-

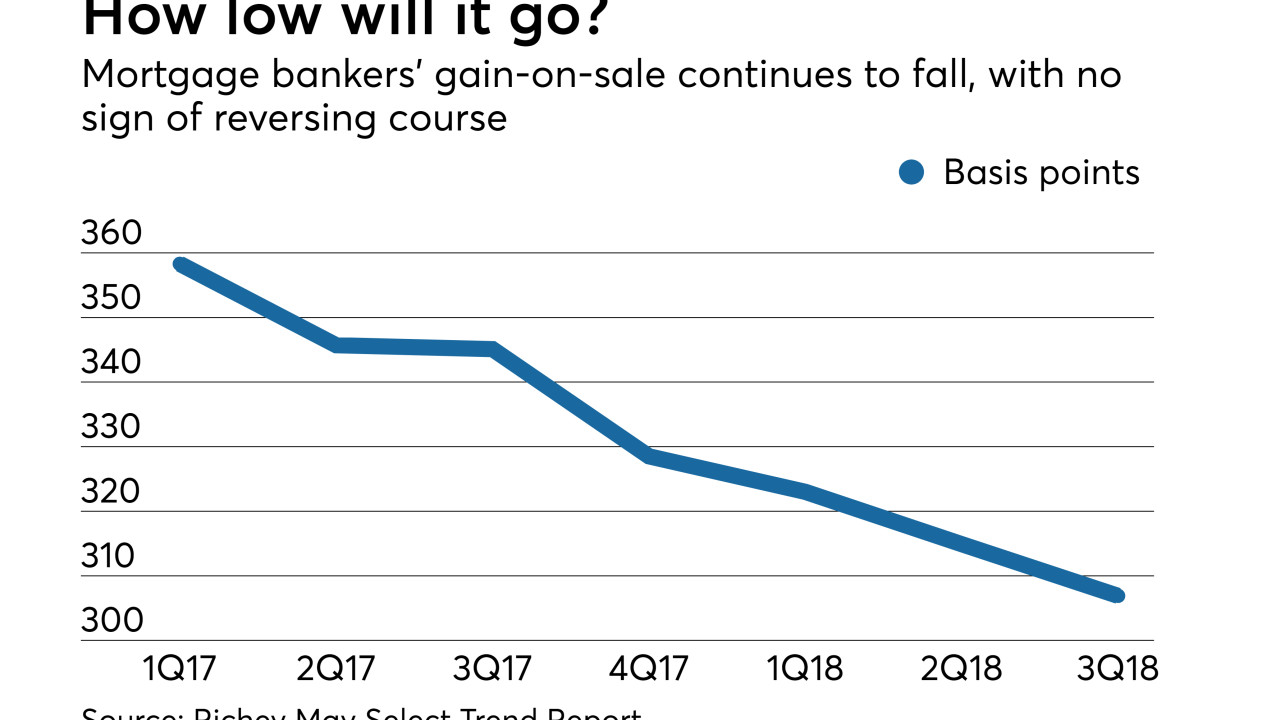

Consolidation is coming in the mortgage industry, but a protracted timetable will continue to constrict industry profits.

December 4 -

Social Finance, the lending and refinancing startup valued at more than $4 billion, is cutting about 7% of its staff, according to a person familiar with the matter.

December 3 -

Hometown Lenders Inc. will acquire TotalChoice Mortgage in a move to expand its geographic footprint and meet its goal of growing annual originations from $1 billion to $5 billion.

November 30 -

Mortgage industry hiring and new job appointments for the week ending Nov. 30.

November 30 -

Third-quarter profitability fell to 2008 levels in the Mortgage Bankers Association's latest report, suggesting the seasonally slower fourth quarter could be particularly challenging this year.

November 29 -

Mortgage rates held steady this week, remaining near their lowest levels in more than a month, according to Freddie Mac.

November 29 -

The rush in holiday shopping also boosted the housing market as mortgage applications increased 5.5% from one week earlier, according to the Mortgage Bankers Association.

November 28 -

The sustained rise in home values will boost Fannie Mae and Freddie Mac's loan limits for 2019, marking the second consecutive year in which it increased by nearly 7%.

November 27 -

Mortgage application activity decreased 0.1% from one week earlier as refinance volume tanked, although interest rates fell, according to the Mortgage Bankers Association.

