-

Loan limits for most mortgages Fannie Mae and Freddie Mac buy will exceed $500,000 for the first time ever next year, and the maximum for most high-cost areas will be $765,000.

November 27 -

From product-specific variations in refinancing rates to pockets of depreciation in an otherwise healthy market, here are some details in housing-related data that highlight important underlying trends in the mortgage business.

November 27 -

Private mortgage insurance now has almost matched the government's Federal Housing Administration program in market share, having gained approximately eight percentage points in the past five years, Keefe, Bruyette & Woods found.

November 26 -

For the private-label mortgage-backed securities market to grow, regulators need to focus on collateral management in addition to changes to data disclosure rules.

November 25 Whalen Global Advisors LLC

Whalen Global Advisors LLC -

The former head of the Office of Federal Housing Enterprise Oversight explains why he thinks the mortgage industry is closer than ever to having a truly paperless process, and weighs in on GSE reform.

November 22 -

Changing or eliminating the exemption to the qualified mortgage rule could harm consumers and put smaller lenders at a disadvantage to the big banks.

November 20 Freedom Mortgage Corp.

Freedom Mortgage Corp. -

The Federal Housing Finance Agency has extended its deadline for investor comments on a proposal aimed at better aligning pooling practices for loans in uniform mortgage-backed securities.

November 19 -

The Federal Housing Finance Agency is scrapping a capital proposal it released last year and will seek comments on a new plan in 2020.

November 19 -

With economic expansion expected to keep churning through at least the first half of next year, Fannie Mae upwardly revised its single-family mortgage origination outlook for 2019 and 2020.

November 18 -

The Federal Housing Financial Agency's latest report on credit risk transfers shows Fannie Mae continues to slowly improve a multifamily mortgage risk-sharing metric that lags Freddie Mac's by a wide margin.

November 15 -

JPMorgan Chase may be leading the next trend for banks seeking to shift risk away from their mortgage portfolios — if regulators give Wall Street the green light.

November 13 -

And the government-sponsored enterprises could hold initial public offerings in 2021 or 2022 to ensure they hold adequate capital, FHFA Director Mark Calabria said.

