-

Consumer lending should also be a bright spot, while mortgage lending could be suppressed by rising rates and tight housing supplies.

January 9 -

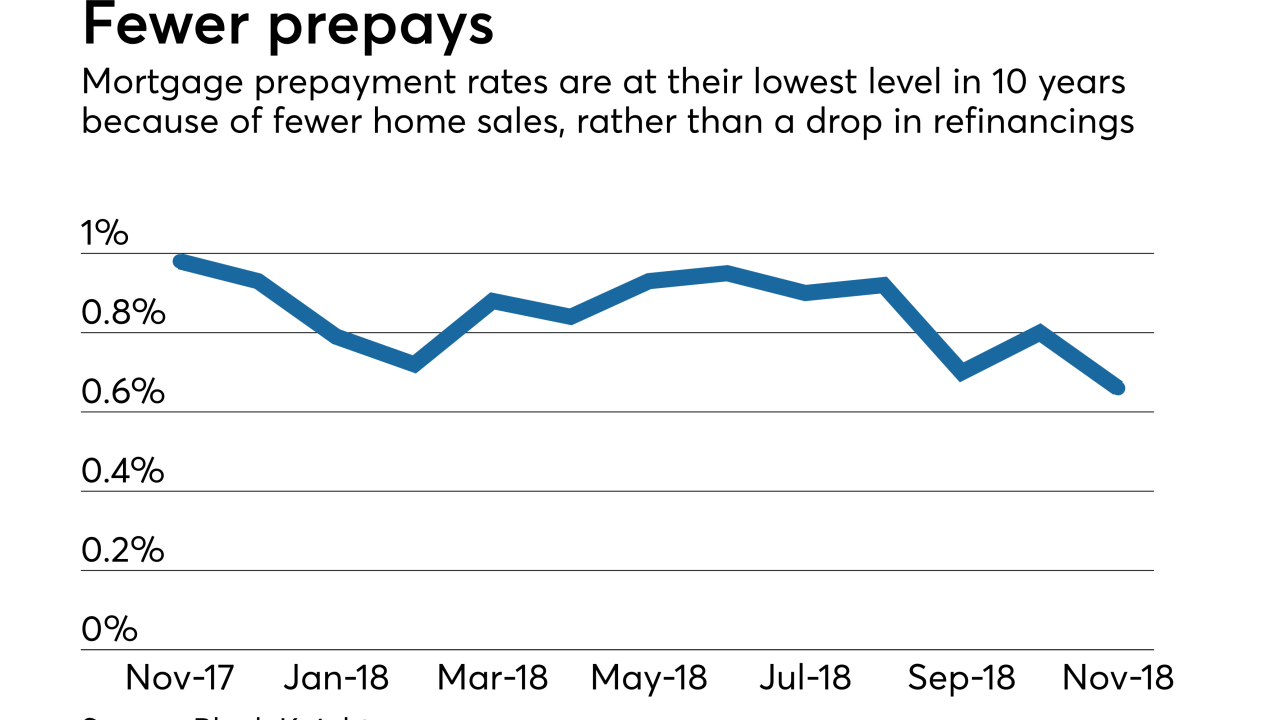

Continual declines in the refinance share of mortgage originations led to prepay rates dropping to their lowest levels since 2009, according to Black Knight.

January 9 -

More consumers fell behind on their loans in the third quarter of 2018, even as average wages rose and the unemployment rate fell to a 50-year low.

January 8 -

The strong economic headwinds from last fall facilitated a declining loan delinquency rate across the country, though areas hit by natural disasters had increased defaults, according to CoreLogic.

January 8 -

The banking industry has long been critical of the government-sponsored enterprise, but the system could provide valuable banking services to large swaths of the country currently lacking access to them.

January 7 Duke Financial Economics Center

Duke Financial Economics Center -

A new marketing tool lets consumers start the mortgage prequalification process by sending a text message, providing would-be borrowers with credit and loan program details and offering lenders a low-cost source of leads.

January 3 -

The agencies are weighing a plan to reduce the scope of residential real estate transactions requiring an appraisal, but appraisers have warned that the proposal could have consequences.

January 3 -

With its bolstered fundraising cache, the Mortgage Bankers Association Political Action Committee should hold an increased influence over the industry's policy and regulation issues in the coming year.

January 2 -

Bank OZK's George Gleason, one of our community bankers to watch in 2019, needs to rein in the Arkansas bank's commercial real estate exposure to placate nervous investors.

December 31 -

Fannie Mae's overall single-family serious delinquency rate dropped another notch in November, according to its most recent report, but the current government shutdown raises questions about whether that trend will continue.

December 31 -

The Massachusetts progressive said in a New Year's Eve email and video message to supporters that she’s launching an exploratory committee for a 2020 bid, which could give her an early edge in fundraising among several potential rivals for the Democratic Party nomination.

December 31 -

Freddie Mac issued its first non-low-income housing tax credit forward commitment, providing financing for an affordable housing development in Minnesota.

December 28 -

The cost of Wells Fargo's scandals continues to rise as regulators from all 50 states forced the institution to pay hundreds of millions in penalties for the creation of fake accounts, improper enrollment in life insurance, force-placed auto insurance policies and other activities.

December 28 -

The industry could see a boost in mortgage lending from regulatory changes, but other factors may slow growth.

December 26 -

The biggest question is whether new CFPB Director Kathy Kraninger will deviate from the pro-industry policies of her predecessor, or bring continuity.

December 25 -

Rep. Maxine Waters, D-Calif., will take the gavel on the Financial Services Committee next term.

December 24 -

Cash-strapped lenders need to find a way to consistently fund marketing that resonates with more cultures if they really want to be able to replace lost volume by reaching underserved borrowers.

December 21 Cultural Outreach

Cultural Outreach -

Many servicers expect their Federal Housing Administration mortgage portfolios to grow in the next year or two, and that increase could coincide with an uptick in delinquencies, warns Altisource Portfolio Solutions.

December 21 -

Selling $1.6 billion in mortgages, and paying off a similar amount of wholesale borrowings, will allow the company to expand its net interest margin in 2019.

December 21 -

Mortgage prepayment speeds fell to their lowest level in 10 years in November as rising interest rates took a toll on origination activity, according to Black Knight.

December 20