-

-

New home equity conversion mortgage endorsements slowed in April, but remained almost 50% higher than the level from one year ago.

June 22 -

Delays in closing the deal after it was announced in August resulted in the parties' decision to remain separate, although they will still work together.

June 7 -

Alternative financing startup Hometap says it increased its investments in the segment by more than threefold over the past year.

May 3 -

-

The new asset investment funding will be used for the company’s transactions, unlike a December capital raise that is being used to support operations.

January 25 -

Bain Capital and American Family Ventures were among the investors in this funding round for the company, which has more than doubled its staff in the past 12 months.

December 6 -

The deal comes just days after Figure closed on a capital raise that valued it at $3.2 billion.

August 3 -

Offered through the company’s 11 chartered units in 12 states, the five-year fixed-rate installment loan is secured by the home and is available between $5,001 and $14,999.

August 2 -

The company’s 4Q originations were down from the same time in 2019 and the number of overall loans for 2020 marked a decline from the year before.

January 19 -

When the economy inevitably slides, leaders with a culture based on the mantra, "Treat people like family, and the money will take care of itself," won't need a miracle to survive.

October 6 Incenter

Incenter -

Mortgages taken out to fund business operations can now be modified in bankruptcy. That’s a relief to borrowers — particularly with business failures expected to increase as the pandemic drags on — but a possible headache for banks and investors that hold the loans.

July 20 -

Closing loans is just one way BMO Harris and other banks are looking to use online notarization. But there are obstacles to overcome before it becomes standard practice.

May 14 -

Wells Fargo will temporarily stop accepting applications for home equity lines of credit, following a similar move by rival JPMorgan Chase.

April 30 -

Is JPMorgan Chase an outlier or the canary in the coal mine when it comes to home equity lending during the coronavirus spread?

April 28 -

The nation's largest bank is temporarily reducing its exposure to the mortgage market amid rising unemployment and estimates that home prices could drop by 10%.

April 16 -

The worsening economy brought on by the coronavirus pandemic has big banks rethinking who they will lend to.

