-

The Conference of State Bank Supervisors on Friday launched a centralized link to state websites highlighting information relevant to business continuity plans for licensed mortgage loan officers.

March 13 -

Sports leagues have suspended their seasons. Organizers have canceled conferences. The coronavirus is starting to inflict economic damage as Americans hunker down to stop its spread.

March 13 -

Coronavirus is spreading in New York City. But when it comes to real estate, fear of contagion only slightly trumps fear of missing out on a deal.

March 13 -

The social and economic impact of the coronavirus, not necessarily Covid-19 itself, has homebuyers and sellers on edge and is changing the way Realtors do business.

March 13 -

Covid-19 and the economic fallout that has come with it are putting some homebuyers and sellers in the Twin Cities on edge.

March 13 -

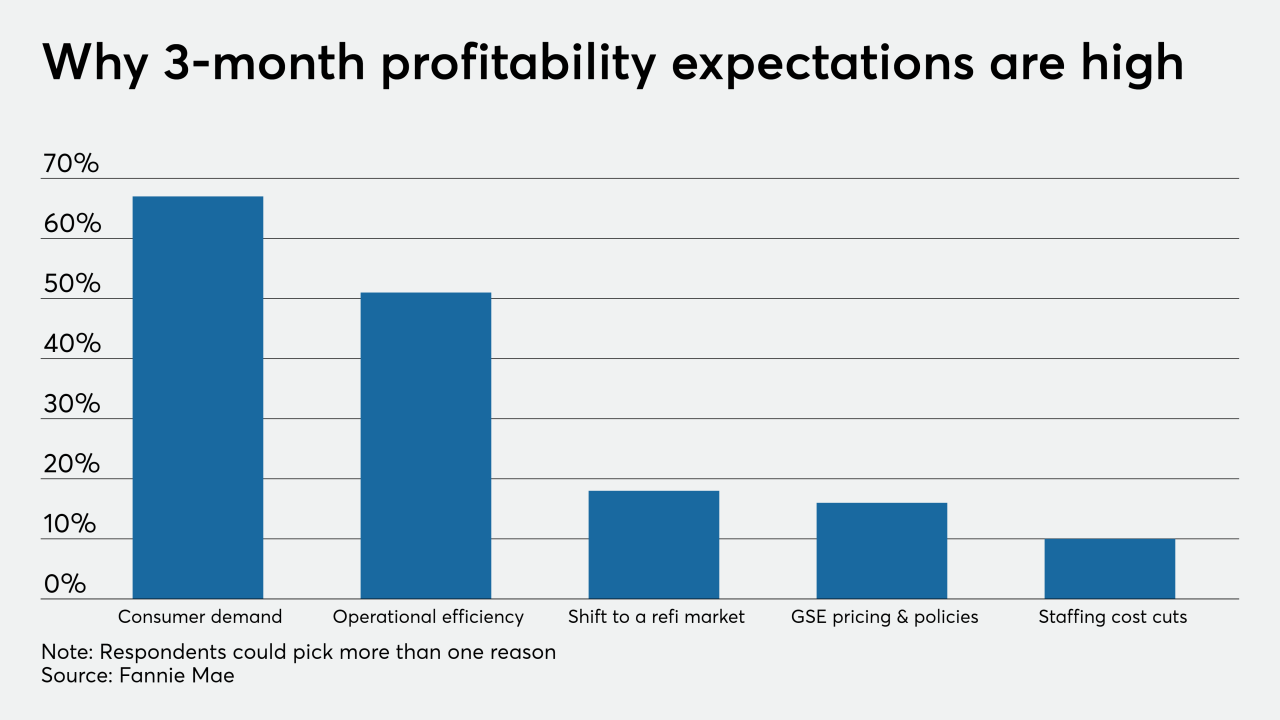

Increased refinancing volume led Fannie Mae to raise its 2020 estimate by $300 billion and 2021 projection by $280 billion.

March 12 -

Not so long after Treasury bond yields experienced an unprecedented drop, the average 30-year mortgage rate rose, reflecting volatility related to the coronavirus as well as capacity issues on multiple levels.

March 12 -

The central bank has been under increasing pressure to act as investors have been losing faith in the Trump administration's efforts to contain the economic fallout.

March 12 -

Companies in the mortgage business were already focused on processing a lot of loans and generating efficiencies before the latest uptick in business hit.

March 12 -

Houston-area home sales experienced another double-digit gain in February as buyers came out in droves to take advantage of low mortgage rates.

