-

From 2016 to 2019, the Long Island man stole from Home Point Financial, LoanDepot and United Wholesale Mortgage, and faces 30 years in prison.

September 2 -

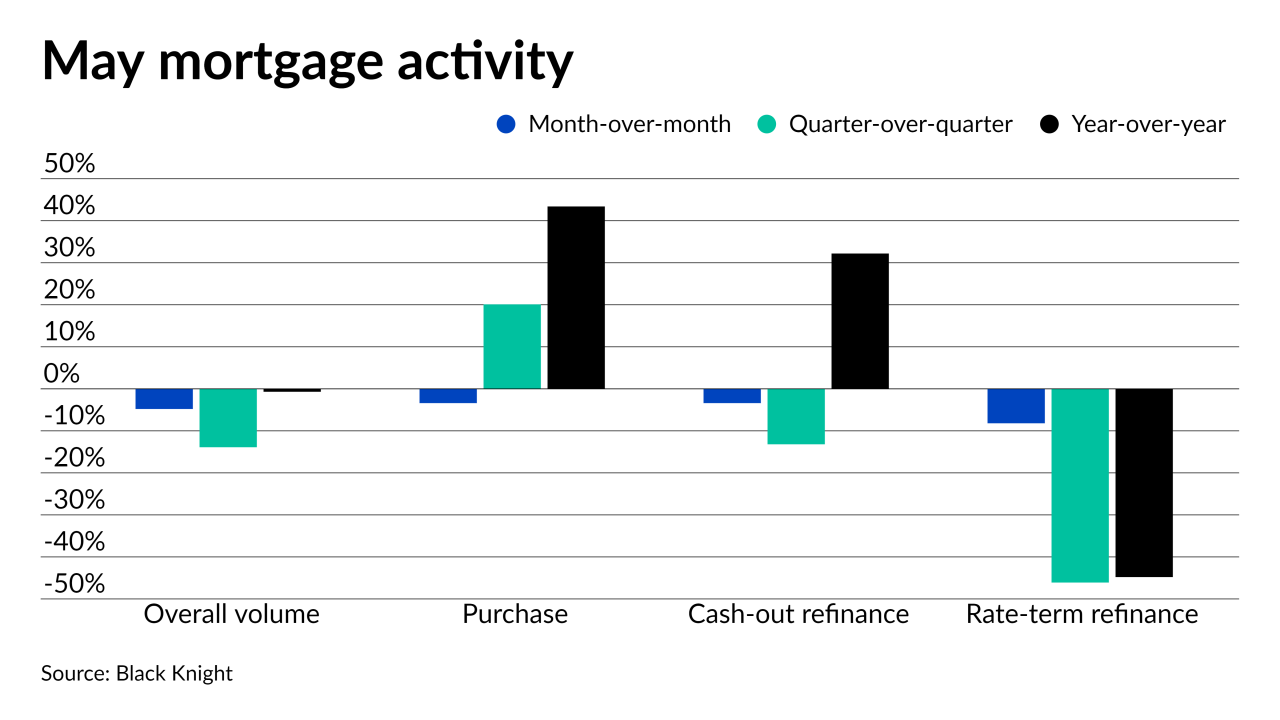

Purchase activity dominated the period and experienced the most growth while refinances cooled off and home equity lines of credit made a comeback, according to Attom Data Solutions.

August 19 -

Many banks reported sharp declines in income from home loans during the second quarter. The large gains they enjoyed last year thanks to a surge in refinancing activity are unlikely to return, according to bankers and analysts.

August 4 -

Borrowers reacted positively to the increased interaction and engagement resulting forbearances and payoff requests, J.D. Power found.

July 29 -

The adverse market fee change could contribute to an increase in refinance volume, adds Mortgage Bankers Association economist Mike Fratantoni.

July 19 -

The GSE forecasts $4 trillion in production this year because refinance activity is stronger than expected.

July 16 -

The agency’s new chief said eliminating the “adverse market fee” — in place since December — will make it easier for families to refinance while mortgage rates are still low.

