-

Home prices are expected to increase in 2019, but there is little chance for a bust because the typical warning signs a bubble is forming aren't evident, a report from Arch MI said.

January 11 -

The government shutdown could affect mortgage origination credit quality as lenders miss some red flags normally found using data that is not currently available, according to Moody's.

January 10 -

The standards for mortgage lending constrained in December, as a drop in conventional credit brought availability to its lowest point since February 2017, according to the Mortgage Bankers Association.

January 10 -

Borrowers and financial institutions may be feeling the strain from reduced operations at the FHA and IRS, which has suspended the release of certain income documentation during the budget impasse.

January 4 -

The single-family rental market could benefit from more consistent loan terms and expanded secondary mortgage market opportunities, Freddie Mac found in a preliminary test of expanded involvement in the sector.

December 28 -

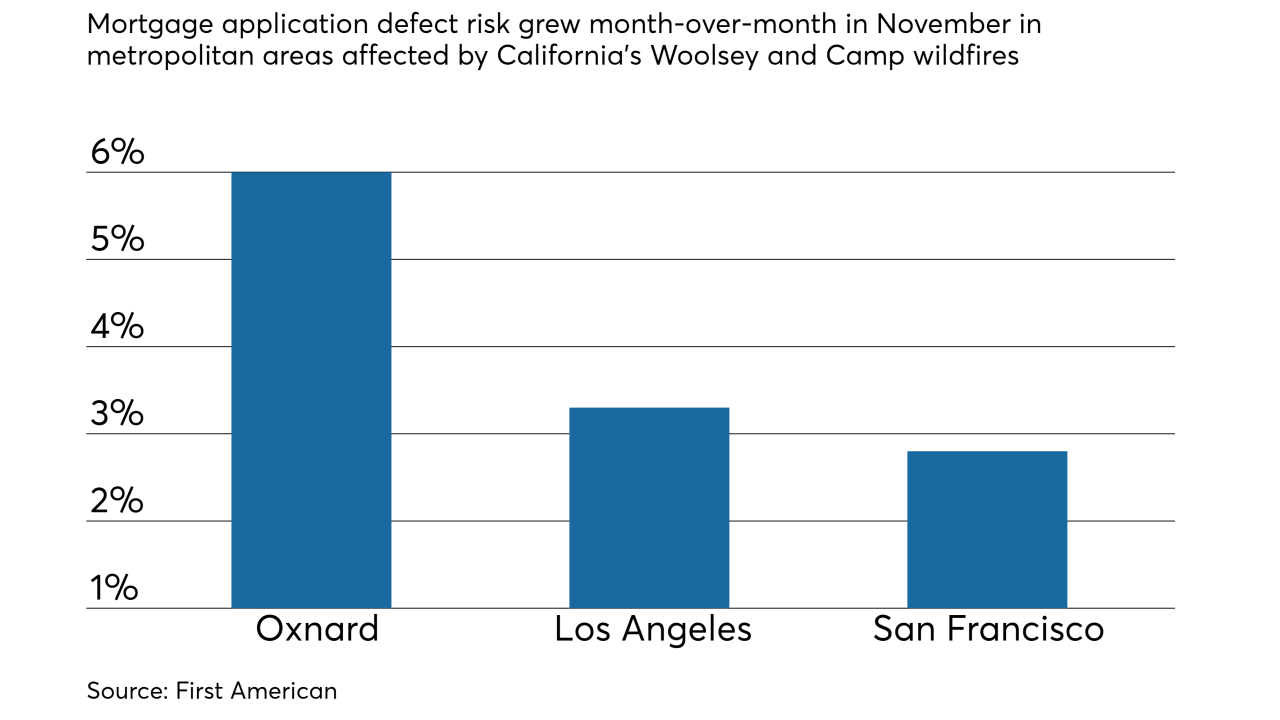

Mortgage application fraud risk continued growing for the fifth consecutive month, and the recent California wildfires are partly to blame, according to First American Financial Corp.

December 27 -

Liquidity, products and pricing are the main concerns for the secondary mortgage market in 2019.

December 26 -

A year ago, National Mortgage News made five predictions regarding how the mortgage industry would fare in 2018 — and we got four of them right.

December 21 -

Adjustable-rate mortgages in November had their highest share of closed loans since Ellie Mae started tracking this data in 2011 as rates for 30-year loans reached 5.15%.

December 19 -

Online competition has threatened brick-and-mortar retail, but as holiday shopping surveys this year show, certain businesses in the sector are still attractive to consumers and commercial mortgage lenders.

December 17 -

The Federal Housing Finance Agency has proposed barring Fannie Mae and Freddie Mac from using credit scores developed by VantageScore over concern about conflicts of interest with the joint venture of Equifax, Experian and TransUnion.

