-

But profitability may have peaked. Rocket reported a 4.41% profit margin on newly originated loans last quarter but told investors on Thursday to expect margins on new loans this quarter to be around 3.6% to 3.9%.

February 26 -

The automation is more prevalent but the net adoption rate is low, the Stratmor Group found.

February 25 -

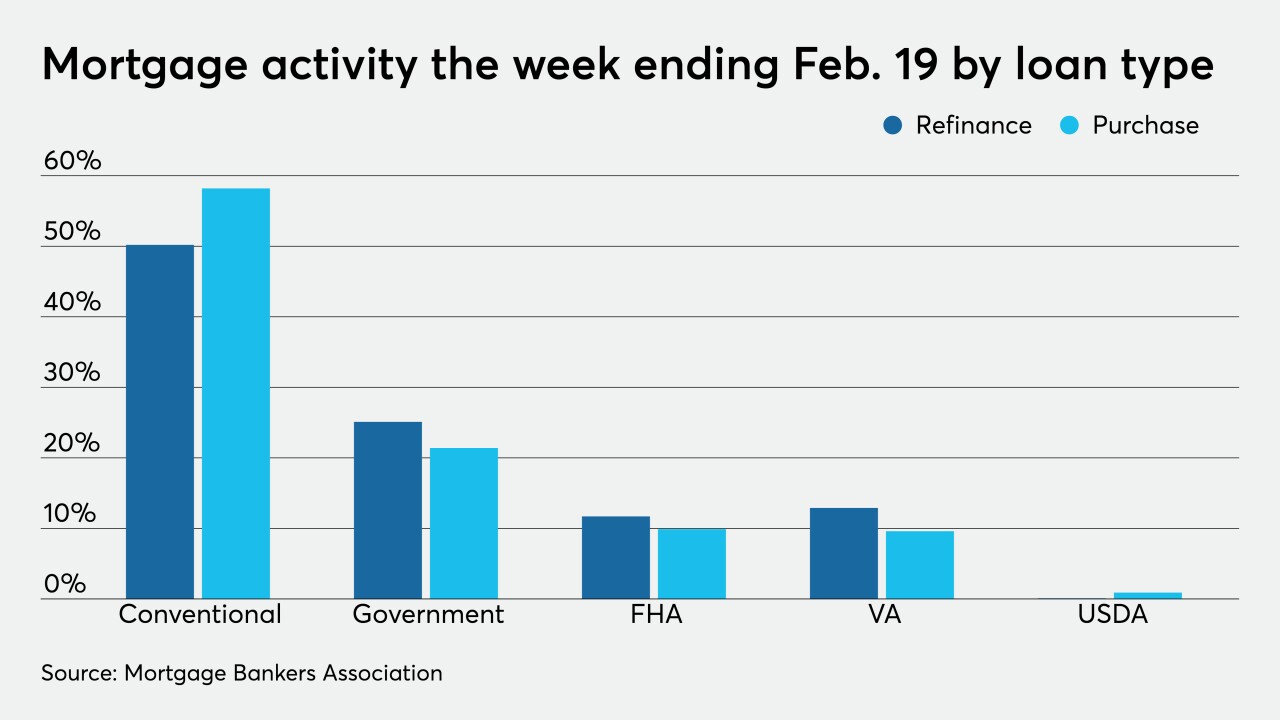

Severe winter weather and another hike in mortgage rates stifled loan volume for the week, according to the Mortgage Bankers Association.

February 24 -

As its mortgage origination volume delivered another quarter of strong earnings, Mr. Cooper’s banking on its "enormous backlog" of REO orders to generate further profitability once the foreclosure moratorium is lifted.

February 23 -

The company received an undisclosed amount of Series A funding from two investors to expand technology currently focused on helping lenders with timelines that are, on average, spinning out of control.

February 22 -

The organization postponed the issuance of its next set of revisions, which would have gone into effect at the start of 2022.

February 22 -

Also: CoStar boosts CoreLogic offer, Biden extends forebearance and the Fed sounds alarms on commercial real estate

February 19 -

Redfin expects the FTC to be more open to its proposal to buy RentPath than it was to CoStar’s earlier offer, Chief Financial Officer Chris Nielsen said.

February 19 -

With historic barriers of systemic discrimination, predatory lending and wealth inequities to overcome, change will take time, but leaders from National Association of Real Estate Brokers and other groups propose lenders take these steps now.

February 19 -

The newly public digital mortgage giant is relying on a diverse set of loan channels to take on competitors in an increasingly crowded field, CEO Anthony Hsieh said in an earnings call this week.

