-

Fannie Mae's profitability suffered but it managed to stabilize the mortgage market in the first quarter even with the coronavirus disrupting, among other things, certain credit-risk transfer vehicles it has used.

May 1 -

Net income grew by nearly 1,990% year-over-year as its core mortgage services businesses gained scale.

May 1 -

The Home Loan bank will make zero-interest loans, match charitable donations that members make to nonprofits and small businesses, and provide additional funding for economic development grants.

May 1 -

About 7.3% of U.S. mortgages entered forbearance plans in April, providing temporary relief to more than 3.8 million borrowers who have lost income during the coronavirus pandemic.

May 1 -

Wells Fargo will temporarily stop accepting applications for home equity lines of credit, following a similar move by rival JPMorgan Chase.

April 30 -

The S&P CoreLogic Case-Shiller home price index hasn't yet reflected the impact of the coronavirus, but an independent market maker has some thoughts on how it might.

April 30 -

An early look at securitized residential home-loan performance amid the coronavirus pandemic indicates encouraging trends thus far in impairment levels of non-qualified mortgages, according to a new report from investor analytics firm Dv01.

April 30 -

While Freddie Mac stabilized liquidity in mortgage markets, coronavirus-related credit losses drove the GSE's income down in the first quarter of 2020.

April 30 -

Mortgage rates fell to their lowest level since Freddie Mac started reporting this data in 1971, as the coronavirus shutdown continued to play havoc with the economy.

April 30 -

Mounting economic fallout from the pandemic is fueling apartment landlords' concerns that more tenants will struggle to make their rent payments, even after most managed to come up with the money for April.

April 29 -

The bureau issued an interpretive rule clarifying that consumers under certain conditions can modify or waive waiting periods required by the Truth in Lending Act and Real Estate Settlement Procedures Act.

April 29 -

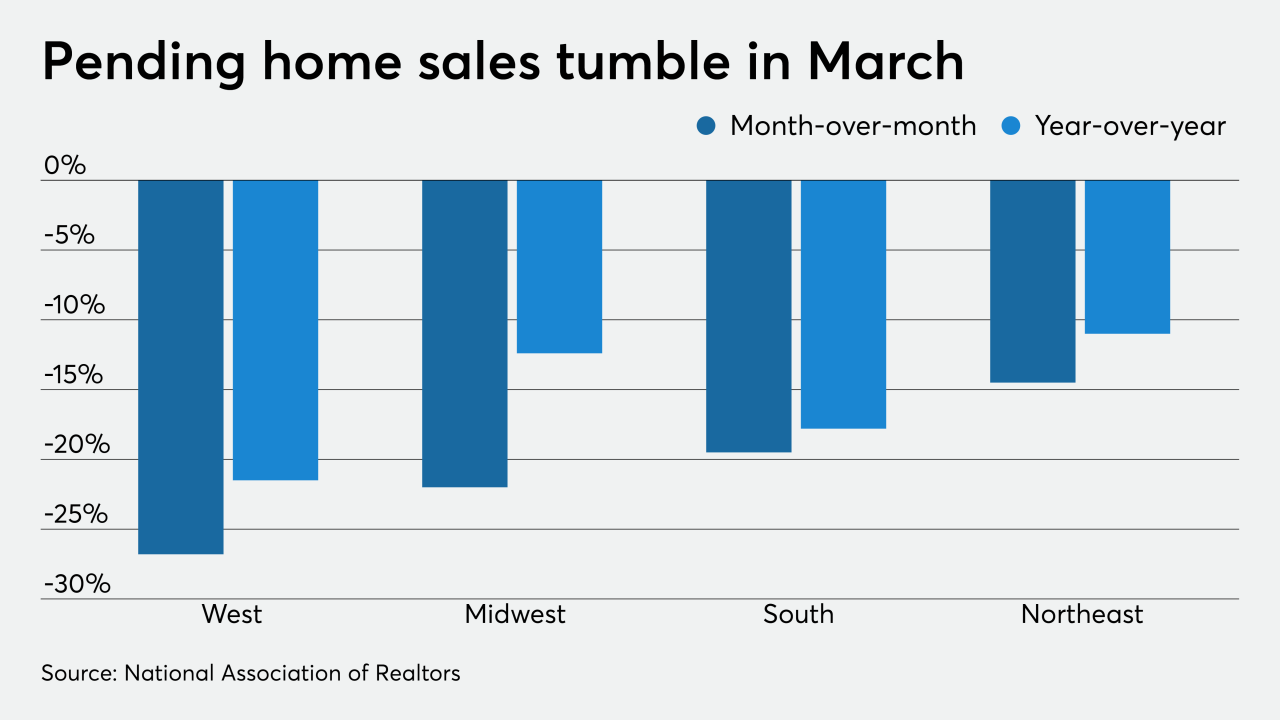

The coronavirus disruption caused March's pending home sales to fall and the losses will reverberate through the rest of 2020, according to the National Association of Realtors.