March 12 -

Paradoxically, mortgage rates actually increased this past week, even as the 10-year Treasury yield plumbed new depths, likely because lenders are too busy to handle the influx of applications.

March 12 -

Bank of America cut its ratings and price targets on several homebuilders and building products companies as the firm is bracing for the "inevitable" coronavirus impact on the U.S. housing market.

March 12 -

JPMorgan Chase is planning to implement a staggered work-from-home plan for its New York-area employees to help slow the spread of the coronavirus. The plan applies to most corporate employees, but not to branch workers or traders.

March 12 -

Financial executives who visited the White House pledged to help small businesses and consumers get through any economic damage as the virus continues to spread. They also encouraged the government to support fiscal stimulus policies.

March 11 -

Financial institutions need to alert customers about emails or websites that pretend to offer important COVID-19 information but instead could end up stealing their account numbers or logins.

March 11 -

Banks may be protected from a direct hit, but they have invested in vehicles that include such loans, potentially exposing them to defaults.

March 11 -

The Mortgage Bankers Association raised its refinance projections for 2020, a move precipitated by an application volume increase of 55.4% from one week earlier.

March 11 -

Kathy Kraninger was grilled about whether her agency and others were doing enough to cushion consumers from the economic blow of the coronavirus crisis.

March 10 -

While clients are uneasy about the spread of coronavirus, Kelly King touted the added volume his company has seen from lower rates.

March 10 -

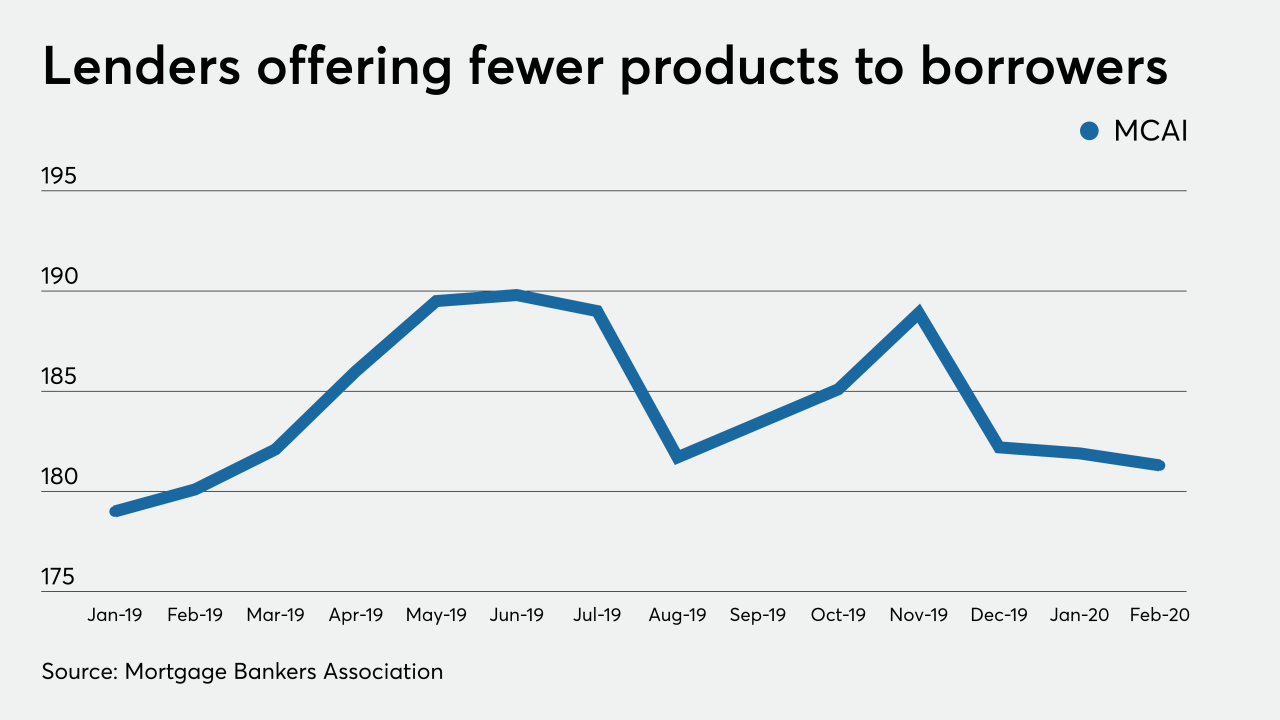

Mortgage credit availability dropped slightly in February, making three consecutive months of tightening, but that streak will likely end with falling interest rates, the Mortgage Bankers Association said.

March 10