-

The commercial mortgage-backed securities delinquency rate increased for the first time since October lead by a 31-basis-point rise in late payments for loans secured by retail properties, Fitch Ratings said.

April 8 -

Controlling classes of investors in commercial mortgage-backed securitizations can replace a special servicer, but before they do, they should make sure the long and potentially expensive process is worth it.

April 3 Alston & Bird

Alston & Bird -

Home retention actions for loans owned by Fannie Mae and Freddie Mac declined in the fourth quarter and that trend is likely to continue given the strong economy.

March 26 -

While fading 9.53% annually, February mortgage delinquencies posted a month-over-month increase for the first time in 12 years, according to Black Knight.

March 21 -

The money for a proposed $300 million sports complex at a foreclosed famed New York Catskills Mountain hotel was not produced by a March 22 deadline.

March 21 -

Mortgage foreclosure filings across New York dropped 46% between 2013 and 2018, from 46,696 to 25,334, according to a report issued by New York State Comptroller Thomas DiNapoli.

March 11 -

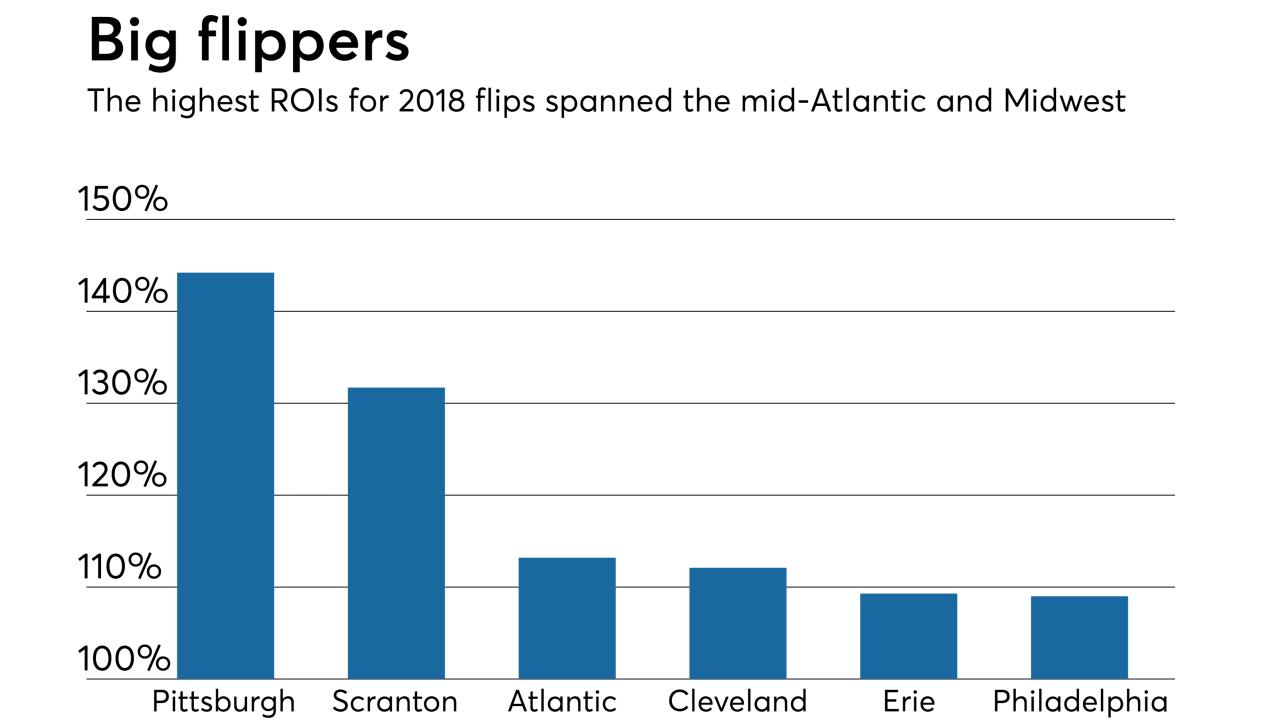

Financing poured into purchasing homes to flip in 2018, reaching the highest total since 2007, according to Attom Data Solutions.

February 28 -

In what some real estate professionals are referring to as part of the "after-effects" of the recession, is a spike in the sale of foreclosures across Staten Island.

February 20 -

The funds the bank promised to spend on consumer relief will instead be used to make new home loans, according to a report by the monitor of its 2017 settlement with the U.S. Justice Department.

February 15 -

Mortgage delinquencies in the fourth quarter were at their lowest level in nearly 19 years, helped by wage growth, low household debt and low unemployment, the Mortgage Bankers Association said.

February 15 -

The government-sponsored enterprises are going through a transition period. From proposals for rebuilding their capital cushions to tackling shortages in affordable housing, Fannie Mae and Freddie Mac face a number of key challenges with wide-ranging consequences this year.

February 14 -

A year after forming, the Erie County, Pa., land bank is compiling a list of blighted, tax-delinquent properties outside the city that need to be demolished or rehabilitated.

February 12 -

As more homeowners decide to age in place, the amount of equity rich properties continues to rise, according to Attom Data Solutions.

February 7 -

Residential mortgage-backed securities servicers are better able to weather a downturn and the resulting loan defaults today versus before the crisis because of their investments in technology and regulatory compliance, Fitch Ratings said.

February 1 -

New York State is providing additional funding to municipalities that will boost efforts regarding mortgage servicer compliance with the state and local vacant property laws.

January 28 -

Risk aversion, economic momentum and the multidecade nadir of unemployment rates helped push delinquencies to the lowest year-end measure of the 21st century, according to Black Knight.

January 23 -

The distressed real estate market has bounced back from the housing bubble as most foreclosures are due to natural disasters, according to Attom Data Solutions.

January 17 -

Consecutive-month default rates for home loans are increasing, and they could remain higher the next few months, according to a recent report.

January 15 -

Loans in commercial mortgage-backed securities originated after 2009 by nonbank lenders have a significantly higher default rate than those originated by banks, a Fitch Ratings report said.

January 14 -

Due diligence firm American Mortgage Consultants has purchased Meridian Asset Services as part of its continuing efforts to expand through acquisition or organic growth.

January 10