April 29 -

It's now definitive: Before coronavirus hit, the Seattle area's home market was hotter than almost anywhere else in the country.

April 29 -

Contracts to buy existing homes plunged in March by the most since 2010 as the coronavirus forced people to stay home and the economy spiraled down.

April 29 -

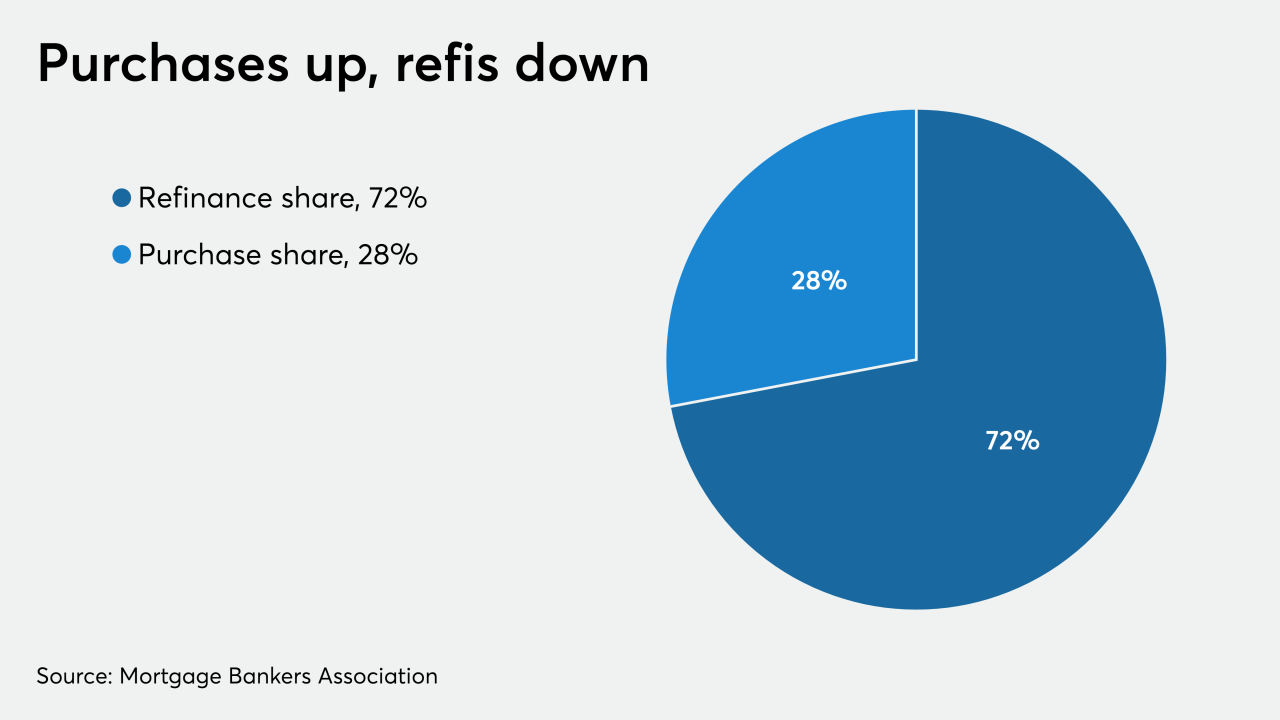

Even though mortgage application volume decreased from one week earlier, lenders had their best week for purchase business since the coronavirus shutdown began, according to the Mortgage Bankers Association.

April 29 -

The Southern California housing market was on track for record-setting prices and increased sales before the coronavirus outbreak hit, new numbers show.

April 28 -

The government-sponsored enterprises are focusing on how loans can be repaid after the federal forbearance period ends, and projections for loan modification volumes suggest the larger industry should, too.

April 28 -

Fannie Mae and Freddie Mac are now able to buy loans in forbearance to alleviate pressure on the sector, but the fees charged by the mortgage giants to assume more risk could turn away some originators.

April 28 -

Refinancing drove a 75% year-over-year increase in mortgage banking revenue during the first quarter at Flagstar Bancorp as it shored up its operations to avoid other negative repercussions from the coronavirus.

April 28 -

Manhattan homebuyers were already calling the shots in deals before the coronavirus hit. Now they're more in control than ever.

April 28