-

Earnings reports out this week beat pessimistic expectations, but strained coronavirus relief negotiations in Congress cloud the outlook for what's ahead.

August 7 -

With infections resurging, consumer confidence in the housing market hit a snag in July, but sellers are feeling better about their prospects, according to Fannie Mae.

August 7 -

The rising number of positions appears to reflect an ongoing need to adjust capacity to address rate-driven demand.

August 7 -

Even though revenues beat analysts' estimates, Zillow lost $84 million in the second quarter, with its mortgage business losing $240,000.

August 7 -

The company reported nearly $23 million in losses for the second quarter, but that was an improvement on a quarter-to-quarter basis.

August 7 -

Though overall forbearance share is down, the number of extensions is rising as coronavirus hardship filings surpass the 90-day mark that delineates the end of traditional forbearance plans.

August 7 -

In the face of the COVID-19 pandemic, Southern Nevada home prices continued to inch higher in July, according to a new report.

August 7 -

After an initial fizzle, the stock at one point was trading above the original expected price range.

August 6 -

Whether mortgage rates continue to decline may depend on Friday’s job numbers.

August 6 -

Commercial real estate fundamentals improved in July, but the pandemic continues to affect development projects and is likely to remain a significant challenge for more than a year, according to a COVID-19 impact report by the NAIOP Commercial Real Estate Development Association.

August 6 -

So far, only Tulsa County has opted in, but the Indian Nation Council of Governments is working with officials across the state to get other counties on board.

August 6 -

The company, which launched last fall, announced a partnership with an organization that aids military families.

August 5 -

PREIT, which owns a number of large malls, is trimming the salaries of its CEO and chief financial officer while suspending dividend payments as part of a deal with its lenders to stave off default as the coronavirus pandemic continues to take its toll on the troubled company.

August 4 -

The mortgage servicing rights package going up for bid adds to signs that the market for large offerings is becoming more active.

August 3 -

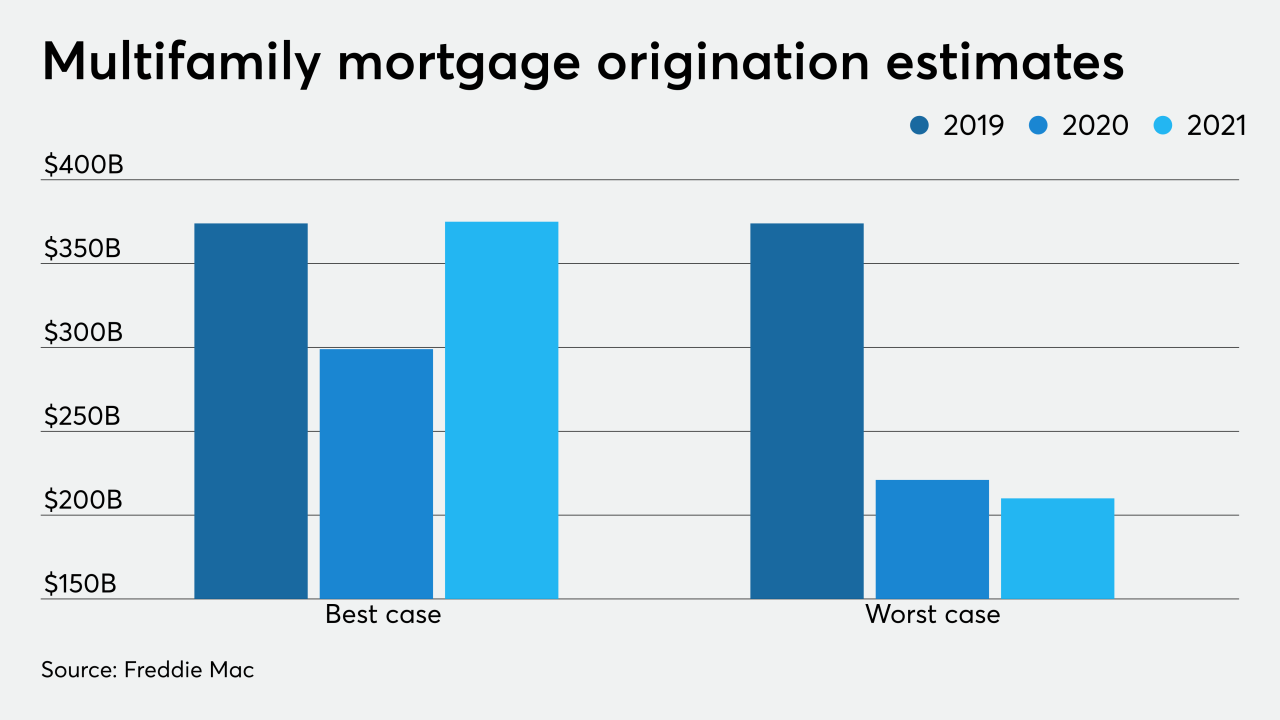

The size of the decline depends on how bad the economy sinks and if the coronavirus spread is halted.

August 3 -

Fannie, Freddie also announced they'll face banklike liquidity standards starting Sept. 1.

July 31 -

The combined impact of coronavirus forbearance periods ending while low rates persist means large workloads for title insurers, appraisers and others.

July 31 -

Some real estate agents in the Daytona Beach, Fla., area have been reporting an increase in bidding wars for homes because of the low inventory.

July 31 -

The mortgage giants will have to meet benchmarks for covering cash flow needs during stressed periods. The FHFA views the requirements as a prerequisite to the companies exiting conservatorship.

July 31 -

The government-sponsored enterprise's earnings were up tenfold as it stabilized mortgage market liquidity amid the coronavirus.

July 30