December 13 -

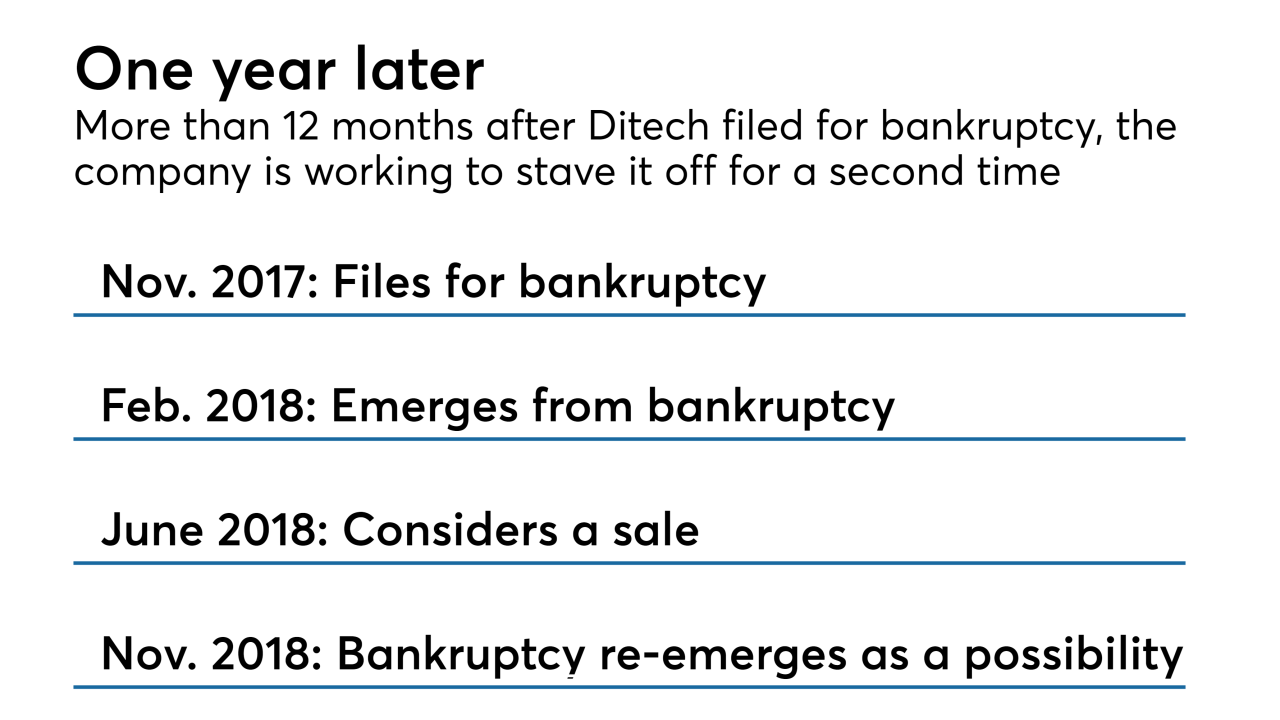

Ditech Holding Corp. is proposing to pay $257,000 and improve governance to settle a stockholder lawsuit alleging that a lack of oversight allowed improprieties to occur in several mortgage-related business lines.

December 10 -

Another adjustable-rate mortgage index is going away as the Federal Home Loan Bank of San Francisco will no longer publish the monthly Eleventh District Cost of Funds Index after January 2020.

December 10 -

Mortgage credit available to consumers increased in November by 1.1% from the previous month as lenders offered more conventional products with expanded underwriting criteria, the Mortgage Bankers Association said.

December 6 -

There was an 8% year-over-year increase in mortgage loan application defect risk in California during October and that should rise further because of the wildfires that devastated the state, First American said.

December 3 -

Greenway Mortgage, a New Jersey lender that pledges to support charitable causes, is launching a consumer-direct digital mortgage division that will specialize in one-stop shopping for home renovations.

November 27 -

Private mortgage insurers are moving away from traditional rate cards in favor of more granular risk-based pricing to make their products more competitive and efficient for lenders.

November 26 -

Average credit scores for mortgage borrowers remain at a 2018 high, a sign that lenders aren't easing standards despite refinance candidates already falling off on higher rates, according to Ellie Mae.

November 21 -

Carrington Mortgage Services has created a nondelegated correspondent channel, looking to build on relationships it has with originators that currently broker loans to the company.

November 20 -

Bank jumbo mortgage underwriting standards weakened in the third quarter by the most in three years and as profitability remains under pressure, loosening should continue at an accelerated pace, a Moody's report said.

November 16