-

Default risks soar in minority neighborhoods during challenging economic times because, data shows, homes there are overpriced relative to incomes. Zoning and other changes could make loans more affordable by boosting housing stock and driving down prices.

November 25 American Enterprise Institute’s Housing Center

American Enterprise Institute’s Housing Center -

The Federal Housing Administration said in its annual actuarial report that the capital reserve ratio on its mutual mortgage insurance fund increased to 6.10% in fiscal year 2020, up from 4.84% a year earlier.

November 13 -

With an unusually high number of unknowns to factor in, mortgage industry leaders offer a peek at their playbooks for the next year.

November 12 -

Rick Thornberry discusses the company's third-quarter results and the decision to drop traditional appraisals.

November 11 -

More than six months after the CARES Act became law, the two entities joined a host of industry organizations in launching the COVID Help for Home campaign to educate borrowers on the next steps in forbearance.

November 11 -

The overall mortgage delinquency rate improved in the third quarter as the economy got healthier while late-stage delinquencies hit a decade high, according to the Mortgage Bankers Association.

November 11 -

Growing equity levels increased the share of equity-rich and pulled borrowers out from underwater in the third quarter, according to Attom Data Solutions.

November 5 -

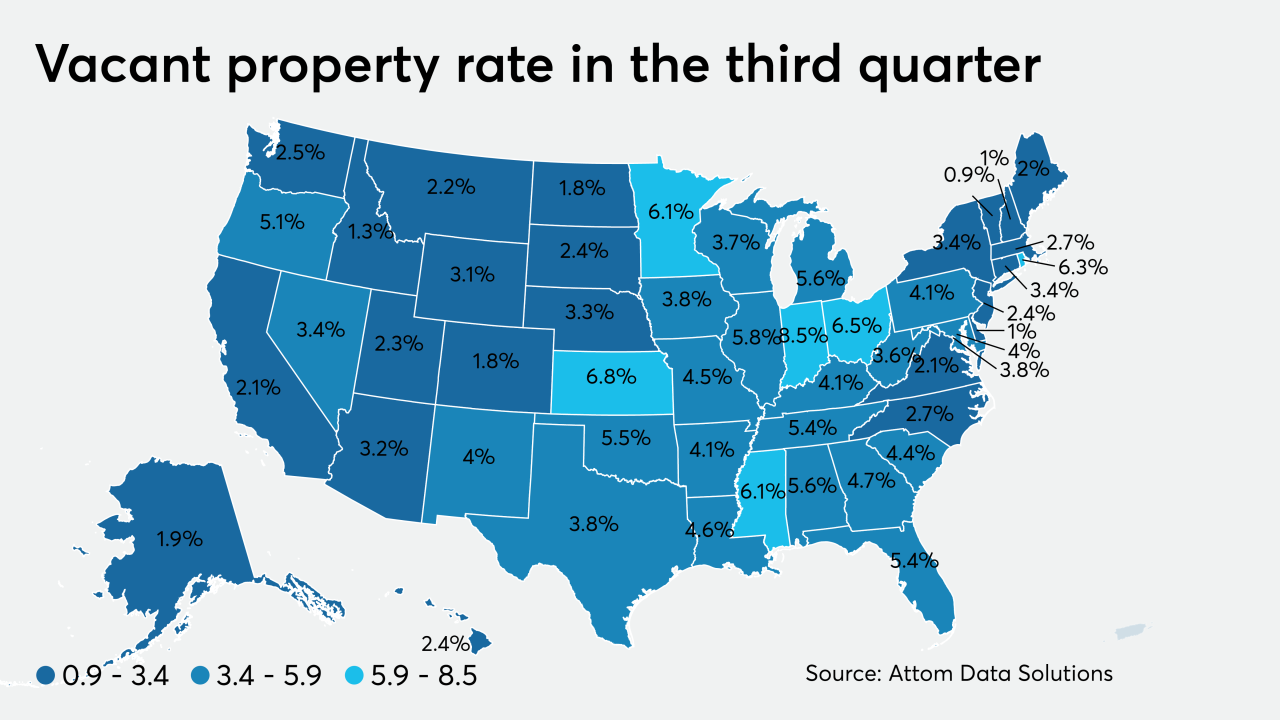

And an uptick from second-quarter numbers is attributed to seasonality rather than any upswing in the economy.

