-

As part of a settlement with the National Fair Housing Alliance and the American Civil Liberties Union, the social media platform will no longer allow certain advertisers to target users by age, gender or ZIP code.

March 19 -

Having an all-digital process results in lower customer satisfaction for home equity line of credit providers than an all in-person or a mix of methods, a J.D. Power survey found.

March 14 -

Borrowers were more than twice as likely to use a lender they found online in 2018 as they were in 2017, making search engines the mortgage industry's top source of referrals.

March 12 -

Assessing the implications of big tech's inevitable next run at the business of mortgage lending.

March 6 -

American Mortgage Consultants has acquired title search outsourcer String Real Estate Information Services as part of ongoing efforts to support all the services secondary-market clients need to conduct trades.

March 4 -

A significant percentage of consumers are willing to turn to technology companies for their financial needs, including applying for a mortgage, although they have trust issues with them, a Fannie Mae report said.

February 5 -

The deadline for the 2019 Top Producers has been extended to Friday, Feb. 22 at 6 p.m. EST. Loan officers are encouraged to take the survey and participate in the annual ranking program that recognizes the accomplishments and successes of the industry's best originators.

January 22 -

Due diligence firm American Mortgage Consultants has purchased Meridian Asset Services as part of its continuing efforts to expand through acquisition or organic growth.

January 10 -

New Penn Financial will change its name to NewRez at the start of 2019, reflecting its acquisition earlier this year by New Residential Investment Corp.

December 7 -

Equifax is supporting mortgage lender customer retention efforts with a new tool that predicts the likelihood that a lead will apply for a loan within the coming months.

November 29 -

Investing in community partnerships can feel counterintuitive at a time when most mortgage lenders are cutting costs, but it can pay off by attracting a key homebuyer demographic.

November 27 Cultural Outreach

Cultural Outreach -

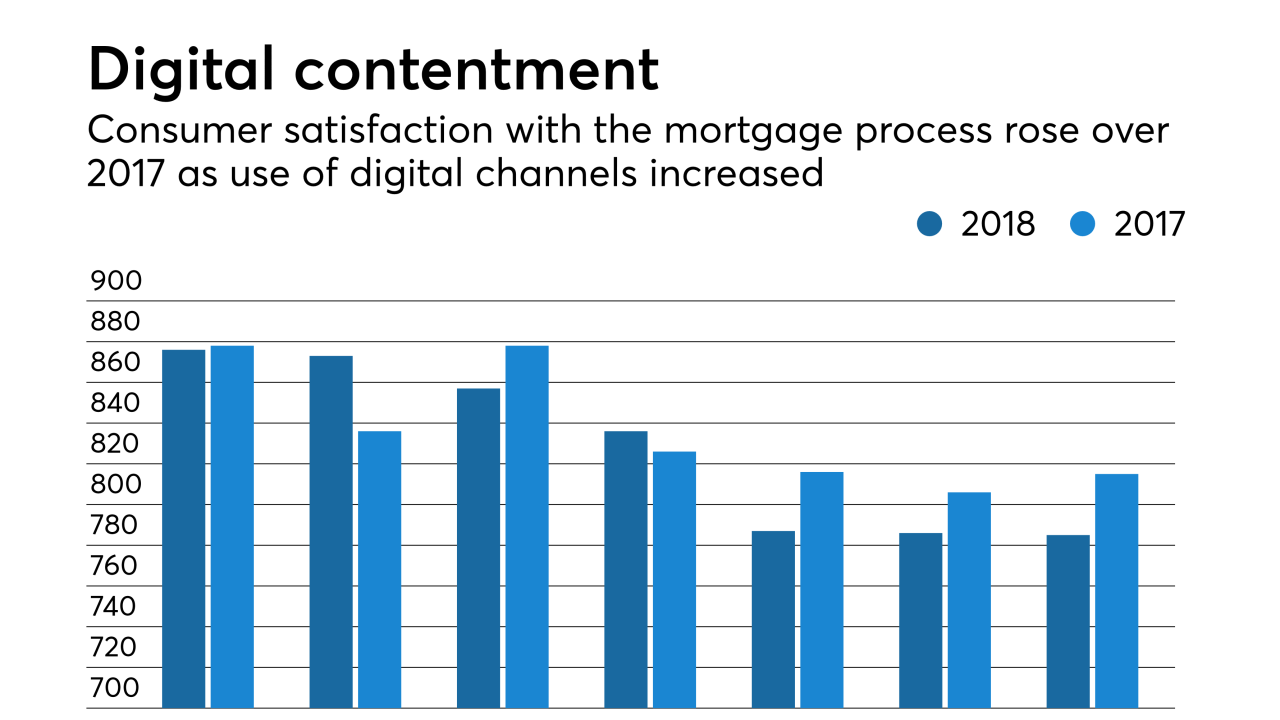

The growth of digital mortgage origination channels has improved customer satisfaction with the process, but consumers still want personal interaction at some point, according to J.D. Power.

November 8 -

Washington Mutual successor WMIH Corp. has completed its pending 1-for-12 reverse stock split and its common shares will soon begin trading under the Mr. Cooper name it inherited from Nationstar Mortgage.

October 10 -

Ellie Mae EVP Joe Tyrrell talks customer acquisition strategy. Crafting a personalized consumer experience, he says, starts with data.

September 18 -

Casey Crawford, CEO of Movement Mortgage, bought First State Bank in Virginia last year. He has since injected more capital into the bank in an effort to reinvent it.

September 10 -

The vast majority of consumers start the mortgage process with internet research, but when it comes time to initiate contact with a lender, borrowers are nearly as likely to pick up the phone as they are to connect online.

August 29 -

The Department of Housing and Urban Development took the very rare step of filing a secretary-initiated fair housing complaint — only three were made in the last two fiscal years — against Facebook.

August 20 -

The U.S. is siding with fair housing groups that claim Facebook's ad targeting tools permit discrimination based on sex, religion, familial status and national origin.

August 20 -

Amid a tight housing market and rising rates, mortgage brokers and wholesalers have been engaged in an intense competition for control over borrower relationships.

August 13 -

Zillow Group is moving from being a mortgage marketer to originating loans with its acquisition of Mortgage Lenders of America, in an effort to support its home-flipping business.

August 6