-

This pool was part of the government-sponsored enterprise's RPL3-2022 transaction but unlike the other two portions, it was not awarded in the initial announcement two weeks ago.

August 1 -

The jump for second mortgages and bank cards was even more pronounced, according to indices published by Standard & Poor’s and Experian.

July 20 -

Mark Calabria, who oversaw the two government giants under Trump and was fired by the Biden administration, said in a recent interview that the government-sponsored enterprises are once again at risk of insolvency.

May 17 -

The big threat to the mortgage banking community comes from any future Fed sales of mortgage-backed securities.

April 14 Whalen Global Advisors LLC

Whalen Global Advisors LLC -

As interest rates fluctuated and purchase volumes increased in the second quarter, mortgage loans were more prone to defaults, according to actuarial and consulting firm Milliman.

November 22 -

Following completion of this sale and that of the valuation business, Xome will focus on real estate auction and asset management.

September 20 -

Approximately 65% of all current forbearance plans will expire by year-end and many of those borrowers won't be able to resume paying their contractually mandated amounts.

August 24 -

But 45% of the top 100 counties still have an above-average likelihood that borrowers won’t make their payments on these business-purpose loans, RealtyTrac said.

August 18 -

Although activity crept down in May from April, it posted “dramatic” increases from the year before, according to Attom Data Solutions.

June 15 -

Storm-related reconstruction costs — a large share of which may be concentrated in the New York City area — are estimated to total $1.9 trillion for water damage and $8.5 trillion for wind damage.

June 1 -

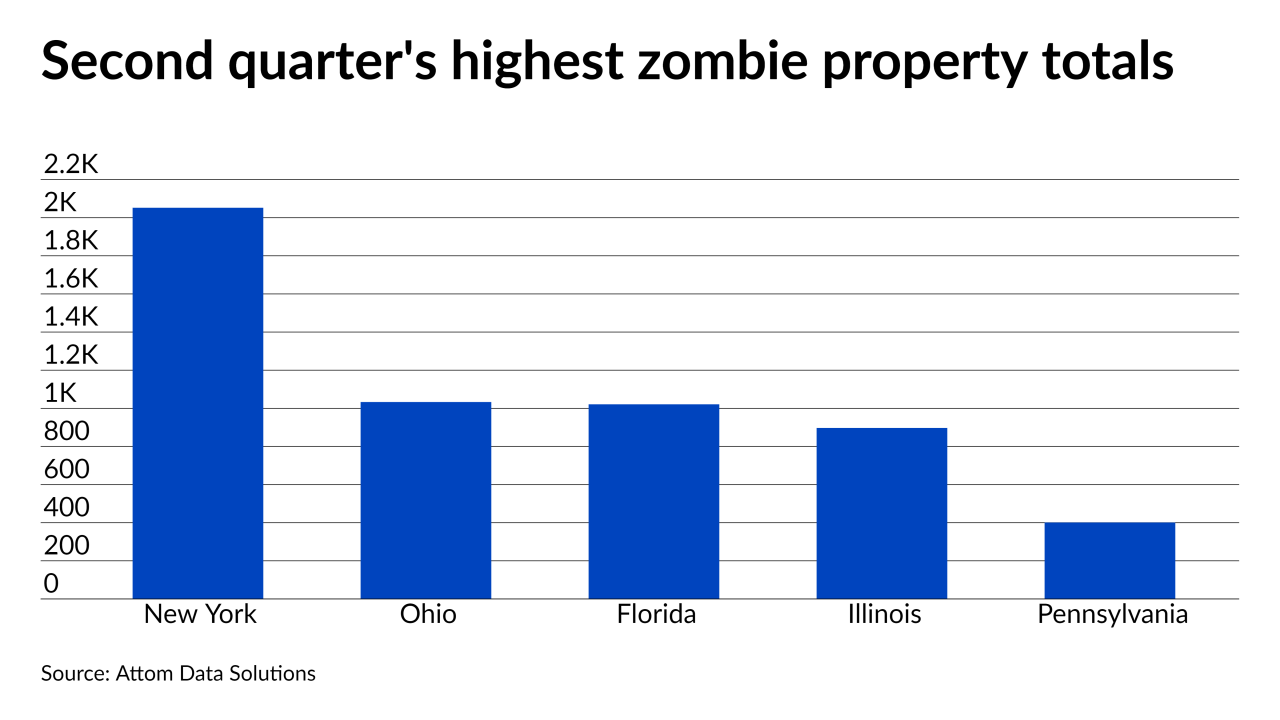

The ongoing CARES Act foreclosure moratoria may have led to distressed borrowers abandoning their homes, according to Attom Data Solutions.

May 27 -

Most of the activity covered vacant and abandoned properties or commercial loans, according to Attom Data Solutions.

May 12 -

The agreement, which is extended for five years, also expands upon the delinquent mortgages services Altisource will provide to Ocwen.

May 6 -

While cash-out refinances were a “significant driver” of risky loans leading to the Great Recession, those mortgages pose less of a threat due to tighter underwriting standards, according to Milliman.

May 5 -

While the overall delinquency rate decreased for the fifth straight month, states with unemployment rates that were double and triple the national average had the most overdue loans, a CoreLogic report found.

April 13 -

Inventories should keep shrinking, which is likely to drive higher returns on equity and reduce their loss ratios, a BTIG report said.

April 8 -

As an improving job market aided financial stability for borrowers, 2020 ended with drops in delinquent home loans, a CoreLogic report found.

March 9 -

While foreclosure moratoria keep the overall numbers down, zombie foreclosure rates jumped in the majority of states, according to Attom Data Solutions.

February 25 -

With President Biden extending the moratorium, foreclosures hit an all-time low at the start of 2021 as millions of delinquent borrowers avoided entering the process, according to Attom Data Solutions.

February 11 -

Gains in consumer financial stability helped to decrease the rates of distressed home loans, but job creation is needed to make recovery sustainable, a CoreLogic report found.

February 9