-

A quarter-percent increase would eliminate more than a million buyers for median-priced homes according to the National Association of Home Builders.

March 8 -

CalHFA’s executive director Tiena Johnson Hall discusses her agenda for encouraging affordable housing development in the inventory-strapped state.

November 19 -

Only eight states experienced annual appreciation viewed as sustainable, according to Fitch Ratings.

November 17 -

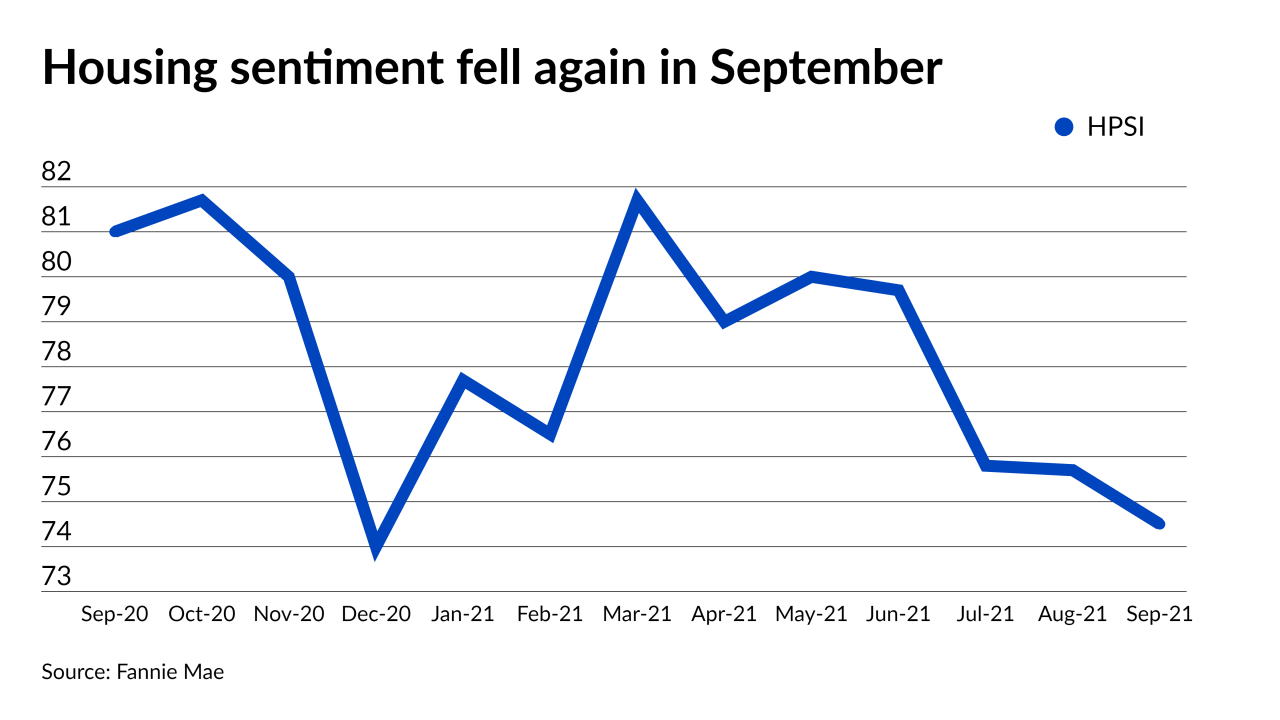

The share of borrowers who thought it was a good time to buy hit an all-time low, according to Fannie Mae.

October 7 -

The sharp increases of the pandemic era have added nearly a year to the amount of time the average consumer needs to save for a 20% down payment, according to Tomo.

September 28 -

However, with mortgage rates down and household income increasing, consumers have 129% more buying power today than they did 16 years ago, according to First American.