July 16 -

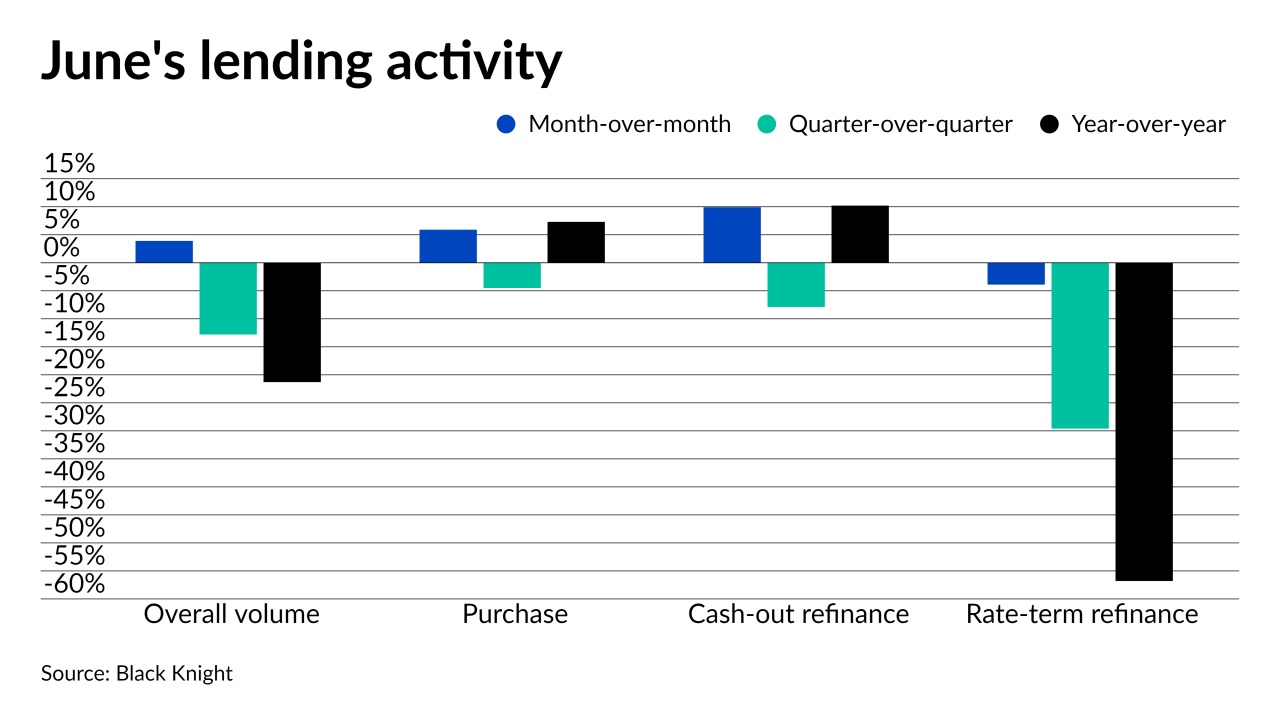

Boosts in purchases and cash-out refinances drove the summer turnaround, according to Black Knight.

July 12 -

Even though the channel helped the bank do over $2 billion in business last year, going forward it will produce loans through the traditional retail business.

July 2 -

The financial services company will incentivize existing card members with statement credit for taking out or refinancing a home loan with either lender.

July 1 -

Consumer advocates and mortgage industry officials are urging Sandra Thompson, the new acting director of the Federal Housing Finance Agency, to undo many policies that her predecessor, Mark Calabria, put in place over the past year.

July 1 -

Premiums written increased 45%, while net operating income was up over 65%, the American Land Title Association said.

June 28 -

Corresponding Treasury yields seesawed over the past week, as some experts see “transitory” inflation persisting.

June 24 -

Increases in refinances, both in applications and average size, help lead overall numbers higher

June 23 -

For all respondents, cash edged financing by one percentage point, but half of those that bought last year used cash, ServiceLink found.

June 23 -

A spike in government-sponsored applications helped lead indexes to their largest gains in several weeks.

June 16 -

Changed borrower psychology and the severe housing inventory shortage dropped lending activity across the board, according to Black Knight.

June 14 -

Even though product availability is now at the same point where it was one year ago, it remains at 2014 levels.

June 10 -

More than two-thirds surveyed said they expect to make less money over the next three months as price reductions ramp up along with a market shift to purchases.

June 10 -

Purchase loans tick upward, even as housing demand pushes prices well above 2020 levels.

June 9