-

Philadelphia officials have expanded a program that will give first-time homebuyers and other eligible city residents up to $10,000 when they purchase a home in the city.

May 13 -

The documents and other information needed for a loan application.

May 9 -

Whether online or advertised on a sign, very few consumers will qualify for that incredible low-rate deal. Here's why.

May 9 -

A larger share of Midwestern loan officers compared with their counterparts nationwide said working with first-time home buyers was extremely important for their success, the 2019 Top Producers Survey found.

May 8 -

Two nonprofits threatened by the effort say the Department of Housing and Urban Development tried to avoid scrutiny last month when it announced the new policy outside the formal rulemaking process.

May 6 -

Millennial homebuyers are increasingly using savings from their primary paychecks to put money down on a home, according to Redfin.

April 29 -

The Trump administration is cracking down on national affordable housing programs because of concern over growing risk to the government's almost $1.3 trillion portfolio of federally insured mortgages.

April 22 -

The Hispanic homeownership rate increased for the fourth consecutive year, despite the fact that the demographic remains more exposed to barriers to buying a house than the general population.

April 10 -

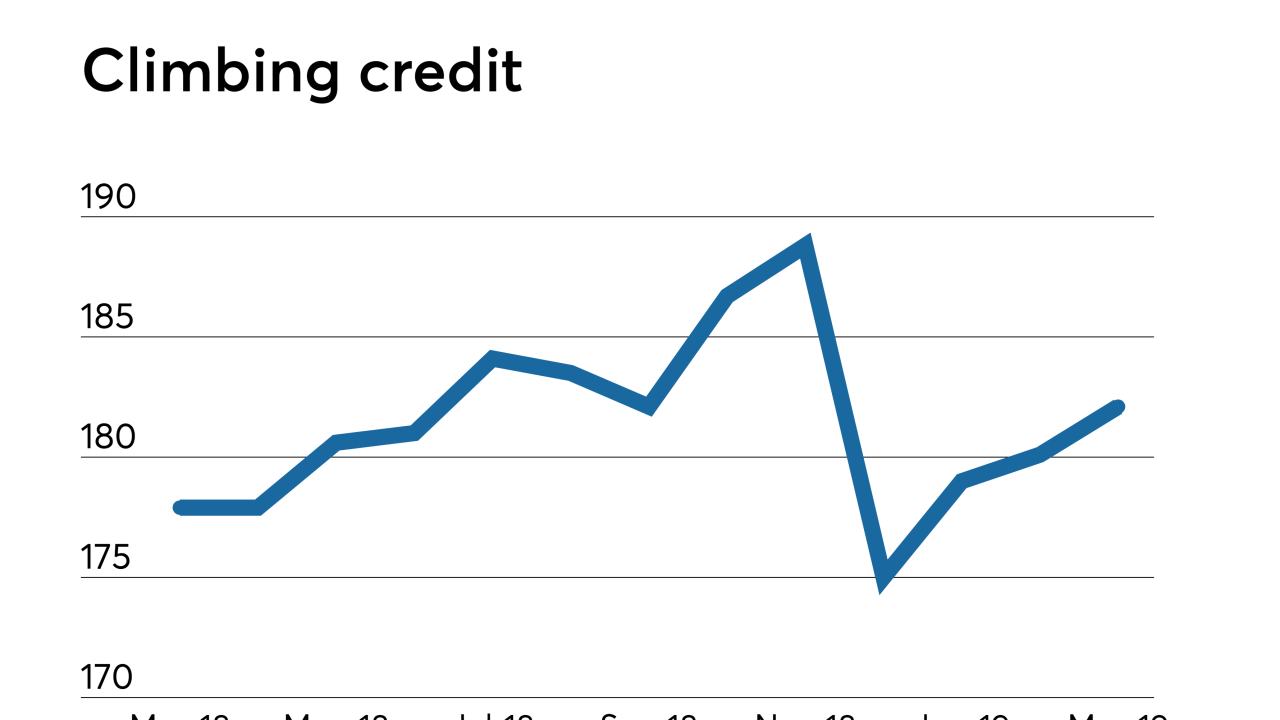

Mortgage lending standards loosened in March, as a swell in jumbo credit helped drive an expansion in availability for the third straight month, according to the Mortgage Bankers Association.

April 4 -

Bank of America is setting aim at low- to moderate-income and multicultural homebuyers and communities with the launch of its Neighborhood Solutions affordable homeownership initiative.

April 2 -

The mortgage industry is stepping up its fight against a bill that would raise the Department of Veterans Affairs' mortgage fees to cover medical costs for Vietnam vets.

April 1 -

Canada's housing agency will spend up to C$1.25 billion ($943 million) over three years to take equity positions in homes bought by first-time buyers, part of a plan by Justin Trudeau's government to make housing more affordable for the youngest voters.

March 20 -

The Federal Housing Administration is moving forward with a long-delayed plan to reduce the term of the home warranty required for high loan-to-value mortgages on new houses.

March 14 -

Millennials make up the largest cohort of homebuyers, but a quarter of them don't even know their credit score, which could be a call for mortgage lenders to help them prepare to enter the housing market.

March 13 -

A city program that helps first-time homebuyers purchase affordable homes has received an additional $3.2 million in grant funding.

March 13 -

Rises in the amount of low down payment loans and private mortgage insurance due to tight affordability led to the most first-time homebuyers since 2006, according to Genworth Mortgage Insurance.

March 1 -

Slower home price growth and cooled mortgage rates could bring buyers out in droves in 2019, according to NerdWallet.

February 26 -

Two Alabama cities lead the nation in several categories according to a study charting the best cities in which to buy a home based on the buyer's occupation.

February 7 -

The number of homeowners participating in an expanding down payment assistance program offered by Wells Fargo and NeighborWorks could top 20,000 this year.

February 4 -

Across rural America, the government shutdown has eliminated one of the best options for low-to-middle income homebuyers, a zero down payment mortgage from the U.S. Department of Agriculture.

January 24