November 3 -

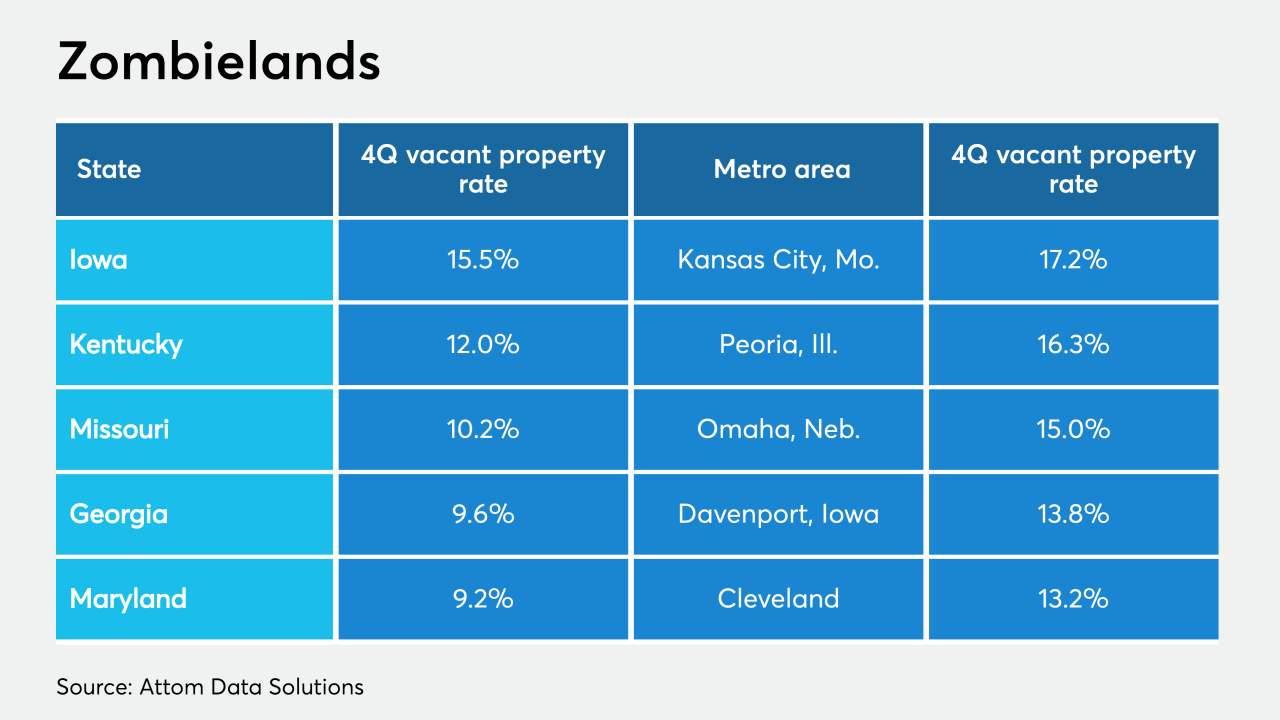

While the total foreclosures continued to fall with coronavirus moratoria in place, the share of zombie properties rose in the fourth quarter, according to Attom Data Solutions.

October 30 -

While overall mortgage delinquency rates slowly descend, serious delinquencies — especially loans past 120 days due — jumped in July, according to CoreLogic.

