-

But deal sponsors are primarily restricting property assets to the lower risk multifamily and office buildings that lenders are more confident will weather the economic strains brought by the coronavirus pandemic.

June 12 -

The coronavirus pandemic brought more attention to the affordable housing issue and illuminated already vulnerable, low-income populations.

June 12 -

Home sales in the Baltimore area plummeted in May, the steepest drop in a decade amid the pandemic, but record-low mortgage rates are pushing buyers into the housing market.

June 12 -

Borrowers gained over $6 trillion in home equity since the Great Recession ended and the relative health of the housing market should stave off a coronavirus-induced collapse, according to CoreLogic.

June 11 -

The measures extended by the Federal Housing Finance Agency include alternative methods used for certain appraisals and for verification of employment.

June 11 -

The expected rise in refinance volume overrides pessimism about purchase activity for their businesses.

June 11 -

Home sales in the San Antonio area plunged 20% in May, the market's worst stretch since the onset of the coronavirus pandemic.

June 11 -

Lenders are cautioning not only that second-quarter provisions might exceed the spike seen earlier this year, but also that credit costs could be elevated into 2021 if the economic slowdown drags on or fears of a second coronavirus wave are borne out.

June 11 -

As revenue-starved retailers fall further behind on rent payments, landlords' cash flow will be strained, and defaults on commercial real estate loans could rise.

June 10 -

The Federal Housing Administration's move to insure loans with forbearance could help support homeownership opportunities constrained by the coronavirus if one change was made to it, trade groups said.

June 10 -

The coronavirus market disruption actually caused the company's execs to speed up its return.

June 10 -

Now the shutdown has stretched into mid-June, effectively canceling the long-anticipated Memorial Day listings bonanza.

June 10 -

The coronavirus pandemic is driving rents down in San Francisco and across the region, reshaping a housing market that for the past decade has generated enormous profits for residential developers while displacing tens of thousands of workers from the inner Bay Area.

June 10 -

Some lawmakers fear that when forbearance plans and enhanced unemployment coverage expire, the consequences for mortgage borrowers still affected by the pandemic will be severe.

June 9 -

If delinquency rates rise, all four stand-alone firms would have a capital shortfall.

June 9 -

Looming economic uncertainties forced mortgage lenders to tighten underwriting standards in May.

June 9 -

Southern California housing markets are rebounding off what arguably was the worst April in the history books.

June 9 -

As brick-and-mortar shopping centers steadily lost market share to online competitors, the family behind three of the four biggest malls in North America built a thriving business by infusing their properties with heavy doses of entertainment.

June 9 -

Sales of single-family homes and condominiums on Oahu tanked in May as owners and buyers elected to practice social distancing.

June 8 -

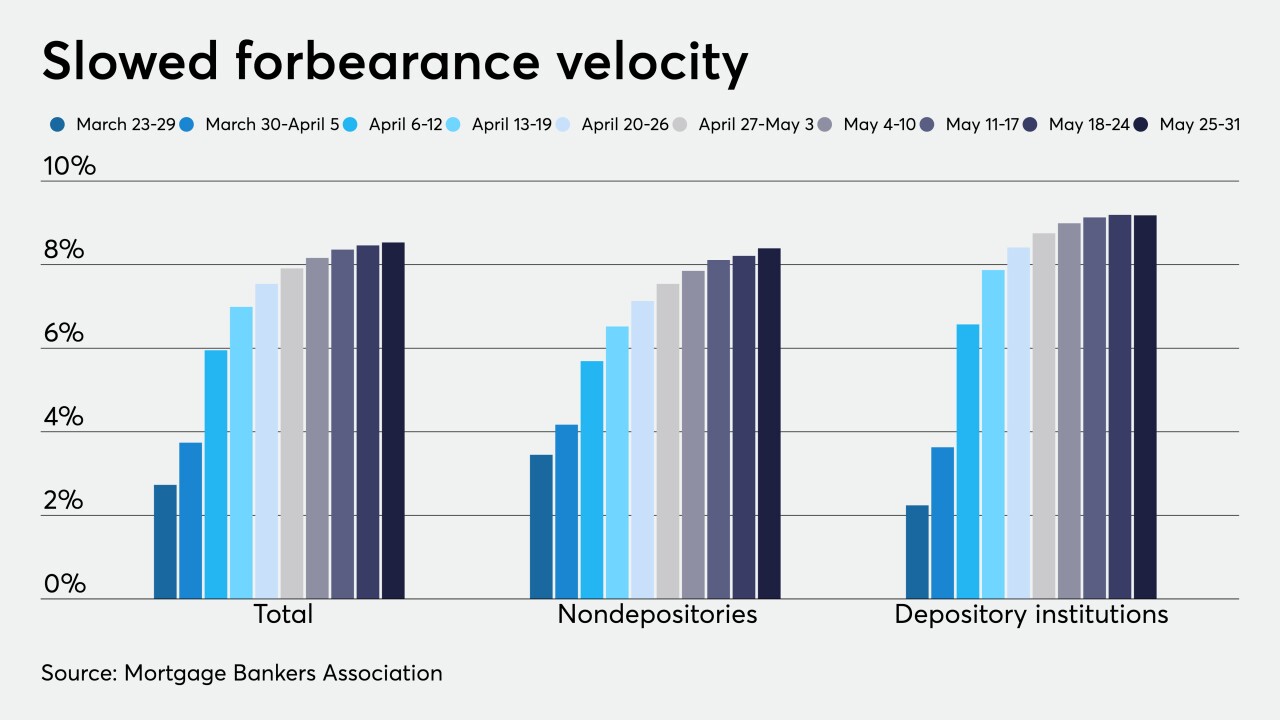

The number of loans going into coronavirus-related forbearance slowed to a rate of 7 basis points between May 25 and May 31, according to the Mortgage Bankers Association.

June 8