential and actual existing home sales is narrowing even though supply shortages still vex the market, according to First American’s latest report.

March 21 -

From New York to Seattle, here's a look at cities with the best homebuyer purchasing power for the upcoming competitive spring market, based on changes in house values compared to local wages and mortgage rates.

March 11 -

Rising household incomes paired with December's drop in mortgage rates gave consumers their largest monthly jump in home buying power since 2013, according to First American Financial Corp.

February 25 -

Home affordability is at a 10-year low across the nation. Here's a look at the 12 cities most in danger of a housing bubble in 2019.

February 21 -

Women have lower incomes than men, limiting their options when buying a house. But in some of the more pricey housing markets, single female homeowners outpace single male homeowners, which could suggest some tightening in the home value gap, according to Attom Data Solutions.

February 14 -

The Spokane, Wash., housing market is bucking national trends, with home prices continuing to rise here.

February 1 -

Dallas-area home price gains slightly outperformed the national average in November.

January 3 -

Rising construction costs and a big drop in public funding is forcing an organization that builds inexpensive homes for low-income buyers in the Bay Area to sell them for higher prices than many of those people can afford.

January 3 -

Southern California home sales fell sharply in November, deepening a retreat from a sustained housing boom that placed home ownership out of reach for many.

December 28 -

Contract signings to purchase previously owned homes unexpectedly fell for a second month in November, offering yet another sign that the housing market is struggling.

December 28 -

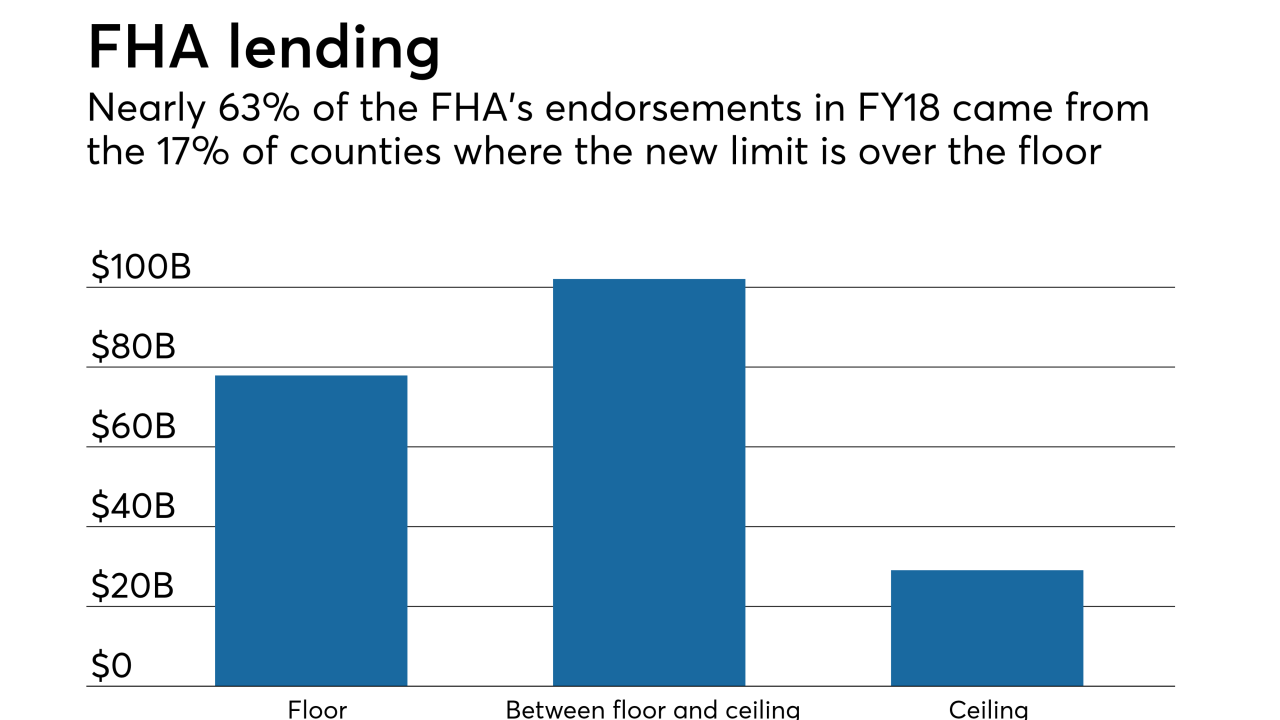

The Federal Housing Administration mortgage loan limit will increase by approximately 7% for next year, mirroring the rise for conforming loans.

December 14 -

Here's a look at 12 cities with slower home price appreciation and more favorable mortgage rate and wage conditions, offering purchasing power advantages to consumers.

November 28 -

The sustained rise in home values will boost Fannie Mae and Freddie Mac's loan limits for 2019, marking the second consecutive year in which it increased by nearly 7%.

November 27 -

Rising interest rates are holding back existing homeowners from listing their properties, driving the gap between existing and potential sales even as that disparity narrows, First American Financial said.

November 19 -

The number of homes sitting unsold in King County has doubled in the past year as buyers continue to retreat from the once-hot market — pushing prices in the city of Seattle down even further.

November 9 -

The housing market slows down for winter, but it doesn't stop. Here's a look at 12 cities where price cuts, rent appreciation and affordability conditions will give house hunters more negotiating power going into the new year.

November 8 -

A typical homebuyer has already lost over 6% of purchasing power because of rising interest rates since the start of the year, a study by Redfin found.

October 24 -

With the home selling season winding down and autumn in full swing, here's a look at the cities where both home purchase prices and monthly rents are starting to ease.

October 18