-

Paradoxically, mortgage rates actually increased this past week, even as the 10-year Treasury yield plumbed new depths, likely because lenders are too busy to handle the influx of applications.

March 12 -

Bank of America cut its ratings and price targets on several homebuilders and building products companies as the firm is bracing for the "inevitable" coronavirus impact on the U.S. housing market.

March 12 -

JPMorgan Chase is planning to implement a staggered work-from-home plan for its New York-area employees to help slow the spread of the coronavirus. The plan applies to most corporate employees, but not to branch workers or traders.

March 12 -

Financial executives who visited the White House pledged to help small businesses and consumers get through any economic damage as the virus continues to spread. They also encouraged the government to support fiscal stimulus policies.

March 11 -

Financial institutions need to alert customers about emails or websites that pretend to offer important COVID-19 information but instead could end up stealing their account numbers or logins.

March 11 -

Banks may be protected from a direct hit, but they have invested in vehicles that include such loans, potentially exposing them to defaults.

March 11 -

The Mortgage Bankers Association raised its refinance projections for 2020, a move precipitated by an application volume increase of 55.4% from one week earlier.

March 11 -

Kathy Kraninger was grilled about whether her agency and others were doing enough to cushion consumers from the economic blow of the coronavirus crisis.

March 10 -

While clients are uneasy about the spread of coronavirus, Kelly King touted the added volume his company has seen from lower rates.

March 10 -

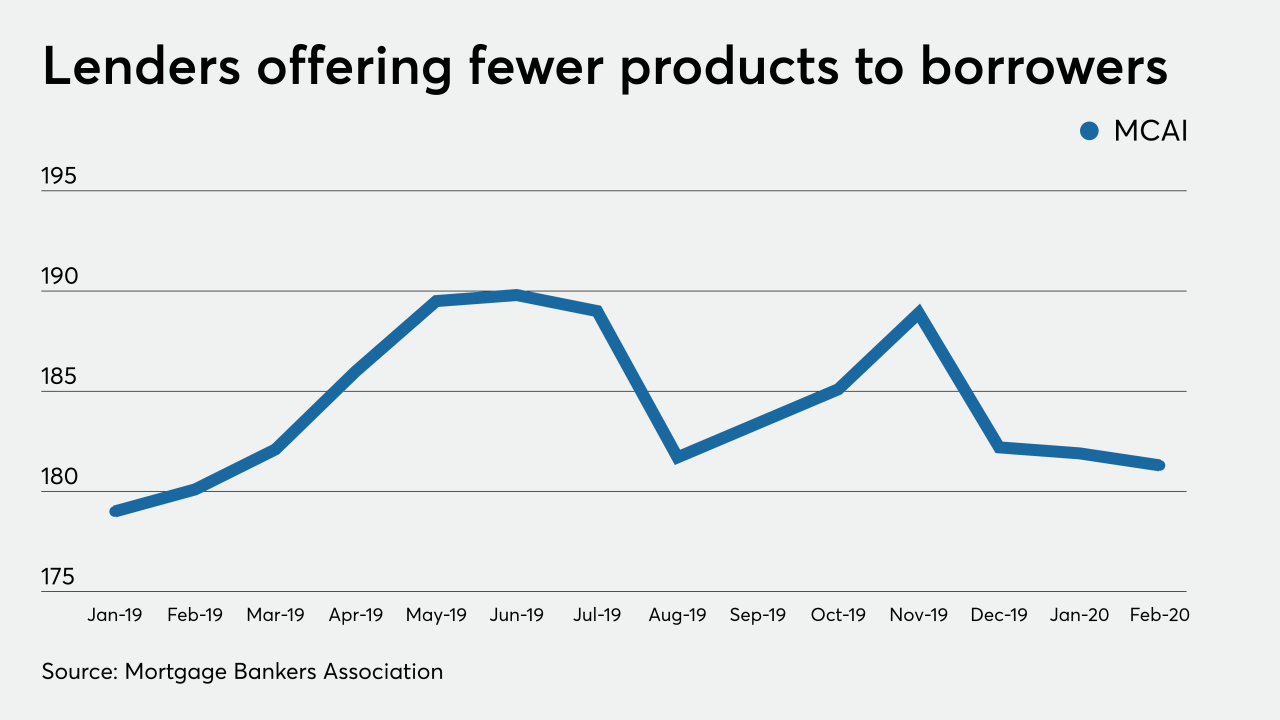

Mortgage credit availability dropped slightly in February, making three consecutive months of tightening, but that streak will likely end with falling interest rates, the Mortgage Bankers Association said.

March 10 -

Mortgage companies that borrow heavily to keep their operations running may face financial pressure from coronavirus-related market volatility as it affects the valuations of collateral securing their financing.

March 9 -

Consumer sentiment for home buying stayed near its record high behind low mortgage rates and a strong job market, though the declining stock markets and COVID-19 concerns may change that soon, according to Fannie Mae.

March 9 -

State and federal officials committed to providing “appropriate regulatory assistance” to banks whose customers may be hurt by the coronavirus outbreak and said prudent measures would not be subject to criticism by examiners.

March 9 -

From credit unions to banks, loan officers in South Florida are on the phones with homeowners, many of whom have one question: When can I refinance my mortgage?

March 9 -

Sen. Mark Warner led a group of Democratic senators in calling on bank, credit union and GSE regulators to give detailed instructions on helping consumer and commercial borrowers hurt by the COVID-19 outbreak.

March 9 -

Temporary disruptions from the coronavirus shouldn't lead to consumers having lower credit scores because of missed payments, Democrats on the Senate Banking Committee are telling banking trade groups and regulators in two separate letters.

March 9 -

Mortgage lenders could benefit from the surge in refinancing due to widening market spreads, and that could help offset damage to servicing rights portfolio valuations, according to Keefe, Bruyette & Woods.

March 9 -

Mortgage rates, which fell to a 50-year low last week, are keeping Oahu's real estate market relatively strong even as uncertainties mount over the economic impacts of coronavirus outbreaks.

March 9 -

The 10-year Treasury yield fell below 0.5% and the 30-year yield dropped under 0.9%, taking the whole U.S. yield curve below 1% for the first time in history.

March 9 -

It's hard to overstate just how wild bond markets have gotten amid the coronavirus scare, forcing traders to rethink what's possible.

March 6