-

Adjustable-rate mortgages in November had their highest share of closed loans since Ellie Mae started tracking this data in 2011 as rates for 30-year loans reached 5.15%.

December 19 -

Another adjustable-rate mortgage index is going away as the Federal Home Loan Bank of San Francisco will no longer publish the monthly Eleventh District Cost of Funds Index after January 2020.

December 10 -

Fannie Mae has priced more securities that support a transition away from the London interbank offered rate.

October 26 -

As mortgage rates recently hit their highest point in seven years, closed refinances fell back to their low point of 2018, according to Ellie Mae.

October 19 -

Providing borrowers with an incentive to create financial reserves after closing is a better tool to prevent mortgage loan defaults than measures taken at underwriting, a JPMorgan Chase Institute study declared.

October 18 -

As mortgage rates remained mostly tepid throughout the summer, closed refinances had their first month of growth in August, according to Ellie Mae.

September 19 -

A new study from Pentagon Federal Credit Union finds a sizable portion of consumers will be shopping for a mortgage within two years, but it also revealed some major misconceptions surrounding the process.

September 18 -

Purchase-loan share held steady month-to-month for the first time this year, even though it is still above year-ago levels in line with a seasonal decline, but growth remains in the forecast.

August 15 -

Fannie Mae has issued securities supporting the transition away from the London interbank offered rate; something that could become more pressing for lenders if adjustable-rate mortgages were to become more prevalent.

July 27 -

The number of nonbank lenders and servicers that did not comply with the California Residential Mortgage Lending Act Annual Report requirements grew this year, prompting a reprimand and warning of penalties from the commissioner of the state's Department of Business Oversight.

July 2 -

Businesses are investing more, people are finding jobs, and inflation is picking up, meaning higher interest rates for homebuyers.

April 26 -

There is now less fraud risk associated with adjustable-rate mortgage applications and this will offset some of the higher hazard associated with a purchase market.

April 2 -

Refinance mortgages accounted for 45% of mortgage volume, the highest share in a year, according to Ellie Mae.

February 21 -

MountainView is brokering a nonrecourse $3.5 billion package of Fannie Mae and Freddie Mac mortgage servicing rights on behalf of an unnamed seller.

January 5 -

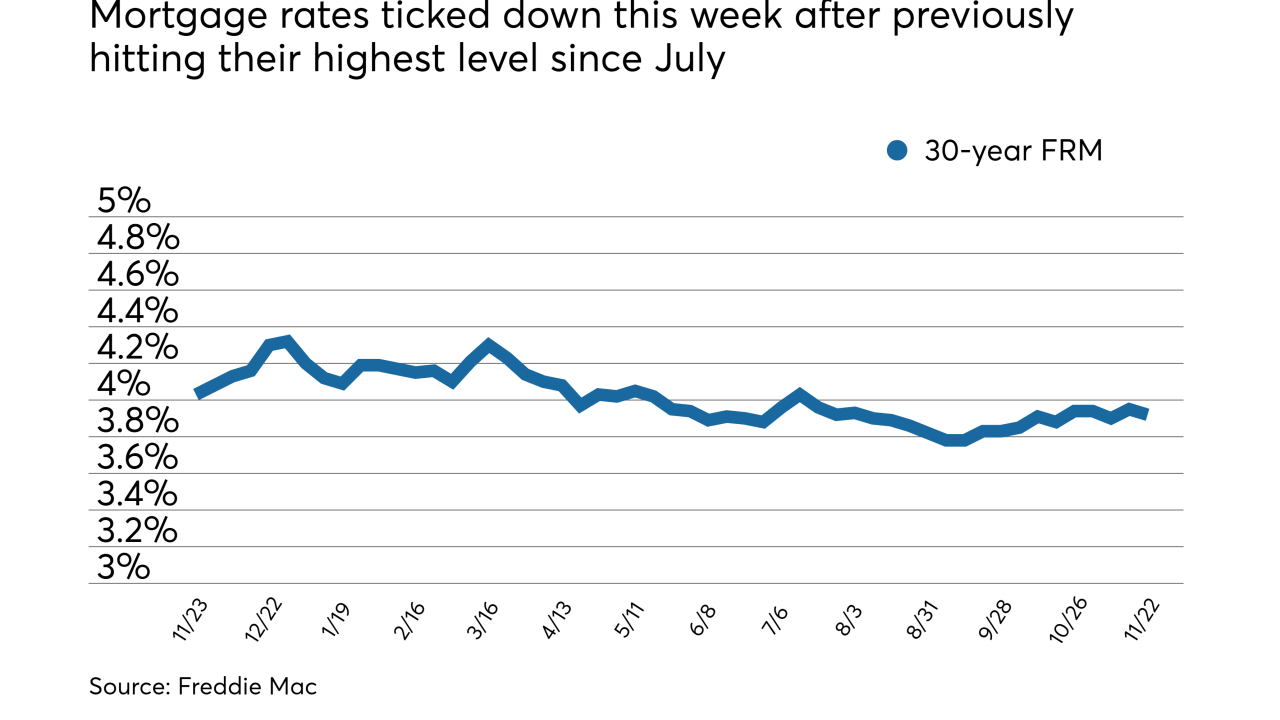

Mortgage rates ticked down this week after previously hitting their highest level since July, according to Freddie Mac.

November 22 -

A slight decrease in the number of jumbo investor offerings contributed to lower consecutive-month credit availability in October, according to the Mortgage Bankers Association.

November 8 -

Slightly looser underwriting outside the government sector is primarily responsible for the latest increase in credit availability.

October 10 -

Looser underwriting standards for agency-eligible adjustable-rate mortgages helped increase credit availability in August to its highest level since April, according to the Mortgage Bankers Association.

September 11 -

Loan application defects were unchanged for July compared with June, the first time in eight months there has not been an increase, according to First American Financial Corp.

August 31 -

A Fed committee studying Libor’s replacement has dwelled heavily on the potential impact to the derivatives market. Loans may become a bigger part of the conversation later this year, but the panel plans to leave a lot of the specifics up to lenders.

August 17