-

Freddie Mac is expanding its Home Possible loan program to allow borrowers in rural locations to use "sweat equity" for down payments and closing expenses.

November 20 -

Wells Fargo & Co. raised its required down payment for homebuyers in Connecticut's Fairfield County to 25% from the standard 20% after it categorized the area as distressed.

November 15 -

The Federal Housing Administration's life-of-loan premium discourages borrowers from refinancing into another FHA mortgage, damaging the stability of the insurance fund.

November 8 Potomac Partners

Potomac Partners -

Eighty percent of millennials said they plan on moving within the next five years, while nearly three-quarters claim affordability as their biggest hurdle in the buying a home.

November 6 -

The amount of mortgage credit available to consumers increased to a post-crisis high in October in reaction to more first-time homebuyers entering the market, the Mortgage Bankers Association said.

November 6 -

A deal between TD Bank and a Vermont nonprofit is just one example of how banks are getting creative in addressing affordable housing needs while reaping financial and regulatory benefits.

October 30 -

While the average down payment percentage of purchase price stayed mostly flat, the average dollar amount dropped 10% from the previous quarter, according to LendingTree.

October 26 -

With home values nearly doubling income growth in the last 20 years, it's now taking homebuyers 7.2 years to put together a down payment, according to Zillow.

October 23 -

Despite mortgage rates at a seven-year high and rising home prices and low inventory that are keeping consumers from buying homes, rental prices are declining in many markets.

October 18 -

Providing borrowers with an incentive to create financial reserves after closing is a better tool to prevent mortgage loan defaults than measures taken at underwriting, a JPMorgan Chase Institute study declared.

October 18 -

The vast majority of Americans, especially those that could be downsizing into a smaller property, would rather renovate their current home than save for a down payment, a Zillow survey found.

October 12 -

Home price index swaps, treated as a second lien on a property, will be used to reduce the default risk associated with low down payment mortgages, one of the program's creators said.

October 10 -

Millennials are targeting homeownership within the next few years, but many are buying into certain house-purchasing myths, according to Bank of America.

October 10 -

Homebuyers put about 15% toward a down payment on house, spend $40,000 in one-time fees and thousands in closing costs, presenting an opportunity for lenders to leverage education and product offerings to prepare them for a purchase.

October 2 -

Homebuyers saving for a down payment contributed to the slowest rate of August price appreciation in nearly two years; and the market could have even less momentum by next summer.

October 2 -

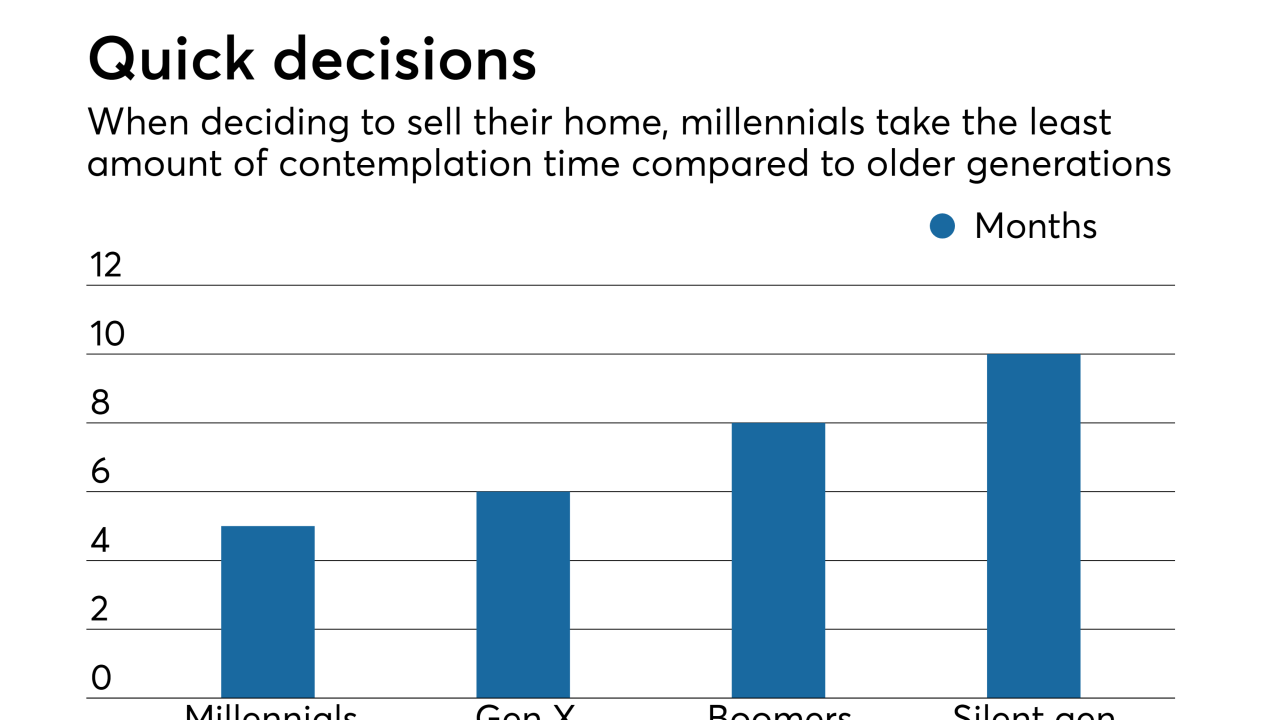

Millennials make up the largest constituent group for both homebuyers and sellers, which could put a squeeze on lending and eventually shift the market.

September 28 -

As home prices continue to rise, a record-high 77% of people surveyed think it's currently a strong time to sell a house, according to the National Association of Realtors.

September 26 -

NMI Holdings is laying the groundwork for President Claudia Merkle to replace CEO Bradley Shuster next year.

September 14 -

Mortgage origination volume continues to decline as homebuyers receiving loans bring more money to the closing table.

September 13 -

How affordable is Tampa Bay? One test is whether someone earning the median income can afford the median priced home.

September 4