-

Mortgage applications to purchase new homes dropped 8% in September from August, as ongoing uncertainty over interest rate movements and economy likely kept buyers out of the market, the Mortgage Bankers Association said.

October 17 -

Bank of America's total first-mortgage originations rose while its home equity production decreased in the third quarter.

October 16 -

Mortgage lenders prefer to invest in improvements to their consumer-facing technology because it offers a better return than similar spending on back-end processes, according to Fannie Mae.

October 16 -

Mortgage applications increased 0.5% from one week earlier, although interest rate instability affected consumers' ability to get the best price for their loan, according to the Mortgage Bankers Association.

October 16 -

Origination volumes continued to drift upward at JPMorgan Chase and Wells Fargo in the third quarter as mortgage servicing rights values fell more sharply than some analysts expected.

October 15 -

The ways in which hedging can be improved by a digital process are more often than not presumed versus proven by industry practice.

October 11 Vice Capital Markets

Vice Capital Markets -

Most home sellers are stressed around issues involving time and money — two things they can't control — because those affect the purchase and financing of their next home, a Zillow survey found.

October 11 -

Mortgage industry hiring and new job appointments for the week ending Oct. 11.

October 11 -

Millennial homeownership rates declined between 2009 and 2016 before picking up in 2017, even as the number of households under the age of 35 dropped by over 1 million, a ValuePenguin study found.

October 10 -

The Department of Veterans Affairs distributed more than $400 million in refunded home loan fees after finding exempt borrowers were mistakenly charged due to clerical errors related to their disability status.

October 10 -

Mortgage applications jumped 5.2% from one week earlier as a drop in rates caused another surge in refinances, according to the Mortgage Bankers Association.

October 9 -

From Texas to Ohio, here's a look at the top 15 housing markets providing the shortest timelines for renters to buy a home, according to SmartAsset.

October 8 -

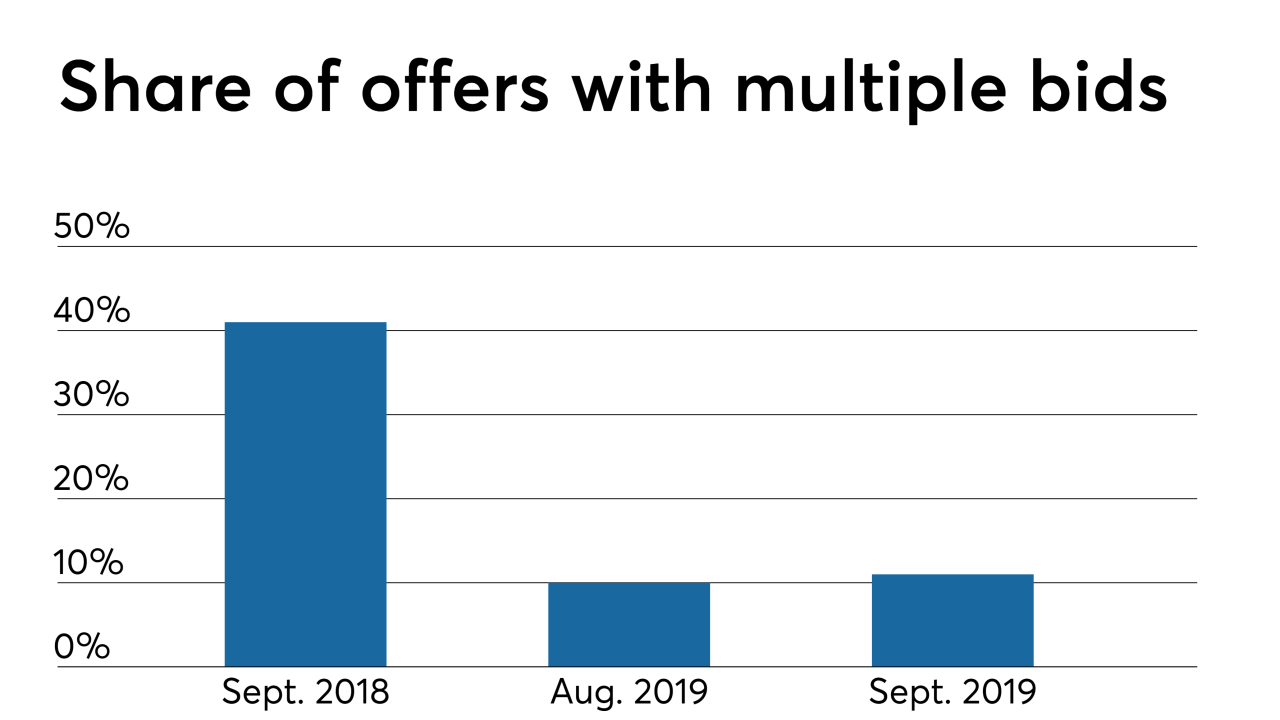

Home bidding activity tracked by Redfin in September was weaker than a year ago but up compared to August, suggesting purchase mortgage originations haven't been subjected to a seasonal slowdown yet.

October 8 -

Mortgage industry hiring and new job appointments for the week ending Oct. 4.

October 4 -

Economic issues were the biggest influence on average mortgage rates in the past week, although two trackers moved in different directions.

October 3 -

Mortgage applications increased 8.1% from one week earlier as conventional mortgage rates fell under 4% again, according to the Mortgage Bankers Association.

October 2 -

Rising demand and plummeting mortgage rates pushed multifamily origination dollar volume above 2017's record to a new peak, according to the Mortgage Bankers Association.

September 27 -

Mortgage industry hiring and new job appointments for the week ending Sept. 27.

September 27 -

The recent spike in mortgage interest rates reduced home purchase application activity last week, contributing to a 10.1% decline in total activity, according to the Mortgage Bankers Association.

September 25 -

By joining forces, Cloudvirga will integrate its digital mortgage software with Exos' cloud technology to enhance customers' desire for self-service during the transaction.

September 24