-

Forborne mortgages stemming from the coronavirus outbreak reached their lowest level since late March 2020, according to the Mortgage Bankers Association.

August 16 -

The expanded credit access in its automated mortgage decisioning goes into effect in mid September.

August 11 -

Total investment property lending this year should be 31% above 2020's pandemic-affected activity.

August 10 -

Landlord groups have challenged the policy, arguing that the administration bowed to political pressure even though it knew the eviction freeze wouldn’t pass muster with the courts.

August 9 -

Late payments on office loans have trended upward recently, but longer lease periods may mitigate the potential for distress in that sector, the Mortgage Bankers Association said.

August 5 -

The numbers in a new Research Institute for Housing America report reinforce other signs that recovery isn’t moving quite as quickly as originally anticipated.

August 4 -

The bank saw a modest increase in net income from the first quarter, as lawsuit settlements tied to the company’s discontinued home lending business and fees regarding an anti-money laundering and securities class action suit continue to limit growth.

August 2 -

The industry had tightened up last year in the face of COVID-19. But as the economic outlook improves, banks are now easing criteria amid heightened competition, according to the Federal Reserve’s survey of loan officers.

August 2 -

The bureau said two rules related to communications with debtors will go into effect as originally planned on Nov. 30. The agency had previously proposed an extension to consider consumer advocates' concerns about the regulations.

July 30 -

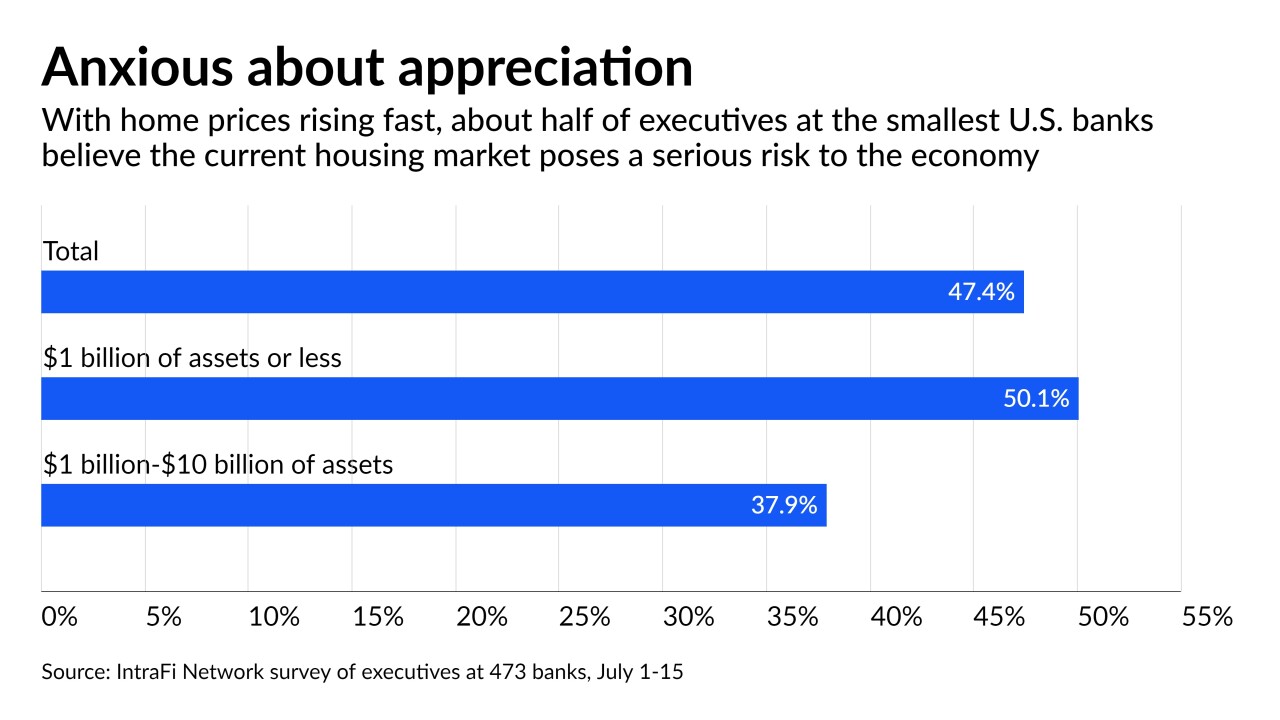

The very smallest banks, whose numbers shrank during the financial crisis, were most likely to express concern that the housing market will imperil the broader economy.

July 27 -

The relatively low share of borrowers who were distressed in June adds to signs that the offramp from government relief measures may not lead to an overwhelming wave of foreclosures.

July 22 -

The Office of the Comptroller of the Currency confirmed it will rescind an unpopular rule overhauling the Community Reinvestment Act and joined other agencies in calling for a renewed interagency effort.

July 20 -

The Rhode Island bank endured a sharp decline in fee income from home loans, which had spiked earlier in the pandemic. But CEO Bruce Van Saun says the company is well positioned as the refinancing boom fades and the home purchase market becomes more important.

July 20 -

Consumers are booking rooms at levels not seen since early 2020 and loan delinquencies have fallen sharply as a result. Still, business travel remains sluggish and new COVID variants are spreading, threatening the hotel industry’s recovery.

July 19 -

Identifying where payment stress is concentrated could help mortgage servicers and federal policymakers prepare for the broader range of loan workouts that will resume this summer.

July 8 -

It will be several years before business and group travel return to normal levels, according to an estimate from the American Hotel & Lodging Association.

July 7 -

Rebounding employment brought total forborne mortgages under 2 million, according to the Mortgage Bankers Association.

July 6 -

The lack of a stabilizing force in the commercial real estate mortgage business is creating one of the most significant threats the lending industry faces, writes the CEO of Cirrus.

July 5 Cirrus

Cirrus -

The number of grievances about evictions and federal student loans declined between January 2020 and May 2021. Nonetheless, the Consumer Financial Protection Bureau warned financial firms that poor customer service can undermine government efforts to provide aid.

July 2 -

Private mortgage insurers can continue to hold less capital for forborne delinquent loans, which helps them potentially upstream payments to parent companies in the third and fourth quarters.

July 1