-

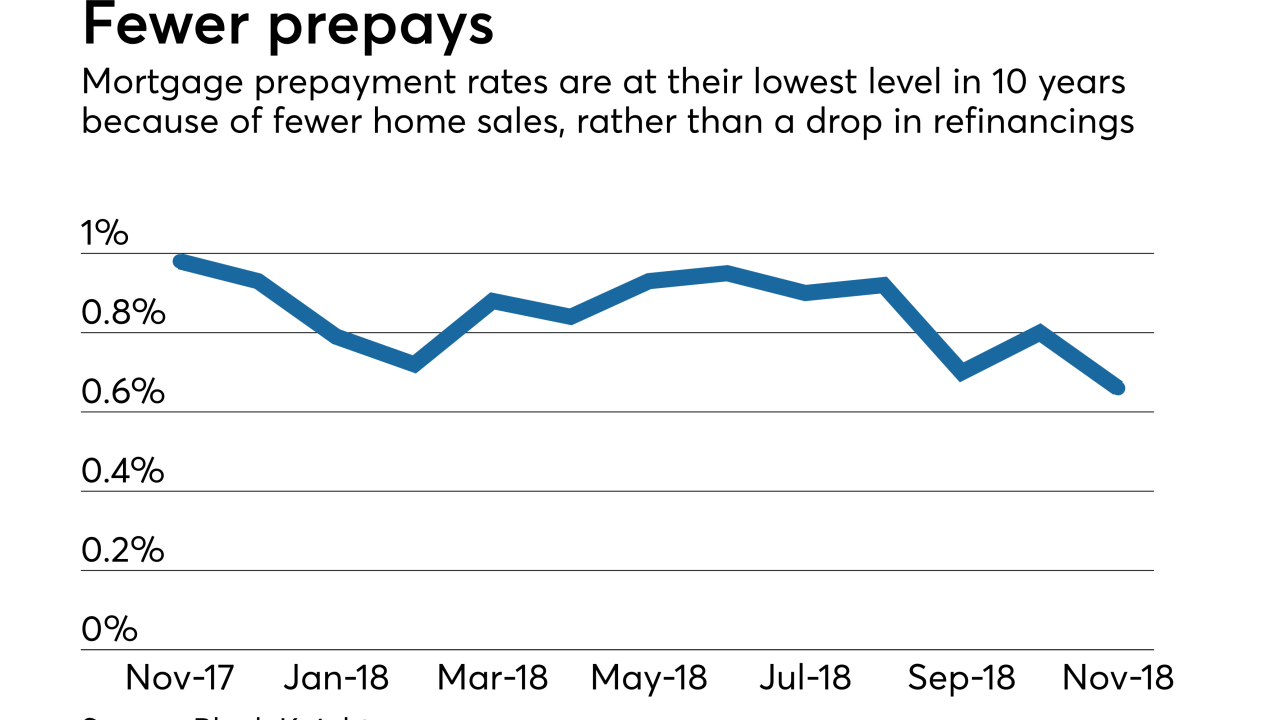

Mortgage prepayment speeds fell to their lowest level in 10 years in November as rising interest rates took a toll on origination activity, according to Black Knight.

December 20 -

Maria Vullo is stepping down as head of New York's banking and insurance regulator after three years in which she created a national model for cybersecurity regulations at banks and fought back against federal attempts to chip away at payday-lending rules.

December 19 -

The newly sworn-in director’s first public remarks seemed to contrast with the approach of her predecessor, Mick Mulvaney, who at times questioned the role of the agency.

December 11 -

Democrats on the House Financial Services Committee are expected to shine a spotlight on Trump-appointed regulators, but that light might shine brightest on one agency in particular.

December 5 -

The performance of loans included in commercial mortgage-backed securities improved for the fifth consecutive quarter, with delinquencies down 179 basis points over the time frame, according to the Mortgage Bankers Association.

December 4 -

Private-label residential mortgage-backed securitization is approaching a post-crisis high, according to Kroll Bond Rating Agency.

December 3 -

Social Finance, the lending and refinancing startup valued at more than $4 billion, is cutting about 7% of its staff, according to a person familiar with the matter.

December 3 -

Kathy Kraninger, who may get a confirmation vote as early as this week, has suggested a similar vision to that of the agency’s current acting chief. But some see signs she could bring a different approach to the job.

November 27 -

October's loan delinquencies, especially those in serious delinquency, got much healthier after improving from the fallout of the last two hurricane seasons, according to Black Knight.

November 27 -

Carrington Mortgage Services has created a nondelegated correspondent channel, looking to build on relationships it has with originators that currently broker loans to the company.

November 20 -

Subprime originations are climbing in multiple consumer loan categories, including mortgages, but the increase is much smaller in the home loan sector than it is in other markets, according to TransUnion.

November 19 -

The bank recently notified an upstate New York man that he was wrongly denied a mortgage modification, and enclosed a $25,000 check. But details of what went wrong have been hard to come by.

November 13 -

The mortgage delinquency rate dipped to a 12-year low, but overvalued housing markets and eventual reversal in the unemployment rate present risk for future delinquencies, according to CoreLogic.

November 13 -

Mortgage delinquencies inched up, in part from natural disasters hindering homeowner performance, but a stronger economy is still keeping defaults low, according to the Mortgage Bankers Association.

November 8 -

Despite recriminations about how the crisis and ensuing regulations have tightened loan access, an actual assessment of mortgage credit availability finds the situation is more complicated.

October 24 -

A new credit score that includes consumers' cash flow alongside their credit score is winning praise for its potential to help expand access to credit, but some worry it gives the credit bureaus even more data that could be compromised.

October 23 -

In a move designed to improve access to financial products for consumers with low credit scores and short credit histories, Experian, FICO and Finicity are developing an "UltraFICO" score that lets individuals share checking and savings account data and help lenders better assess risk.

October 22 -

The senior Democratic lawmaker said the CFPB chief and the Trump administration "are doing everything in their power to roll back consumer protections."

October 2 -

After a run-up in the latter half of last year, delinquencies on mortgages sold to Fannie Mae and Freddie Mac look fairly stable for the time being.

September 27 -

A new financial technology company called Scratch is planning to use a new web-based platform along with an alternative pricing model to compete with companies that service mortgages and other consumer loans.

September 20