November 13 -

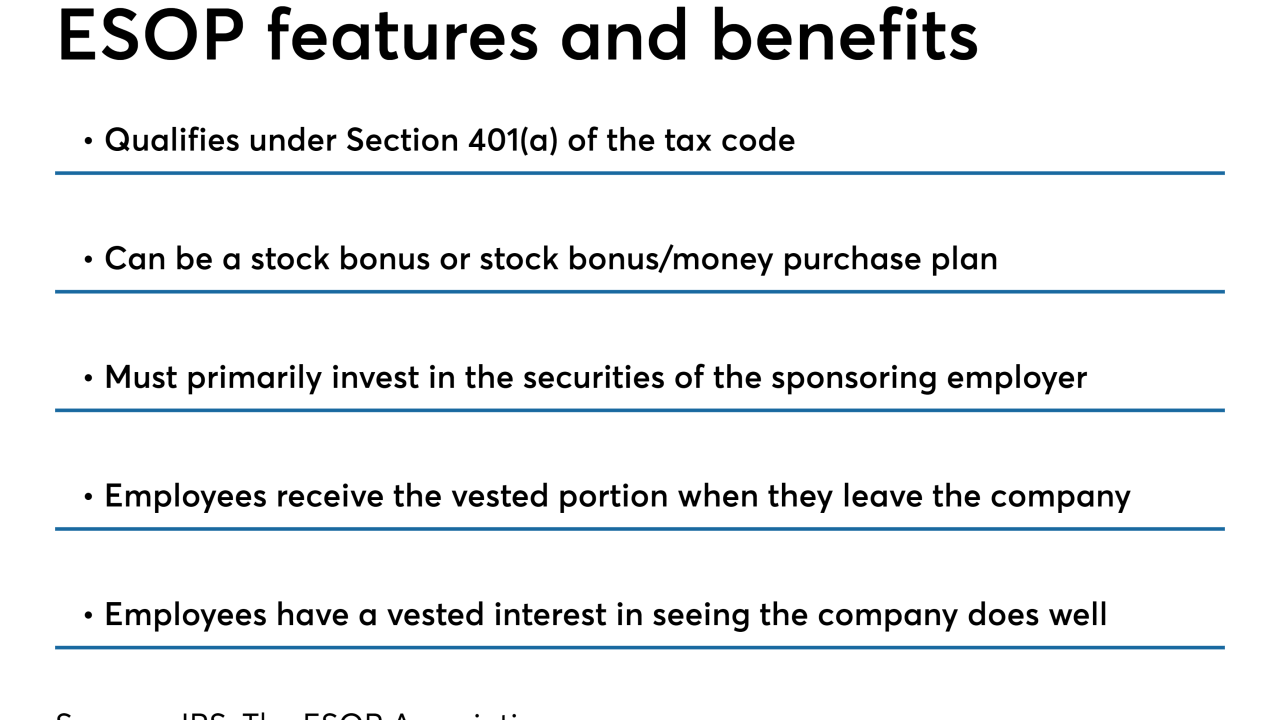

The American Mortgage Network name is being revived again, this time for a de novo company that will be 100% employee owned.

November 13 -

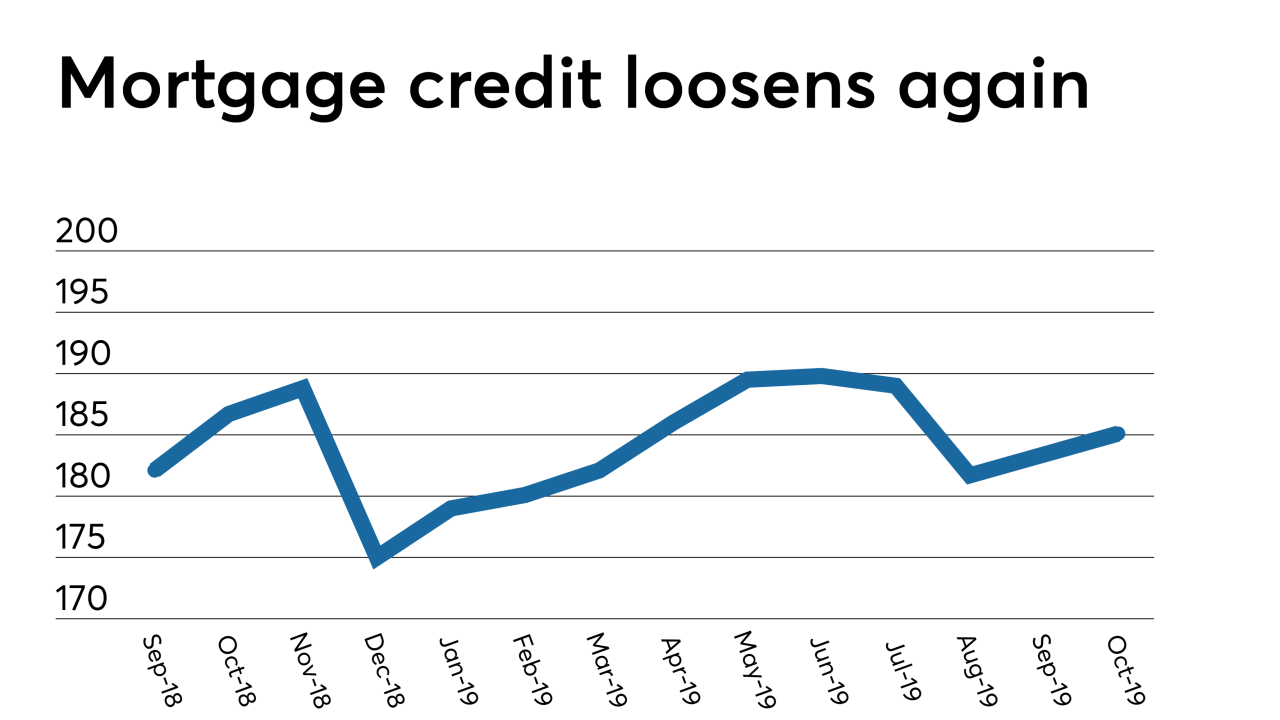

Mortgage credit availability increased in October from the previous month, as mortgage lenders increased their product offerings outside the government market, according to the Mortgage Bankers Association.

