-

Women in the mortgage industry are taking a stand and becoming empowered.

December 19 Mortgage Bankers Association

Mortgage Bankers Association -

With housing projected to grow hand-in-hand with the economy, Fannie Mae boosted its single-family mortgage origination outlook for 2019, 2020 and 2021.

December 18 -

Finance of America Reverse has launched a revolving credit line product that allows borrowing power to increase over time by allowing 75% of funds to grow for future use.

December 18 -

Mortgage applications decreased 5% from one week earlier as, absent any rate incentive, activity slowed because of the holiday season, according to the Mortgage Bankers Association.

December 18 -

Better.com saw huge growth in mortgages to traditionally underserved customer bases in 2019 and believes digital applications led to the avoidance of discriminatory lending.

December 17 -

Even with an increase in both new and existing home construction activity during November, the slowdown over the previous 11 months will constrain inventory going into 2020, according to BuildFax.

December 16 -

Figure Technologies appears to be one of the few companies to find a viable use case for blockchain in the financial industry — cutting down the costs associated with loan origination.

December 13 -

The SoFi co-founder said Figure Technologies is working with national banks to employ its distributed ledger tech for loan originations.

December 13 -

From the Southeast to the Midwestern plains, here's a look at the 12 cities where first-time homebuyers can afford the largest share of houses for sale, according to First American.

December 12 -

Mortgage lenders became slightly bearish on their profitability outlook in the fourth quarter, with the competitive landscape and shift to a purchase market cited as the main concerns, according to Fannie Mae.

December 12 -

Mortgage industry hiring and new job appointments for the week ending Dec. 13.

December 12 -

Mortgage application activity increased 3.8% from one week earlier, with refinance volume for Federal Housing Administration-insured loans taking the spotlight, the Mortgage Bankers Association said.

December 11 -

Florida-based depository Capital City Bank has struck a deal to purchase a 51% share in regional lender BrandMortgage.

December 11 -

The prequalification letter is a great way to move borrowers from casual tire kickers to committed applicants, but advances in digital verification will soon make it obsolete.

December 10 Blend

Blend -

The share of Department of Veterans Affairs-guaranteed loans in Ginnie Mae mortgage-backed securities issuance rose to 42% in the most recent fiscal year from almost 39%, and could continue to rise.

December 9 -

The U.S. Trustee overseeing the bankruptcy filing by Ditech is objecting to certain fees and expenses sought by Weil, Gotshal & Manges, among others.

December 9 -

The U.K.’s Financial Conduct Authority is forcing firms to spell out executives’ responsibilities and put them on the hook for conduct problems. The toughest rules will apply to larger mortgage lenders.

December 6 -

Mortgage industry hiring and new job appointments for the week ending Dec. 6.

December 6 -

Despite an uptick in homebuilding and favorable financing rates, Hovnanian Enterprises' latest earnings results remained in the red due to a charge the company took to reposition debt.

December 5 -

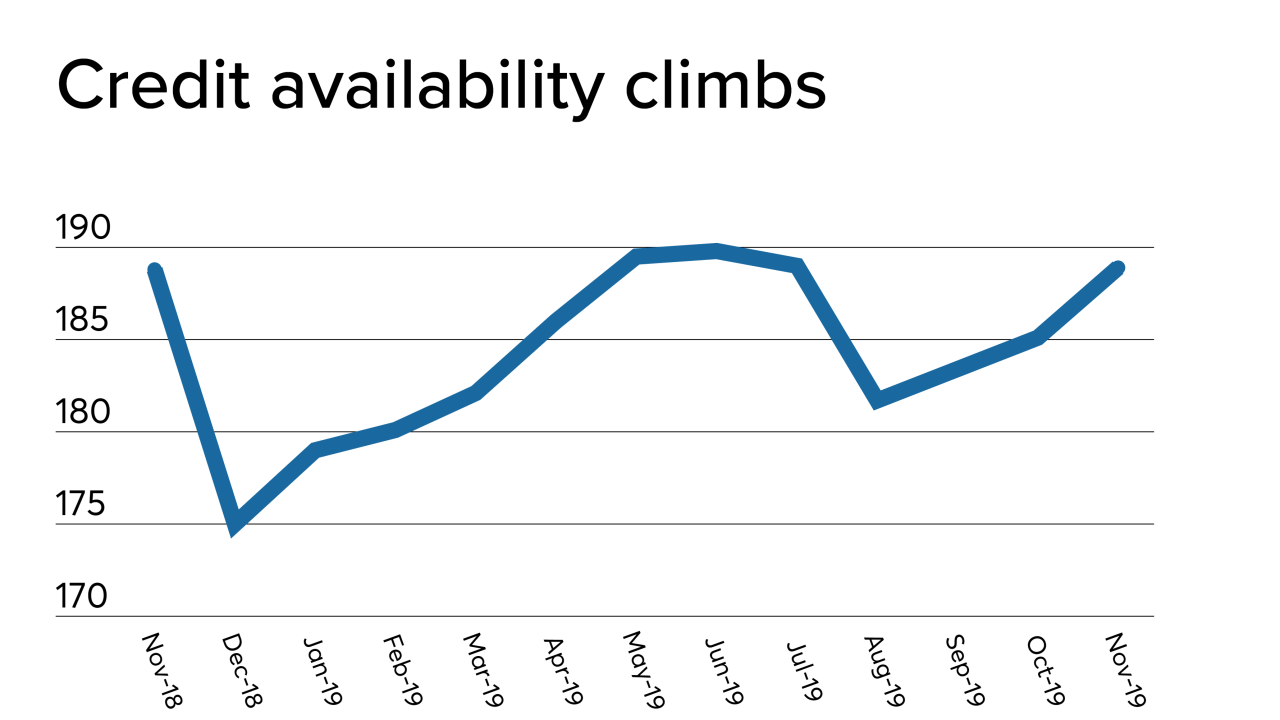

The availability of mortgage credit jumped in November from the previous month as jumbo activity and refinancing in the government market increased, according to the Mortgage Bankers Association.

December 5