February 18 -

The shrinking ranks of appraisers, combined with the record number of loan applications in 2020, created "the perfect storm between supply and demand," which inspired the new payment plan, Incenter's Mark Walser said.

February 17 -

Between the dip in refis and the approach of the spring buying season, mortgage lenders are likely to start paying a little more attention to the purchase market, which is less rate-sensitive.

February 17 -

The offering went down to $14 from an anticipated $19 to $21 per share.

February 11 -

But the average amount for a purchase loan increased to an all-time high, showing the upper end of the housing market remains strong.

February 10 -

But the company sees reasons to be optimistic about the second half of the year, CEO and Chairman Michael Nierenberg said during its fourth quarter earnings call

February 9 -

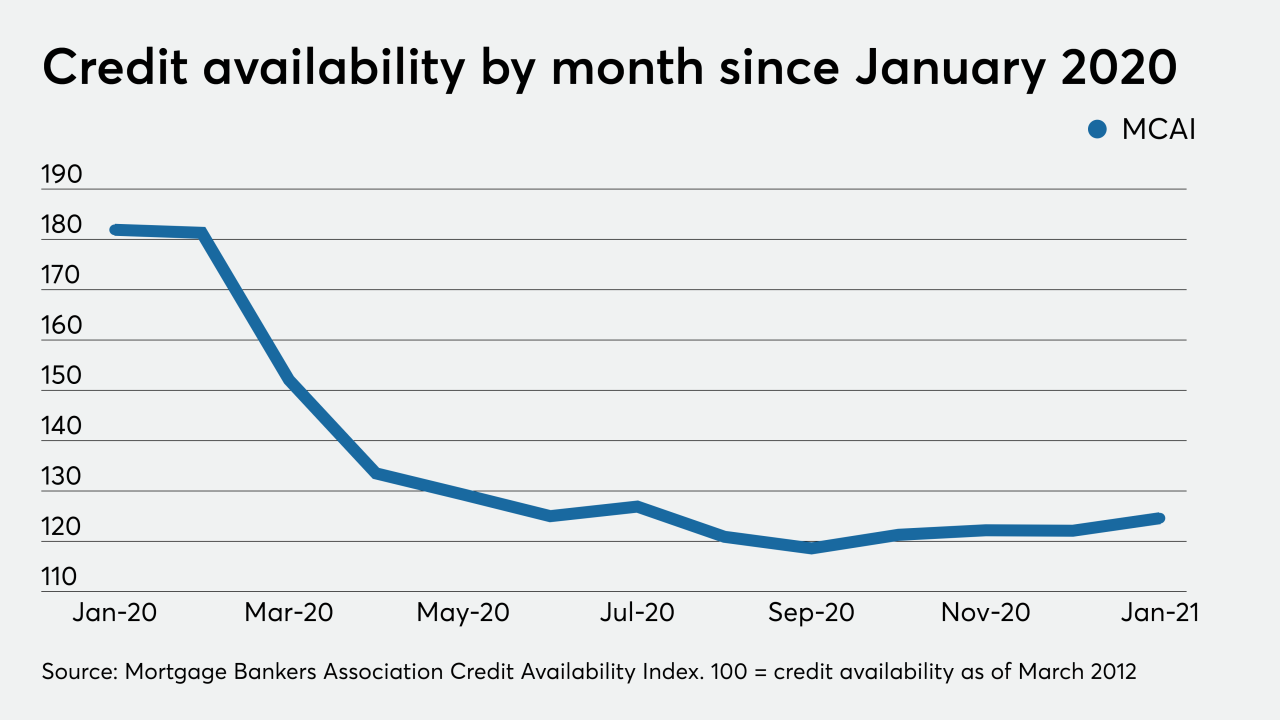

The movement in the MBA’s credit availability index suggests that, amid forecasts of diminished refinancing, lenders want to accommodate consumers buying homes, but they aren’t yet ready to lend as freely as they did before the pandemic.

February 9 -

The mortgage industry’s technology emphasizes speed, but a surge in volume has elongated the closing process for many, which is problematic ahead of a potential seasonal uptick in more time-sensitive purchase loans.

February 9 -

As 2021 shapes up to be a robust year for mortgage volumes, local lenders discuss the 12 metro areas that are expected to get the most interest from buyers, according to Zillow.

February 8 -

2020’s mortgage employment numbers proved to be slightly higher than previously estimated when reconciled with the Bureau of Labor Statistics’ annual business census.

February 5 -

Also, private money is expected to return to the mortgage securitization market, according to lenders who responded to an Altisource survey.

February 5