April 2 -

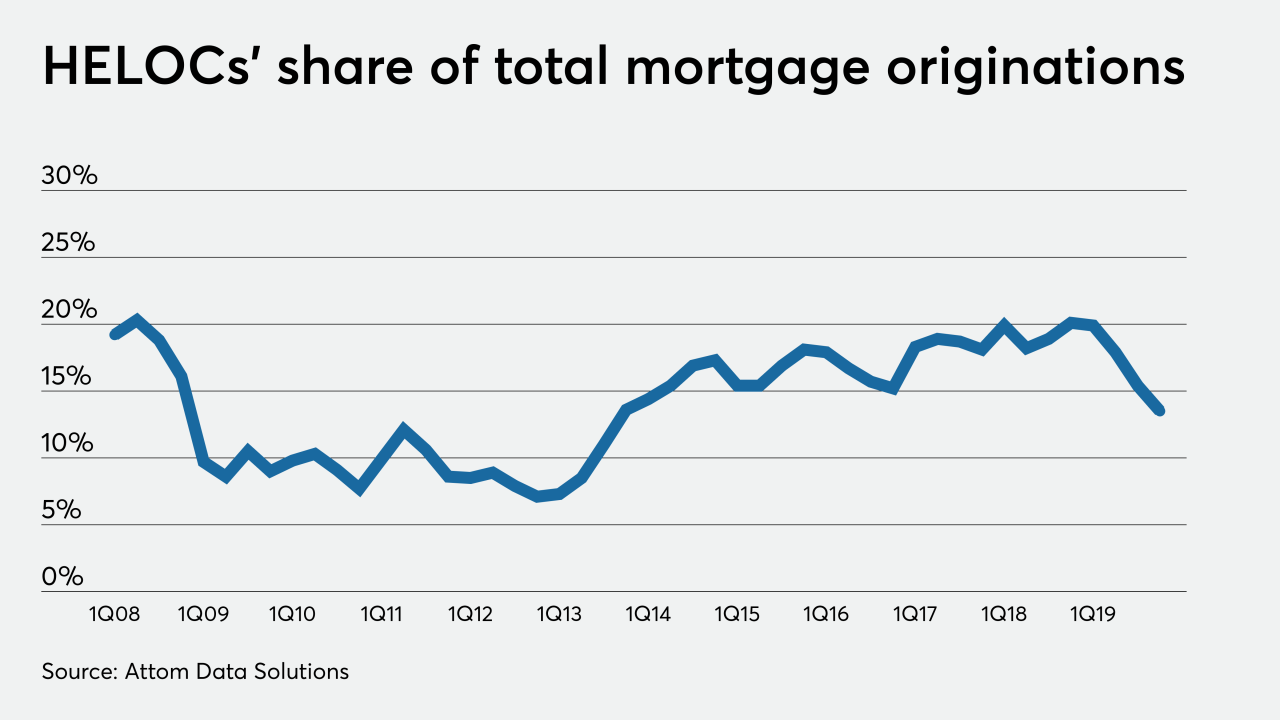

First mortgage volumes continue to rise at credit unions, but home equity lines of credit have fallen dramatically in recent years.

December 20 -

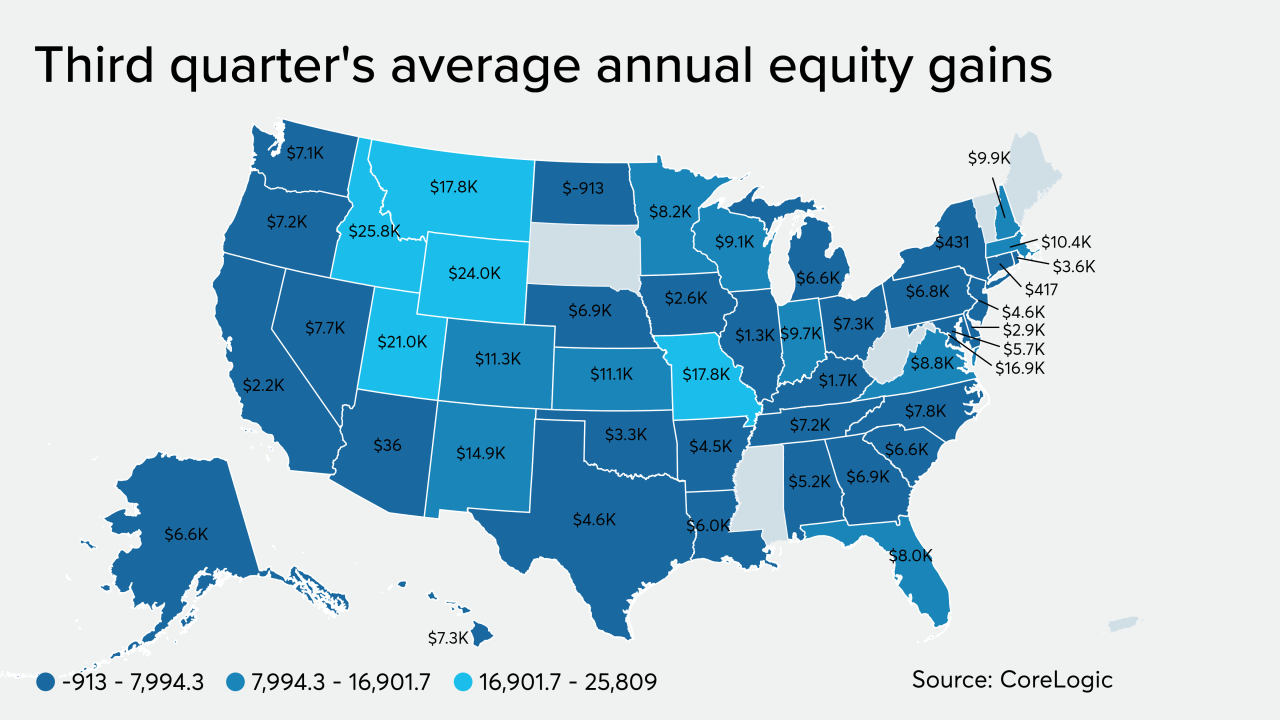

As home value appreciation keeps churning, the share of those upside down on their mortgage grows smaller than ever, according to CoreLogic's Home Equity Report.

December 13 -

Nationstar’s next securitization of defaulted or inactive home equity conversion mortgages will have a higher-than-average exposure to properties with steep leverage, as well as ties to judicial foreclosure states.

November 21