October 13 -

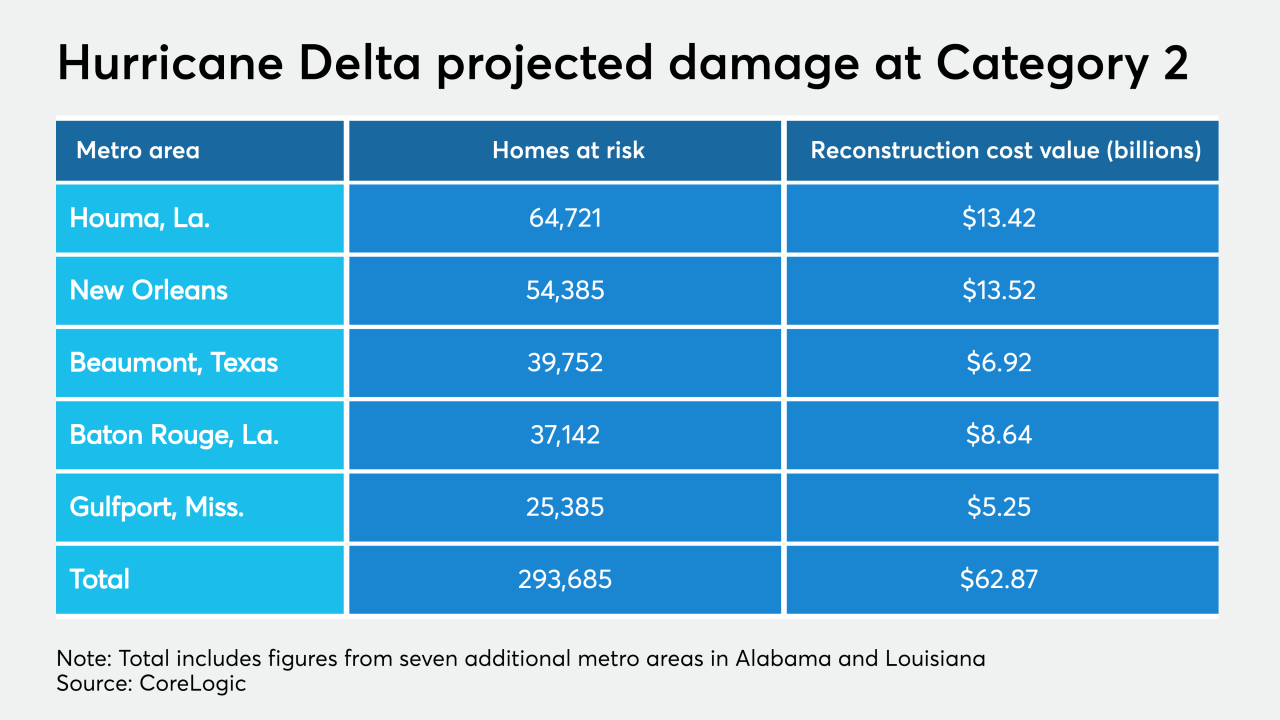

Expected to make landfall as a Category 2 storm, Hurricane Delta's surge is estimated to cause damage to 293,685 residential properties across Alabama, Louisiana, Mississippi and Texas, according to CoreLogic.

October 9 -

If mortgage lenders need to learn anything from the pandemic, it is relying on a single source for any service could disrupt their activities.

October 7 Lereta

Lereta -

If the tally included loans with some form of payment relief, the rate would be close to 8%.

October 5 -

Delinquencies will rise due to the severe effects of the pandemic on the commercial property sector, Fitch said.

September 30 -

Some of the cures were the result of short-term remedies and could reverse as relief measures end.

September 10 -

While the overall amount of foreclosures continued to decline due to the coronavirus moratorium, the share of zombie properties grew during the third quarter, according to Attom Data Solutions.

August 27 -

If it makes landfall as a Category 3 storm as was initially projected, damage from Hurricane Laura's surge could potentially devastate 432,810 residential properties in Texas and Louisiana, according to CoreLogic.

August 25 -

Late fees on loan payments and late-arriving documents tied to forbearance and loan forgiveness are just some examples of how delays caused by cutbacks at the U.S. Postal Service could affect lenders and their customers.

August 24 -

Travel restrictions have left hotels like Miami Beach's Fontainebleau struggling to repay their mortgage loans.

August 17 -

The city of Birmingham plans to set aside nearly $1 million in the 2021 budget to prop up the underperforming CrossPlex Village development in Five Points West, city officials said.

August 14