November 12 -

Fannie Mae and Freddie Mac’s exemption from the Qualified Mortgage rule is on borrowed time, but a House bill would allow lenders to use the mortgage giants’ guidelines for documenting borrower income.

November 12 -

The two newest private mortgage insurance companies had their best quarters ever for new insurance written, aided by the increase in consumers refinancing with less than 20% home equity.

November 8 -

Though still comparatively strong, consumer confidence in the housing market dropped again in October in response to economic uncertainty and lack of affordability, according to Fannie Mae.

November 7 -

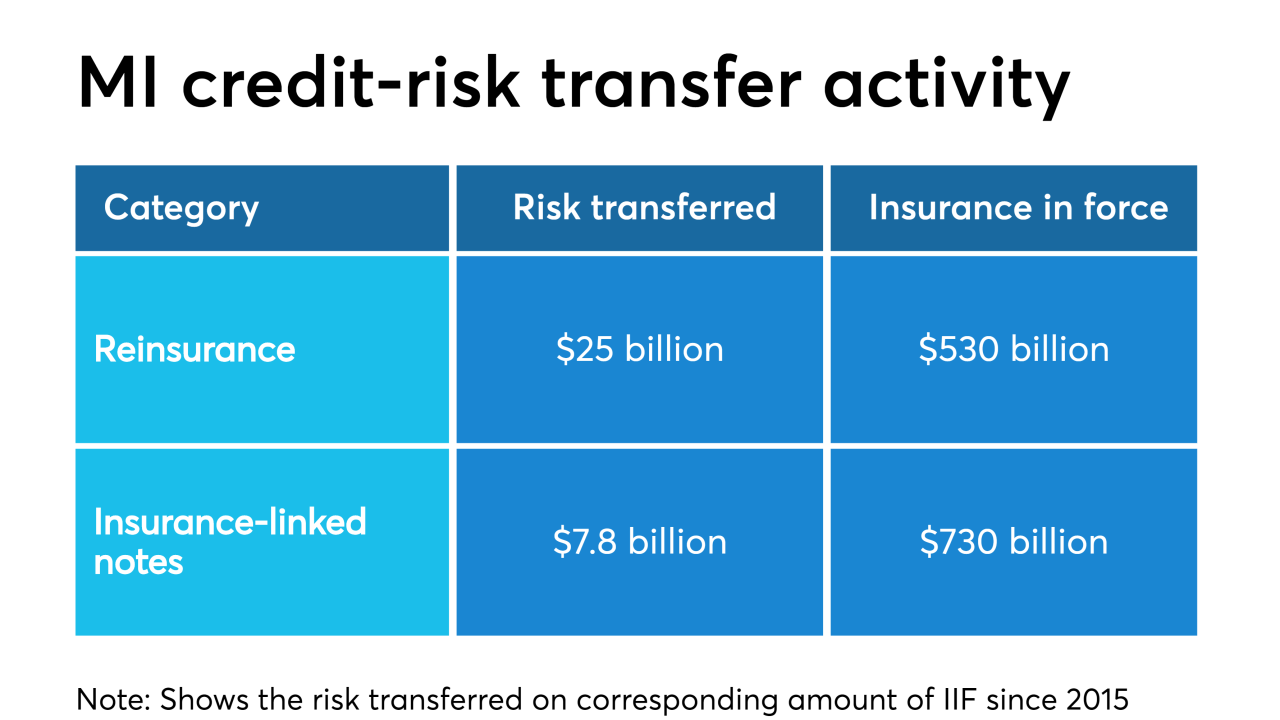

An increase in credit risk transfer activity since 2015 signifies a sea change for private mortgage insurers that may be about to intensify, according to an industry trade group.

November 5 -

The Supreme Court is ready to weigh in on the CFPB’s leadership structure, but both agencies are facing similar constitutional challenges, suggesting a broader impact of any decision.

November 4 -

The Federal Housing Finance Agency is seeking comment on a proposal that could pave the way for potential Fannie Mae and Freddie Mac competitors to use the uniform mortgage-backed security structure.

November 4