November 21 -

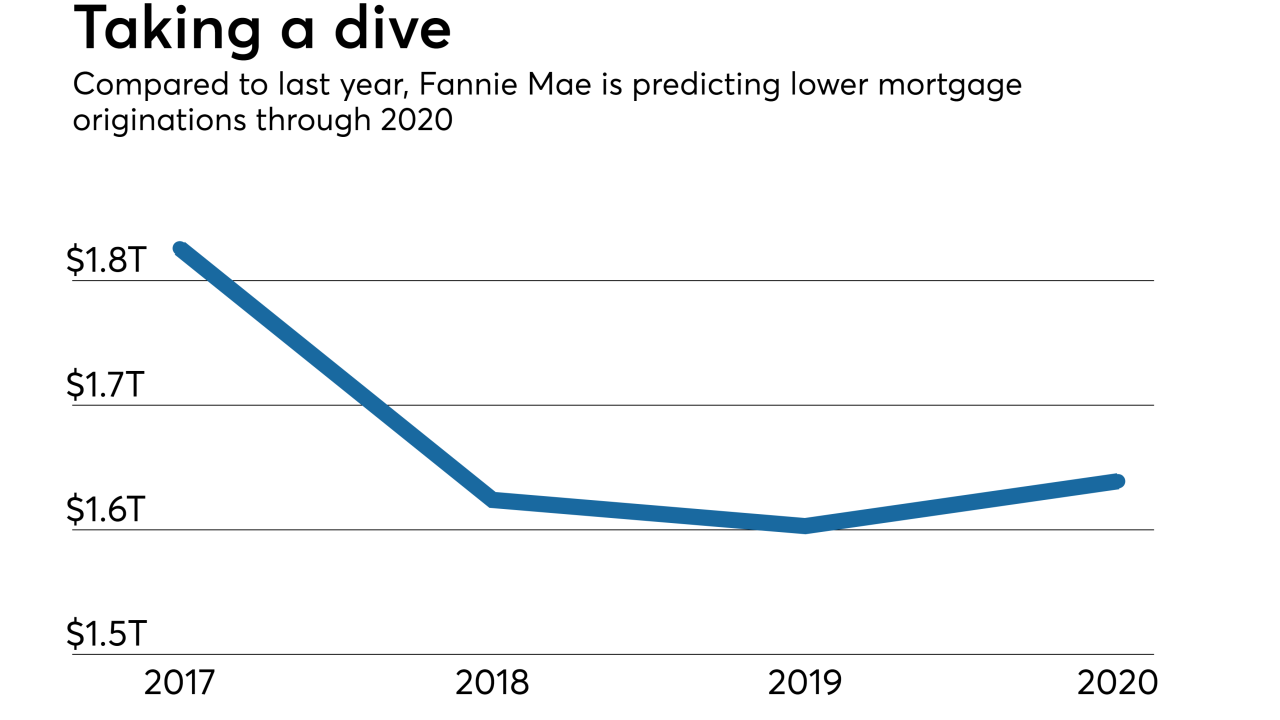

Fannie Mae's economic growth forecast for 2018 inched up slightly, but a strong labor market won't mean the same positive results for housing.

November 20 -

Subprime originations are climbing in multiple consumer loan categories, including mortgages, but the increase is much smaller in the home loan sector than it is in other markets, according to TransUnion.

November 19 -

Borrowers buying new homes produced fewer loan applications than they did a year earlier due to October's rising interest rates.

November 16 -

Mortgage industry hiring and new job appointments for the week ending Nov. 16.

November 16 -

Wells Fargo will lay off 1,000 workers primarily from its mortgage unit in the first major round of a previously announced plan to cut the bank's workforce by as much as 10% over the next three years.

November 15 -

Mortgage application activity decreased 3.2% from one week earlier as interest rates rose to eight-year highs and refinancings fell to an 18-year low, according to the Mortgage Bankers Association.

November 14 -

Lenders are constantly looking for ways they can streamline their operations and produce savings for themselves and their borrowers in order to compete in a leaner market this year.

November 12 -

American Financial Resources, a Parsippany, N.J.-based mortgage lender, will pay any required agent fees for U.S. Department of Veterans Affairs loans for its brokers and correspondents on all AFR-related VA loan submissions starting Veterans Day.

November 12 -

Ginnie Mae officials are concerned about unusual activity with Department of Veterans Affairs cash-out refinances and are investigating the causes, as well as whether predatory lenders are taking advantage of veterans.

November 12 -

More veterans are turning to Department of Veterans Affairs loans to buy a house as the number of purchase mortgages shot up 59% compared to five years ago.

November 9 -

If falling volume and rising costs weren't bad enough for nonbank mortgage lenders, an extended run of tight gain-on-sale margins is further eating into their profits.

November 9