August 30 -

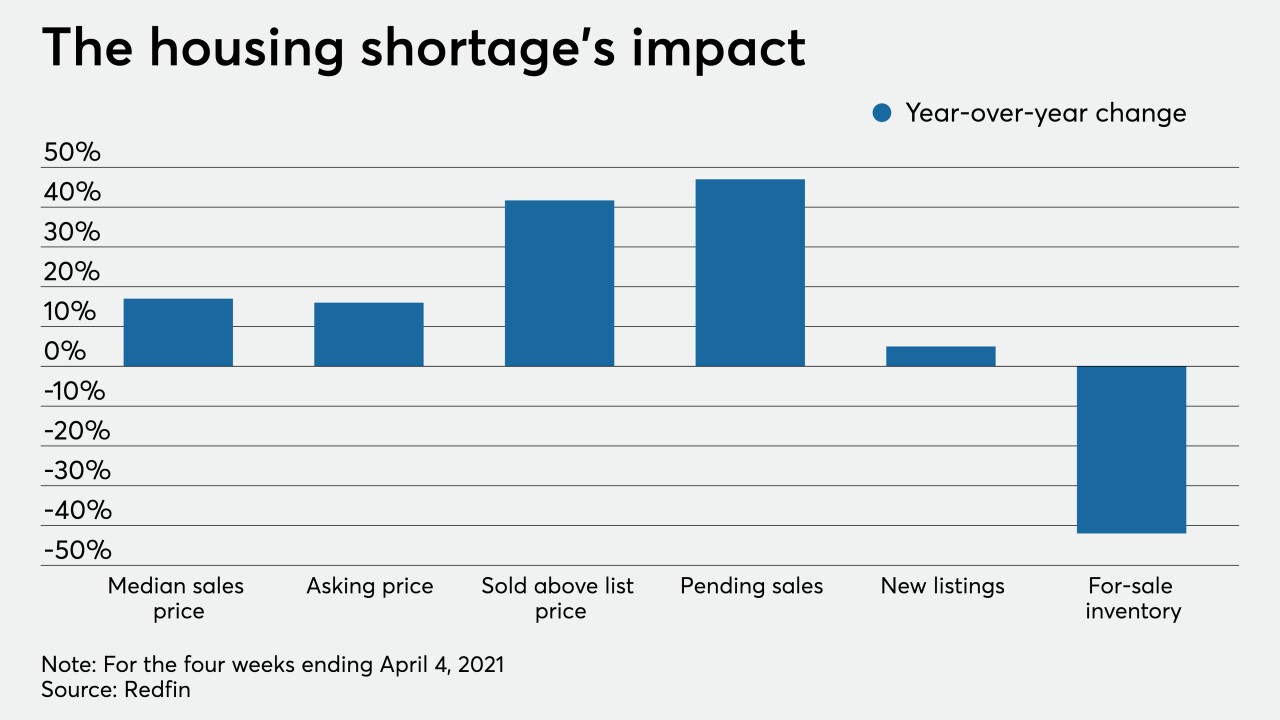

The gulf between buyer demand and the amount of listings for sale drove housing values to a six-decade peak, according to CoreLogic.

August 3 -

Renters will need to reserve an additional $369 per month to keep up with rising listing prices over the next year, according to Zillow.

July 8 -

A Virginia-based builder announced a line of manufactured housing that features clean energy technology, reduced waste and “plug-and-play” assembly.

July 6 -

Financial inclusion is the civil rights issue of our generation — and getting more Americans, especially younger and minority families, into decent, affordable housing is a critical step on the ladder to financial capability, writes a board member of the National Credit Union Administration.

June 29

-

While purchasing power grew for the 16th straight month in April, surging property values and increased mortgage rate forecasts will keep driving down affordability, according to First American.

June 28 -

Home prices grew at a record annual pace in April but indicators of a possible slowdown popped up in May, Redfin noted.

June 7 -

Remote workers looking across the country for an inexpensive house have a wide net to cast, but a few important socioeconomic factors can narrow the search.

May 20 -

Companies in the government mortgage market that serves low income, entry-level buyers are facing higher forbearance rates and more financial strain than others, making homeownership increasingly unattainable as credit remains tight.

May 14 -

As consumers search for homebuying advantages, local lenders discuss the 12 metro areas where it’s more affordable to purchase a property rather than rent a comparable house, according to Realtor.com data.

April 30 -

Even as properties spent the least time ever on the market and the average sale-to-list home price ratio broke 100%, some indicators point to a slight reversal, which could head off “runaway home price speculation or a housing bubble,” Redfin chief economist Daryl Fairweather said.

April 9 -

That means depreciation is a risk that could creep back into some regions, potentially requiring lenders and government-related agencies to consider it when setting down payment requirements or managing loan workouts once forbearance ends.

April 6 -

The increase won’t hurt the incentive for the average home shopper, but it means those who were looking to “buy the dip” in prices amid the pandemic may have missed their chance.

April 5 -

That growth could be attractive to a housing finance industry that needs to find new loan sources as easy rate-and-term refinances dwindle.

March 25 -

Stuck between local zoning hurdles and a lack of ideal federal financing, ADUs could be an important aspect to unlocking much-needed inventory.

March 24